Doosan Enerbility, Bobcat, and Robotics Shareholder Reassurance

Letter Sent After Securing Shareholder Register for May 5 Extraordinary General Meeting

Doosan Enerbility announced on the 4th that it plans to invest the 1 trillion won secured through the split of Doosan Bobcat into the globally booming nuclear power sector amid controversy over shareholder rights infringement regarding the restructuring of Doosan Group's business structure.

Park Sang-hyun, CEO of Doosan Enerbility, explained in a shareholder letter posted on the company's website that the split of Doosan Bobcat will reduce borrowings by 700 billion won and secure 500 billion won in cash through the disposal of non-operating assets to improve the financial structure. This will create additional borrowing capacity and new investment capacity of about 1 trillion won, enabling rapid investment in expanding production facilities.

He expressed expectations for new nuclear power plant orders in countries including the Czech Republic, Poland, the United Arab Emirates (UAE), Saudi Arabia, and the United Kingdom, and mentioned the possibility of expanding orders in the small modular reactor (SMR) business due to increasing power demand.

Doosan Bobcat and Doosan Robotics also posted shareholder letters on their websites under the names of their respective CEOs, announcing business restructuring plans and growth strategies. The three companies plan to send shareholder letters immediately after securing the shareholder registry for the extraordinary general meeting on the 5th.

Scott Park, CEO of Doosan Bobcat, explained that the AI-based unmanned and automation trend is the background of the business restructuring. He stated that through integration with Doosan Robotics, the goal is to secure unmanned and automation technologies and gain market leadership. He mentioned acquisition cases of Caterpillar and Deere & Company and said Doosan Bobcat plans to strengthen cooperation with robotics software startups.

Ryu Jeong-hoon, CEO of Doosan Robotics, revealed plans to expand robot sales by utilizing the North American and European market networks and business infrastructure through integration with Doosan Bobcat. He emphasized the growth potential of the autonomous driving equipment market and said Doosan Robotics can become a global top 3 company in the professional service market.

A Doosan official said, "The business restructuring plan was presented after deep consideration and review to enhance the business value of each company and increase shareholder value, but the market reaction was different from expectations, and we have heard many opinions through various channels." He added, "We humbly accept the criticism that explanations to the shareholders, the most directly involved parties, were insufficient, and we will communicate more with shareholders, including through this letter."

