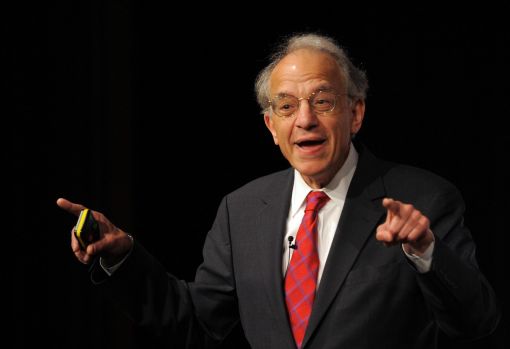

Jeremy Siegel, Wharton School Professor

"Another 0.75%P Cut Needed in September"

Amid the global financial markets being engulfed by the fear of an R (Recession) originating from the United States, Jeremy Siegel, a world-renowned investment strategist and professor at the Wharton School of the University of Pennsylvania, has urged the U.S. Federal Reserve (Fed) to implement an emergency 0.75 percentage point cut in the benchmark interest rate.

In an interview with CNBC on the 5th (local time), Professor Siegel stated, "The current U.S. benchmark interest rate should be between 3.5% and 4%."

He argued that the Fed should immediately cut the rate by 0.75 percentage points and then reduce it by an additional 0.75 percentage points at the September Federal Open Market Committee (FOMC) meeting. He explained that this is the minimum level of response required.

Professor Siegel also emphasized, "The Fed should not think it knows everything. The market knows more than the Fed. The Fed must respond."

Furthermore, he expressed concern, saying, "If the Fed moves as slowly to cut rates as it did to raise them, our economy will not have a good time."

Earlier, according to the July employment report released by the U.S. Department of Labor on the 2nd, nonfarm payrolls increased by 114,000, and the unemployment rate recorded 4.3%. The employment increase fell significantly short of the forecast (176,000), and the unemployment rate rose rapidly beyond expectations (4.1%), heightening concerns about a U.S. economic recession.

As a result, Asian stock markets plummeted, with Japan's Nikkei index falling 12.4%, the largest drop since the 'Black Monday' shock in 1987, and South Korea's KOSPI index plunging 8.77% on the day.

The New York stock market is also falling sharply. As of 10:13 a.m. on the same day, the Dow Jones Industrial Average was down 2.36% compared to the previous close, while the S&P 500 and Nasdaq indices were down 3.04% and 3.91%, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)