Domestic Stock Valuation Drops by 19 Trillion Won in Two Days Due to Sharp Decline

Samsung Electronics Alone Drops by 5 Trillion Won, 18 Stocks Fall Over 20%

Red Light for Achieving Returns if Global Downtrend Continues

The stock valuation of the National Pension Service (NPS), the largest institutional investor in the domestic stock market, decreased by approximately 19 trillion KRW over two trading days. The fear of a U.S.-originated 'R (Recession)' has dealt a direct blow to the NPS in the declining market, casting a red light on achieving this year's return targets.

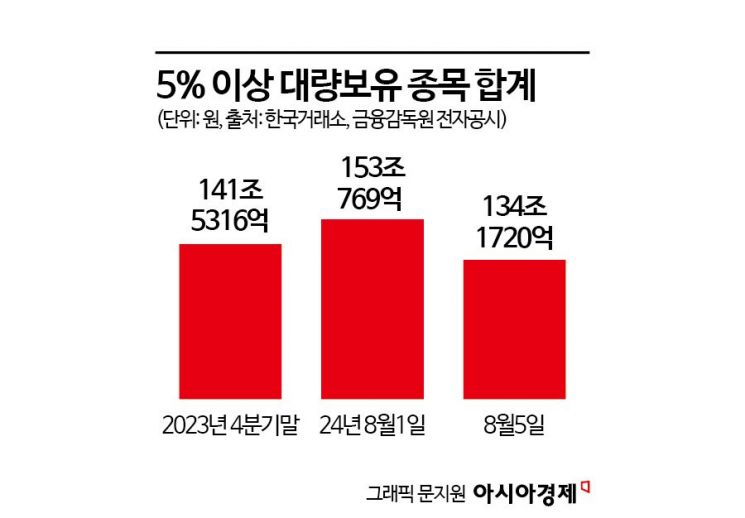

According to the Korea Exchange on the 6th, the total valuation of 284 stocks in which the NPS holds more than 5% shares was 134.172 trillion KRW based on the previous day's closing price. This is a decrease of 18.9049 trillion KRW (about 12.4%) compared to 153.0769 trillion KRW on the 1st. Due to the U.S.-originated shock, nearly 20 trillion KRW in valuation loss occurred in the domestic stock market over two trading days on the 2nd and 5th.

Furthermore, the value of NPS's domestic stocks has not only given back all the gains made this year but has actually retreated. Comparing the valuation at the end of Q4 2023 (141.5316 trillion KRW) with that on the 5th, there was a decrease of 7.3596 trillion KRW. However, it remains higher than the end of 2022 (125.4 trillion KRW).

Samsung Electronics alone lost 5 trillion KRW... All 284 stocks declined

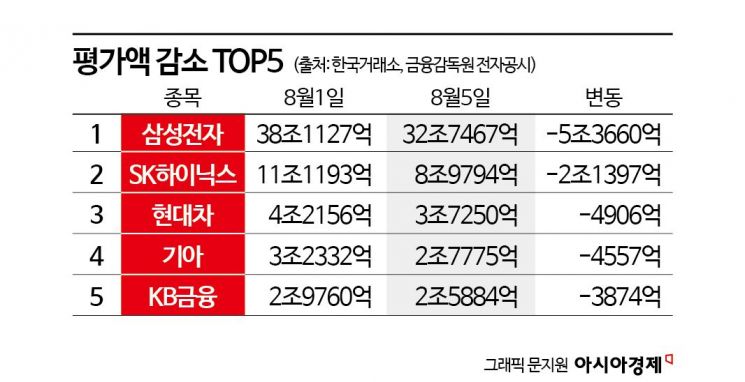

The stock with the largest valuation decrease over two days was the market leader Samsung Electronics. Its valuation dropped from 38.1127 trillion KRW to 32.7467 trillion KRW, a decrease of 5.366 trillion KRW. Following were SK Hynix (-2.1397 trillion KRW), Hyundai Motor (-490.6 billion KRW), Kia (-457.7 billion KRW), and KB Financial Group (-387.4 billion KRW), all showing significant declines in the NPS's holdings. Among the 284 large holdings, every single stock without exception declined in value, with 32 stocks experiencing a valuation drop exceeding 100 billion KRW.

During the same period, 18 stocks fell by more than 20%. These include Samhwa Electric (-27.1%), TEMCo (-25.85%), Isu Petasys (-24.6%), STI (-24.1%), and Techwing (-23.8%). Among these, Techwing, Samhwa Electric, and STI were newly added to the NPS's large holdings in Q2. The number of companies with valuations exceeding 1 trillion KRW decreased from 25 to 23. LG (from 1.087 trillion KRW to 986.7 billion KRW) and HD Hyundai Heavy Industries (from 1.0245 trillion KRW to 831.1 billion KRW) fell below the 1 trillion KRW valuation threshold.

The nightmare from two years ago resurfaces

The NPS recorded a loss of 79.6 trillion KRW in 2022 amid a global market downturn. The fund's operating return was -8.22%, the worst since its establishment in 1988. Losses were incurred across all asset classes, including domestic stocks (-22.7%), foreign stocks (-12.3%), domestic bonds (-5.5%), and foreign bonds (-4.9%), drawing criticism from the public and political circles. However, the NPS achieved a record-high return of 14.14% last year, recovering the losses incurred in 2022.

Not only the domestic stock market but also the U.S. stock market, where the NPS holds a significant proportion of foreign stocks, is experiencing a downturn. If this trend continues, it could seriously hinder achieving this year's fund target return of 5.4%. As of May, the NPS's 2024 fund operating return was 6.67% (annualized 7.23%). During this period, it recorded returns of 2.23% in domestic stocks and 16.13% in foreign stocks. Stocks account for 13.5% domestically and 33.8% overseas, totaling 47.3% of the portfolio, amounting to 526.824 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)