Dow & S&P, Largest Drop Since September 2022

Wall Street Fear Index Hits 4-Year High

US Recession Debate Heats Up

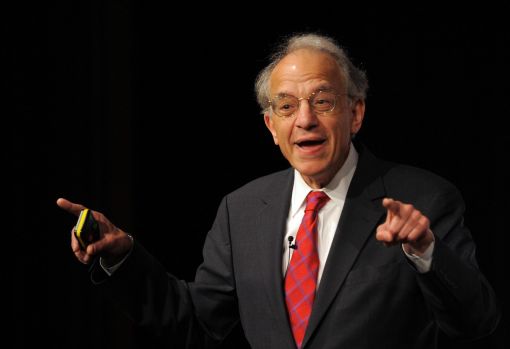

Jeremy Siegel "Fed Must Cut Rates Urgently"

Goolsbee, Chicago Fed President, "No Recession"

Following a plunge in Asian stock markets due to fears of a US-originated economic recession, the US New York stock market also sharply declined on the 5th (local time). Concerns over a recession triggered by the July employment shock, combined with a global capital outflow caused by the unwinding of the 'yen carry trade,' dragged down stock prices. Although the New York stock market reduced its losses thanks to improved service sector economic indicators and avoided the same scale of crash seen in Asian markets the previous day, the recession fears remain significant, leading to calls for the US Federal Reserve (Fed) to implement emergency interest rate cuts.

Employment Shock and Yen Carry Trade Unwinding... Dow and S&P See Largest Drop in Two Years

On this day in the New York stock market, the three major indices all fell by around 3%. The Dow Jones Industrial Average plunged 2.6% from the previous trading day to close at 38,703.27, and the S&P 500 index dropped 3% to finish at 5,186.33. Both indices recorded their largest daily declines since September 2022. The tech-heavy Nasdaq index fell 3.43%, closing at 16,200.08.

The decline was particularly notable among big tech companies that had been rallying amid the artificial intelligence (AI) boom. Nvidia plunged 6.36%, Apple fell 4.82%, while Alphabet, Google's parent company, and Tesla dropped 4.61% and 4.23%, respectively.

Concerns over an economic recession have been spreading following the announcement last week of a contraction in US manufacturing activity in July and a rise in the US unemployment rate to 4.3% last month. This fear of recession led to a panic sell-off in Asian stock markets the previous day and a sharp decline in the New York stock market on this day. Additionally, the Bank of Japan's (BOJ) interest rate hike triggered the unwinding of the yen carry trade, causing global capital outflows, while worries about an AI bubble also contributed to the sell-off. Rising risks of a full-scale conflict between Israel and Iran further worsened investor sentiment.

Subsequently, news of improved US service sector economic indicators helped ease some recession fears. The US Institute for Supply Management (ISM) reported that the July non-manufacturing Purchasing Managers' Index (PMI) rose to 51.4, up 2.6 points from the previous month’s 48.8, which was the lowest in four years. A PMI below 50 indicates economic contraction, while above 50 signals expansion; thus, the service sector shifted to an expansion phase after a month. As a result, the Nasdaq index, which had been down nearly 6%, reduced its losses. Early sharp declines in Treasury yields also reversed. The US 10-year Treasury yield, a global benchmark, rose to 3.78%, and the 2-year Treasury yield, sensitive to monetary policy, increased to 3.89%, rebounding from the morning levels of 3.69% and 3.67%, respectively. The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), known as Wall Street's fear gauge, rose to 38.57 near the New York market close, marking its highest level since October 2020.

As the 'fear of R (Recession)' shocks global financial markets, debates over whether the US is entering a recession have intensified.

Heated Recession Debate: "Emergency Rate Cuts Needed" vs. "No Recession"

Amid growing discussions on Wall Street about a missed opportunity for a rate cut in July, some argue that the Fed should implement emergency interest rate reductions. Earlier, the Fed held its benchmark interest rate steady at 5.25?5.5% for the eighth consecutive time during the Federal Open Market Committee (FOMC) regular meeting on the 31st of last month, two days before the July employment report was released. Jeremy Siegel, a global investment strategist and professor at the University of Pennsylvania's Wharton School, urged the Fed in an interview with CNBC to lower the benchmark rate by 0.75 percentage points, stating that the current US benchmark rate should be between 3.5% and 4%. He further explained that an additional 0.75 percentage point cut in September would be the minimum necessary response.

On the other hand, some caution against overreacting, arguing that the US economy has not yet entered a recession. Austan Goolsbee, president of the Federal Reserve Bank of Chicago, emphasized in an interview with CNBC that "although employment figures were weaker than expected, it does not yet appear to be a recession," adding that "while there are some warning signs such as rising household delinquency rates, economic growth remains fairly stable." He sought to reassure the market by stating, "If conditions worsen, we will address them."

Ed Yardeni, a veteran Wall Street investor and head of Yardeni Research, also assessed that "the labor market remains in good shape," noting that "the US economy is still growing, and the service sector is functioning well." He attributed the recent stock sell-off to the unwinding of the yen carry trade and suggested that "it is more likely to be a technical market deviation rather than leading to a recession."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.