Lotte Energy Materials recorded its highest quarterly sales again in the second quarter of this year, achieving five consecutive quarters of sales growth.

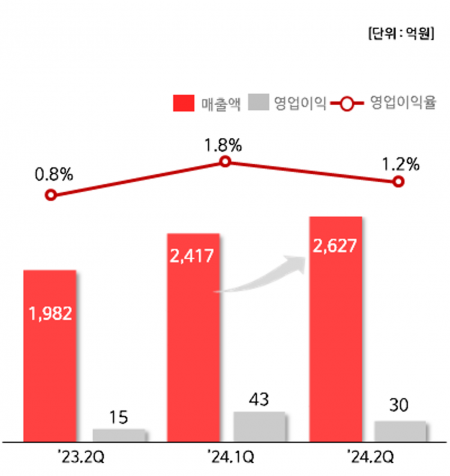

On the 6th, Lotte Energy Materials announced that it posted consolidated sales of 262.7 billion KRW and operating profit of 3 billion KRW in the second quarter. Compared to the same period last year, sales increased by 33%, and operating profit doubled. Net profit turned positive at 8 billion KRW.

The company explained that diversifying its customer base and increased sales volume in North America boosted its performance. North American sales grew significantly by 243% compared to the same period last year. Sales volume of copper foil for hybrid vehicles in Japan also showed remarkable growth, and the company expects sales of this product to increase by more than 40% year-on-year this year.

Compared to the previous quarter, sales rose by 9%, while operating profit decreased by 30%. The company attributed this to "inventory asset valuation effects due to rising international copper prices and increased global logistics costs," but emphasized that it remains "the only profitable company in the copper foil industry."

The debt ratio slightly increased to 31.2% compared to the previous quarter. The company stated, "We still maintain the industry's highest level of financial stability and a net cash position, and we also have the capacity for capital expenditures (CAPEX) to advance next-generation battery business."

Lotte Energy Materials Recent 3 Quarters Sales and Operating Profit Trends

Lotte Energy Materials Recent 3 Quarters Sales and Operating Profit Trends [Image Source=Lotte Energy Materials]

Lotte Energy Materials expects sales growth to temporarily slow down in the second half of the year due to weakness in the upstream industries and increased policy volatility from the U.S. presidential election. To respond, the company plans to flexibly proceed with new overseas facility investments aligned with the expansion schedules of global customers' new plants.

Kim Yeonseop, CEO of Lotte Energy Materials, said, "Although market uncertainties currently exist, we will enhance corporate value by securing high-end market leadership through customer-centric activities, leading technology, continuous implementation of global hub strategies, and development of high value-added products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.