Two Months After Guideline Finalization

Only 11 Companies Announce Value-Up

Tax Benefits Expected to Increase Participating Companies

The government’s decision to promote value-up tax incentives has drawn attention to whether disclosures of corporate value enhancement plans, which have been lackluster, will become more active. The securities industry views the tax reform plan as designed to encourage value-up disclosures, and expects that once the related law is implemented, the number of companies disclosing corporate value enhancement plans will increase. However, there are also concerns that the incentive effect may not extend to large corporations, as the inheritance tax savings benefits are concentrated on mid-sized companies.

According to KIND of the Korea Exchange on the 1st, as of July 31, 11 listed companies across KOSPI and KOSDAQ have announced corporate value enhancement plans. Among them, only six companies?Kiwoom Securities, FnGuide, Kolmar Holdings, Meritz Financial Group, Woori Financial Group, and Shinhan Financial Group?have made official disclosures. The remaining five companies?KB Financial Group, DB HiTek, HK Innoen, Kolmar BNH, and BNK Financial Group?have stated they will present specific corporate value enhancement plans within this year. Although two months have passed since the Korea Exchange finalized guidelines on corporate value enhancement plans on May 27, participation in disclosures by listed companies remains low. Financial sectors, considered the main beneficiaries of value-up, have shown the most active willingness to participate.

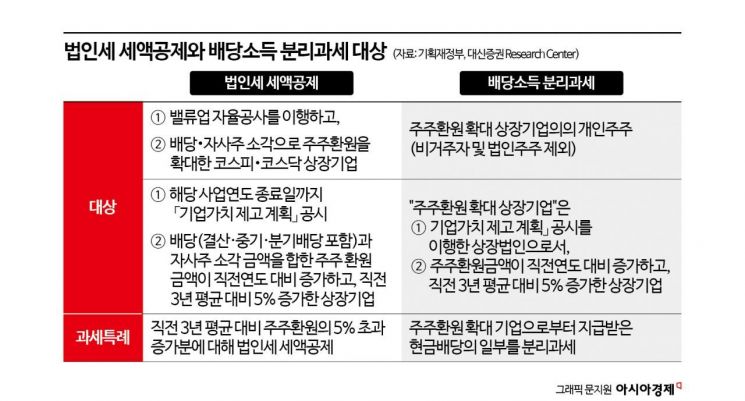

Industry insiders expect that the shareholder return promotion tax measures announced by the government will contribute to the spread of value-up participation. The Ministry of Economy and Finance announced the tax law revision plan on the 25th of last month, stating that it will reduce corporate tax burdens for companies striving to enhance shareholder and corporate value, and will also reduce dividend income tax for individual shareholders investing in these companies. The corporate tax credit benefits and dividend income separate taxation benefits apply to listed companies that have implemented corporate value enhancement plan disclosures.

Lee Kyung-yeon, a researcher at Daishin Securities, said, "These two tax incentives indicate that the foundation of tax support related to value-up is the strengthening of voluntary disclosure of value-up plans," adding, "Since the tax benefits are designed to encourage disclosures, it is expected that the number of companies disclosing corporate value enhancement plans will increase."

For these tax incentives to materialize, they must gain approval from the National Assembly. After the legislative notice period (14 days) by August, the plan must pass the Cabinet meeting and the regular National Assembly session in September. Currently, the ruling Democratic Party has expressed opposition to value-up tax support, citing concerns that when companies expand dividends or retire treasury shares, corporate owners might use these measures to increase their own wealth or reduce corporate tax burdens.

There are also concerns that even if the tax incentives pass the National Assembly and are activated, their effectiveness may be limited. Park Se-yeon, a researcher at Hanwha Investment & Securities, said, "The value-up policy is gaining momentum across various sectors including politics, business, investors, and academia, and above all, the government’s determination is strong, so there is sufficient room for it to contribute to stock price increases in the second half of the year," but added, "Even if this tax reform plan passes the National Assembly, the inheritance tax savings benefits are concentrated on mid-sized companies (with sales under 500 billion KRW), so it remains to be seen how much impact the tax reform will have on value-up."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)