KOSPI Records Largest Ever Drop

First Simultaneous Sidecar and Circuit Breaker Activation Since COVID-19

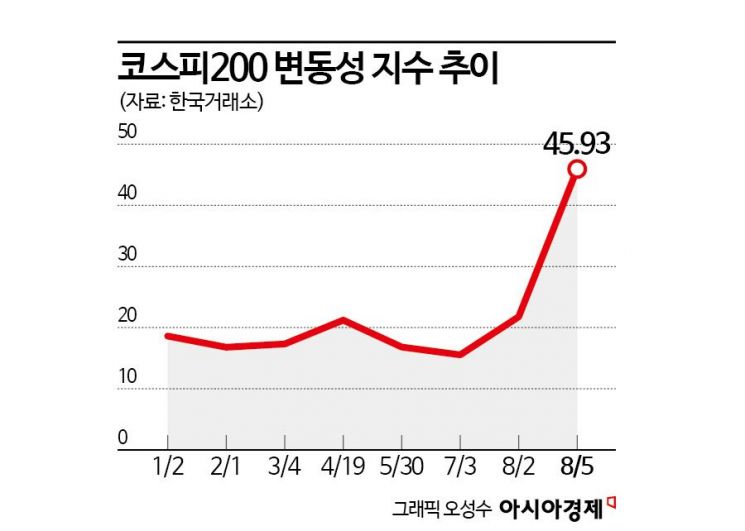

Fear Index Soars as Panic Peaks

Fear Index-Related ETNs Surge

The stock market plunged into panic amid concerns over a U.S. economic recession. The KOSPI retreated to the 2400 level, recording the largest single-day drop in history, while the KOSDAQ fell below the 700 mark. As the plunge continued, the fear index soared to its highest level since the COVID-19 pandemic. As the fear index surged, exchange-traded notes (ETNs) tracking the fear index showed a sharp rise.

According to the Korea Exchange on the 5th, the KOSPI closed at 2441.55, down 234.64 points (8.77%). It started in the 2600 range and plummeted to the 2400 range. The KOSDAQ closed at 691.28, down 11.30%.

Following 'Black Friday,' the market experienced a 'Black Monday' with a seemingly bottomless decline, resulting in a true 'panic market.' The first sidecar and circuit breaker of the year were triggered. A sidecar is activated when the KOSPI200 futures rise or fall by more than 5%, or when the KOSDAQ150 futures rise or fall by more than 6%, or when a 3% or more rise or fall persists for one minute. It was the first time since March 23, 2020, that sell-side sidecars were triggered simultaneously on both the KOSPI and KOSDAQ. The circuit breaker is triggered when the KOSPI and KOSDAQ fall by 8% compared to the previous day and this condition persists for one minute. It was also the first time since March 19, 2020, that circuit breakers were triggered simultaneously. The KOSPI's intraday and post-market closing declines both set record lows. Due to the sharp drop, the KOSPI's market capitalization fell below 2,000 trillion won, with about 192 trillion won evaporating in a single day. Both the Korea Stock Exchange and KOSDAQ recorded the highest number of declining stocks ever on that day.

Ji-won Kim, a researcher at KB Securities, analyzed, "Only negative factors such as economic concerns, increased volatility in the exchange rate (yen), Middle East worries, and news related to big tech companies including artificial intelligence (AI) were reflected, causing the KOSPI to record its largest drop." He added, "Samsung Electronics' plunge of over 10% showed an unprecedentedly poor investor sentiment, the worst since the IT bubble burst in 2000 and the financial crises of 1998 and 2008." He further noted, "Especially since the exchange rate volatility between the won and the dollar was limited, the sharp market decline was driven more by fear sentiment than fundamentals."

Fear sentiment peaked amid the panic market. The KOSPI200 Volatility Index (V-KOSPI), known as the 'fear index' of the domestic stock market, surged 24.16 points (110.98%) to 45.93 on the day. This is the highest level since the panic market during COVID-19 in March 2020. The V-KOSPI rose intraday to 48.51, marking the largest intraday increase since April 10, 2019, when it rose 122.83%.

The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), known as the fear index of the New York stock market, also surged. It rose 64.90% from the previous day to 38.57. Before the market opened, it soared to 65.73, the highest level in about four years.

As the fear index soared, ETNs tracking it surged. The KTB S&P500 VIX S/T Futures ETN(H) rose 51.35% over two trading days from the 2nd to the previous day. Shinhan S&P500 VIX S/T Futures ETN D (50.69%), Samsung S&P500 VIX S/T Futures ETN (50.58%), and Daishin S&P500 VIX S/T Futures ETN (50.27%) also rose more than 50% in two days.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.