Plan to Launch 11 Biosimilars by Next Year

Entering Final Approval Stage for Completion

Total Market Value Reaches 47 Trillion KRW with 5 Additional Products

11 More to Be Added by 2030... Targeting 11 Trillion KRW in Sales

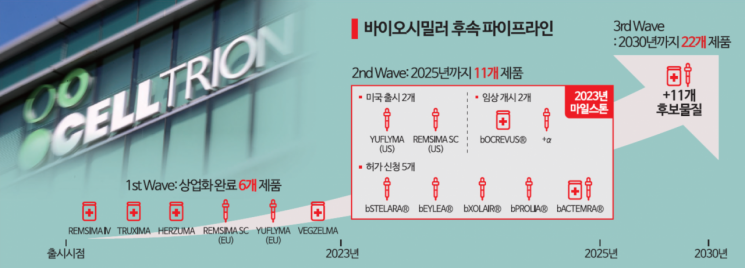

Celltrion's 'second wave' strategy of securing 11 types of biosimilar products by next year is entering its final stage. If successful, it will have the largest biosimilar portfolio in the world. Celltrion is also accelerating its 'third wave' strategy to double the portfolio to 22 types by 2030.

Last year, Celltrion revealed plans to increase its biosimilar product lineup to a total of 11 by adding five more biosimilars by next year, in addition to the six biosimilars already commercialized (Remsima IV, Remsima SC, Uplyma, Truxima, Herzuma, and Vegzelma).

The original products for these additional five biosimilars are global blockbuster drugs with annual sales last year of ▲Stelara $10.9 billion ▲Eylea $9.4 billion ▲Prolia $6.5 billion ▲Xolair $4.4 billion ▲Actemra $2.9 billion. The combined market size is approximately $34.1 billion (about 46.75 trillion KRW). Most of these drugs have patents that have expired or will expire soon, and biosimilars of these drugs are steadily progressing through approval procedures in key regions such as Korea, the United States, and Europe.

The fastest progress is with Omniclo, the biosimilar of Xolair, which has been approved in Korea and Europe. Stekima, the biosimilar of Stelara, received approval recommendation from the Committee for Medicinal Products for Human Use (CHMP), the final hurdle before formal approval in Europe, following domestic approval, and is expected to be approved as early as this month. Idenselt, the biosimilar of Eylea, has been approved domestically, while Prolia (CT-P41) and Actemra (CT-P47) require more time for approval as their final clinical results were released at the end of last year.

If all these biosimilars successfully obtain approval from the U.S. Food and Drug Administration (FDA), Celltrion is expected to hold the title of 'company with the most FDA-approved biosimilars.' As of last month, Pfizer and Amgen in the U.S., Samsung Bioepis in Korea each have 7 FDA-approved biosimilars, Swiss Sandoz has 6, and Celltrion follows with 5. If the five additional biosimilars are approved, Celltrion’s FDA-approved biosimilars will total 10, making it the largest portfolio. Among the 11 products, Remsima SC has been approved as a new drug in the U.S. and is on the market, following FDA recommendations due to its improved dosing convenience.

Celltrion is not stopping there and plans to add 11 more biosimilars by 2030, expanding its portfolio to 22 products. Seo Jung-jin, Chairman of the Celltrion Group, stated in January, "We pride ourselves on having the strongest portfolio among biosimilar companies," and added, "When all 22 products are launched, we expect biosimilar sales of 11 trillion KRW and operating profit of 3.3 trillion KRW."

The main target is the programmed cell death protein 1 (PD-1) series of immune checkpoint inhibitors. MSD’s Keytruda, which became the world's top-selling drug last year with sales of $25 billion (about 34 trillion KRW), belongs to this category. Celltrion submitted a plan in June to conduct a Phase 3 clinical trial of a Keytruda biosimilar in the U.S., aiming to confirm efficacy and safety compared to Keytruda in 606 lung cancer patients. The biosimilar of Ocrevus, a treatment for multiple sclerosis, received approval for a Phase 3 clinical trial plan in Europe, and the biosimilar of Cosentyx, an autoimmune disease treatment, submitted a Phase 3 clinical trial plan to the FDA last month.

Additionally, Celltrion plans to develop various targets in oncology, including human epidermal growth factor receptor 2 (HER2) series antibody-drug conjugates (ADCs), and in autoimmune diseases, expanding beyond tumor necrosis factor (TNF)-alpha to interleukin, CD20, LPAM-1, and others. In the ADC field, Celltrion is targeting Enhertu, which is currently regarded as a leading drug in the cancer market. Celltrion intends to expand beyond simple biosimilars to actual new drug development in the ADC area. To this end, it has begun securing ADC technology through collaborations with companies such as ExsuDa Therapeutics and Pinobio.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)