Bloomberg Highlights Investment Losses of Aegis and Meritz

The losses suffered by domestic institutional investors in U.S. commercial real estate investments are receiving focused attention from the U.S. media as well. Domestic institutions, which rapidly increased their investments in U.S. commercial real estate mainly through mezzanine bonds with high yields during the past low-interest-rate period, have seen the collateral value of real estate plummet due to rising vacancy rates and interest rate hikes after the pandemic. As a result, they have fallen behind in debt repayment priority and lost more than half of their principal investment. With the maturity of over $1,135 trillion in U.S. commercial real estate loans coming due this year, concerns are rising that losses for domestic institutional investors will further expand.

Bloomberg: "Korean Institutions Recover Only 30% of Principal in U.S. Commercial Real Estate Investment Failures"

On the 30th (local time), Bloomberg News highlighted the failures of domestic asset management companies in U.S. commercial real estate investments in an article titled "Risky Bets on U.S. Commercial Real Estate Become a Major Failure for Korea."

According to the report, Aegis Asset Management invested in the '1551 Broadway' office building near Times Square in Manhattan, New York, but recently suffered massive losses and sold mezzanine bonds. The amount recovered was less than 30% of the principal. This is due to the combined effects of high interest rate pressure and increased office building vacancy rates following the spread of remote work after the pandemic, which caused a sharp decline in the value of U.S. commercial real estate. Some building owners are unable to repay loans or are selling properties at prices lower than the bank loan amounts.

Hyundai Asset Management also provided mezzanine loans for '280 Park Avenue' in Manhattan and sold the loan bonds at half the principal value earlier this year. Mezzanine loans are loan bonds issued secured by real estate and correspond to mezzanine or subordinated bonds. Unlike senior bonds, which can recover investment funds by disposing of collateral in case of default, mezzanine and subordinated bonds are lower in repayment priority and are practically difficult to recover.

Domestic asset managers are experiencing large losses not only on the U.S. East Coast but also on the West Coast through commercial real estate investments. Meritz Alternative Investment Management provided mezzanine loans to the Gas Company Tower in Los Angeles (LA), where the building owner is struggling to repay the loan. Meritz is also facing difficulties in recovering the principal.

Spencer Park, an attorney at Milbank, analyzed, "They (Korean asset managers) bought these positions without being fully prepared to structurally respond to downside scenarios. When the situation worsened or was unfavorable, they found themselves in trouble."

John Babas, a real estate finance attorney at New York's Polsinelli, pointed out, "After stocks, the riskiest thing during a recession is highly leveraged debt. That is exactly mezzanine finance."

Investing Mainly in 'Mezzanine Loans' Lower in Repayment Priority... "This Is Just the Beginning of Pain in Commercial Real Estate"

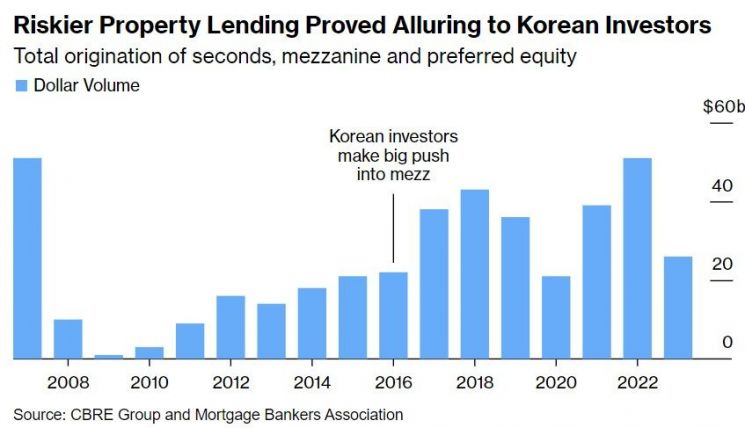

Mezzanine loans became a popular investment method among Korean institutional investors as they expanded real estate investments in major U.S. cities around 2016. At that time, with low funding costs, real estate prices rose, sparking a boom in U.S. commercial real estate investments. As U.S. banks applied strict lending regulations, Korean institutions seized the opportunity by providing mezzanine and other subordinated loans, creating local commercial real estate investment opportunities. According to CBRE Group and the U.S. Mortgage Bankers Association (MBA), the scale of mezzanine financing provided by Korean institutional investors increased from $21 billion (about 29 trillion KRW) in 2016 to $51 billion (about 71 trillion KRW) in 2022.

A representative from a domestic financial institution's New York branch explained, "Domestic institutional investors such as insurance companies and securities firms invested mainly as mezzanine or subordinated bondholders in U.S. commercial real estate because their local credit was low. At that time, if domestic investment yields were 3-4%, the yield on mezzanine and subordinated bonds in U.S. commercial real estate was about 10%, sparking an investment boom." He added, "Recently, as the U.S. commercial real estate market has declined sharply in collateral value, senior bondholders?U.S. banks?are repaid first, and domestic institutions holding mezzanine and subordinated bonds are unable to recover even their principal properly."

In fact, after the pandemic, high interest rates and rising vacancy rates turned U.S. commercial real estate investments by domestic institutional investors into a "nightmare." As collateral values fell and owners failed to repay principal and interest on loans on time, delinquency rates and foreclosures increased. According to market research firm Trepp, the delinquency rate on Commercial Mortgage-Backed Securities (CMBS), which are backed by commercial real estate loans, reached 8.11% as of this month, the highest level in 11 years since November 2013 (8.58%). Foreclosures are also on the rise. According to Morgan Stanley Capital International (MSCI), the scale of foreclosed office buildings, apartments, and other commercial real estate in the U.S. in the second quarter of this year was $20.55 billion (about 28 trillion KRW), a 13% increase from the previous quarter. This is the largest scale in nine years since the third quarter of 2015 ($27.5 billion, about 38 trillion KRW).

Accordingly, domestic institutional investors are withdrawing from U.S. commercial real estate investments. According to CBRE Group, Korean investors invested $700 million in overseas commercial real estate last year, an 86% decrease compared to 2022. However, Bloomberg News forecasts that losses for domestic institutional investors may continue for some time as the commercial real estate market remains in a downturn. According to MSCI Real Assets, 20% of the $820 billion (about 1,135 trillion KRW) in commercial real estate loans maturing this year in the U.S. are related to office real estate.

Dan Zwein, CEO of Arena Investors, stated, "It is impossible to know the extent of losses until assets are sold, and banks tend to sell less stressed assets first. The pain in the real estate market is still just beginning."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.