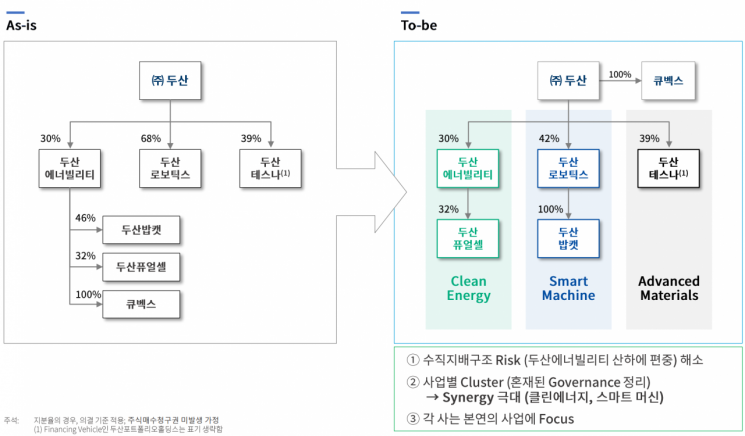

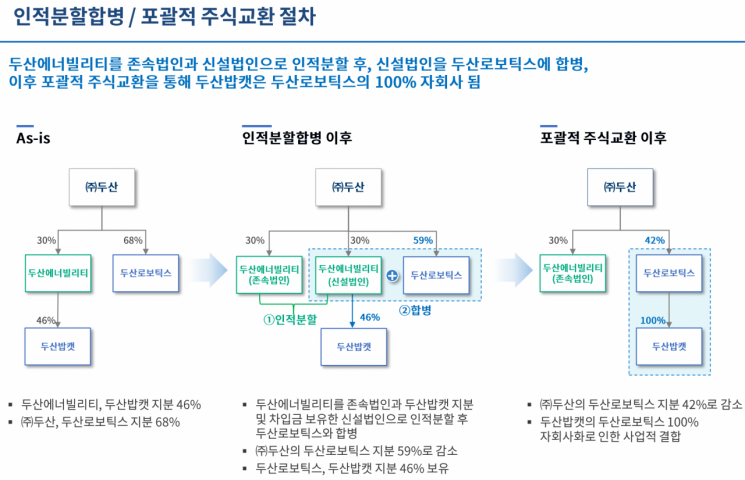

On the 11th of last month, Doosan Enerbility, Doosan Bobcat, and Doosan Robotics held board meetings and approved a governance restructuring plan including subsidiary splits, mergers, and comprehensive stock swaps. The plan involves a human split of Doosan Enerbility into a surviving corporation and a newly established corporation, followed by merging the new corporation into Doosan Robotics. Subsequently, through a comprehensive stock swap, Doosan Bobcat will become a 100% subsidiary of Doosan Robotics. Upon completion of the procedure, Doosan Co., Ltd.'s indirect stake in Doosan Bobcat will increase from 14% to 42% without additional capital injection, thereby strengthening the controlling shareholder's power.

Doosan Group plans to hold a shareholders' meeting on September 25 to propose this governance restructuring plan.

Park Sang-hyun, CEO of Doosan Enerbility: "Securing 1 Trillion Won for Investment in Nuclear Power Business"

Amid a global boom in nuclear power generation, unprecedented business opportunities are at hand. Thanks to being selected as the preferred bidder for the Czech nuclear power plant, competitiveness has been proven, and new nuclear power orders are expected from Poland, UAE, Saudi Arabia, the UK, Sweden, and the Netherlands. Over the next five years, including the Czech Republic, orders for about 10 units are anticipated.

The SMR (Small Modular Reactor) business, which is being intensively nurtured as a future growth engine, has recently emerged as a promising alternative for power demand driven by AI, with the possibility of significantly exceeding the 62 units ordered over the next five years as planned by the company.

The currently planned orders far exceed the company's nuclear main equipment manufacturing capacity. Therefore, the company has set goals to stably secure facilities for manufacturing more than four large nuclear power plants annually over the next five years and to expand SMR manufacturing facilities to a scale of 20 units per year. Securing cash and additional borrowing capacity is crucial for acquiring new technologies and timely expansion of production facilities.

This business restructuring is a good way to secure funds for such growth. The split of Bobcat reduces borrowings by 700 billion won, improving various financial indicators (debt dependency, interest coverage ratio), and 500 billion won in cash can be secured through the disposal of non-operating assets. This creates additional borrowing capacity and new investment capacity of about 1 trillion won, enabling rapid investment in expanding production facilities.

There are concerns about reduced dividend income due to the Bobcat split, but dividend income inevitably fluctuates annually depending on Bobcat's operating performance and is far insufficient for the company's required investment funds. On the other hand, investing the 1 trillion won secured through business restructuring in future growth engines can generate much higher investment returns than dividend income, enabling more profit creation and accelerated growth, which we confidently state.

We are fully aware of dissatisfaction regarding the split ratio. However, this is because some have excessively undervalued the stock price increase momentum due to the reduction in Enerbility's shares after the merger. It is cautious to generalize, but stock prices are determined by corporate value and the number of shares. At the time of the split, Enerbility's shares decrease by 25%, while corporate value is judged to decrease by 10%. Therefore, the per-share value of Enerbility at the time of re-listing is expected to rise by the difference between these two ratios. Considering the potential for additional growth through securing investment funds, please consider that the company's value after the split may increase further.

We are expanding business opportunities beyond nuclear power, including nuclear steam turbines cooperating with Westinghouse's reactor type, SMR steam turbines under business discussions with NuScale, TerraPower, and Rolls-Royce, gas turbines expected to secure orders for a total of 105 units by 2038, and hydrogen turbines progressing faster than advanced companies, aiming for a second leap as a comprehensive clean energy company.

This business restructuring will be finally decided at the shareholders' meeting based on shareholders' opinions. We believe this restructuring is a good opportunity to satisfy both shareholders' interests and the company's growth. We ask for wise decision-making considering future growth prospects.

Scott Park, CEO of Doosan Bobcat: "Strengthening Unmanned and Automation Technologies"

The AI-based unmanned/automation trend is clearly emerging in the company's core small equipment business areas such as construction, landscaping, agriculture, and logistics.

Across all industries, labor shortages, rapid wage increases, and strengthened safety regulations have become megatrends, making 'replacement of human labor' a more important technical challenge. Securing competitive unmanned/automation technologies will be essential for future market leadership. Leading companies, including ours, are making great efforts in future technology development and actively pursuing cooperation or mergers and acquisitions with robotics companies. Caterpillar, the global No.1 in construction equipment, acquired Marble Robot in 2020, and Deere & Company, the global No.1 in agricultural equipment, acquired Fair Flag Robotics in 2021.

Our company also judged integration with Doosan Robotics as an effective way to secure unmanned/automation technologies through technical cooperation with robotics software startups.

The industrial autonomous driving equipment market is expected to reach 80 trillion won by 2031 due to labor shortages, wage increases, and AI technology development. To lead this market, robotization of existing products is essential. Many component technologies such as vision recognition, digital twin, deep learning, and precision control are required. Doosan Robotics possesses strong software capabilities related to robotization.

To secure AI and unmanned/automation component technologies common to both companies, we will aggressively pursue acquisitions, mergers, and alliances with startups possessing leading technologies to accelerate technology acquisition. Additionally, we aim to preoccupy the professional service robot market through further mergers and acquisitions.

Through the comprehensive stock swap, shares held by our shareholders will be exchanged for Doosan Robotics shares, which are shares of the integrated corporation economically and practically combining our company and Doosan Robotics, not the pre-swap Doosan Robotics. Some focus only on the fact that shares will be exchanged for Doosan Robotics shares, but we emphasize the need to consider the 'substance' of the integrated corporation. The two companies plan to merge quickly after completing the stock swap and operate as one company.

We plan to cancel all treasury shares acquired through exercising stock purchase rights in addition to existing treasury shares, which will increase the value of the integrated corporation's shares. The integrated corporation will inherit our current dividend policy, maintain future dividend levels, and actively pursue 'value-up' plans based on business performance.

Stock prices representing company value in the market are formed over a considerable period based on independent judgments of market participants about company value, supply, and demand. Therefore, the law stipulates that exchange ratios in comprehensive stock swaps (including mergers) between listed companies must be calculated on a market price basis. The exchange prices of Doosan Robotics at 80,114 won and Doosan Bobcat at 50,612 won are not significantly different from their 2024 average prices (Doosan Robotics 80,564 won, Doosan Bobcat 51,041 won).

We apologize again for not sufficiently building consensus with shareholders after announcing the restructuring. We believe the integration plan with Doosan Robotics to be decided at the shareholders' meeting will accelerate our technological innovation and enable sustainable growth, making it a good opportunity to satisfy both shareholder interests and company growth. We earnestly ask for wise decision-making.

Ryu Jeong-hoon, CEO of Doosan Robotics: "Expanding Robot Sales Using Bobcat's North American and European Market Networks"

By creating synergy through integration with Doosan Bobcat, we expect to accelerate business growth planned at the time of listing.

Integrating with Doosan Bobcat, which has an overwhelming network and business infrastructure in the largest robot markets of North America and Europe, is expected to increase customer touchpoints in the largest robot markets by about 30 times compared to the current level.

In the manufacturing logistics market, the largest demand opportunity for robot sales, joint sales with Doosan Bobcat's forklifts will become possible. Furthermore, we can jointly enter the autonomous driving robot and autonomous unmanned forklift markets, each with a market size of about 10 trillion won, creating new business opportunities.

Recently, robot demand has expanded beyond traditional factories to professional services (construction, logistics, agriculture, medical, etc.). Combining Doosan Robotics, a leader in collaborative robots specialized in the professional service market, with Doosan Bobcat, which has the longest global experience in construction, logistics, and agriculture, is judged to be an opportunity to leap to an overwhelming leader in the professional service market with no incumbent leaders, establishing a global top 3 company.

Through synergy creation between the two companies, Doosan Robotics aims for an additional 50% growth over the three-year sales target presented at listing and expects to grow into a company with sales exceeding 1 trillion won within five years.

Some concerns have been raised about corporate value based solely on current sales and profit scale, but company value in the stock market is based on various grounds including future potential and technological capabilities beyond past and current performance. We have grown annually by 20%, exceeding the global collaborative robot market growth rate over the past three years, and securities firms presented target prices of 112,000 won before July 11.

We will do our best to ensure the integration with Doosan Bobcat proceeds smoothly and contributes to enhancing shareholder value through faster company growth.

Doosan Group Demerger and Merger by Division and Comprehensive Stock Exchange Procedure

Doosan Group Demerger and Merger by Division and Comprehensive Stock Exchange Procedure [Image Source=Doosan Group]

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.