Korean Air Holds Steady, LCCs Struggle

Operating Profit Drops Double Digits YoY

Labor Cost Burden Realized... Growth in Japan and Southeast Asia Slows

Domestic airlines' performance in the second quarter of this year is expected to slow down somewhat. This is due to the traditional off-season and increased supply focused on short-haul routes, which has intensified pressure on fare reductions. There is a possibility that the performance gap between full-service carriers (FSC) and low-cost carriers (LCC) will widen further.

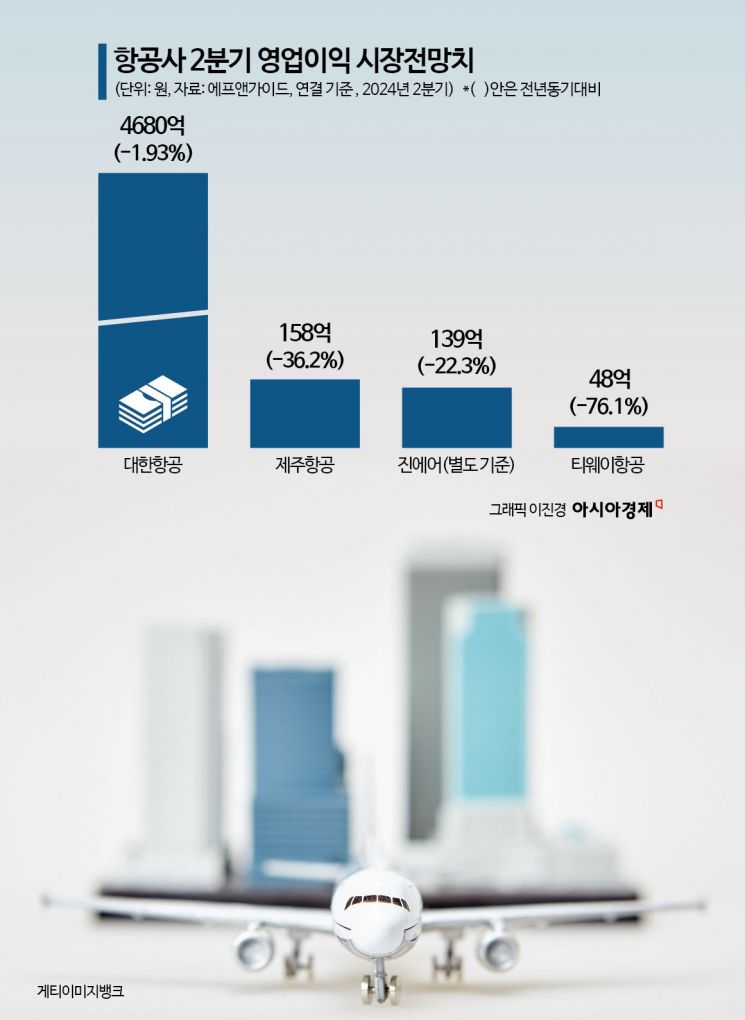

According to financial information analysis firm FnGuide on the 30th, operating profits of major domestic airlines in the second quarter are expected to decline one after another compared to the same period last year. The market consensus for Korean Air's second-quarter consolidated operating profit is 468 billion KRW, which is expected to decrease by 1.93% compared to the same period last year.

LCCs' performance is expected to be even weaker. The second-quarter operating profit consensus for Jeju Air and Jin Air is estimated to decrease by 36.2% and 22.3%, respectively, compared to the same period last year. This is interpreted as a result of labor cost burdens, such as wage increases and additional hiring, which had been postponed but began to be fully reflected as profits, which had stalled due to COVID-19, started to recover from last year. T'way Air's operating profit is expected to be only 4.8 billion KRW, down 76.1%, due to the significant cost burden related to proactively expanding personnel for entry into European routes.

Demand growth has also slowed somewhat. According to the Ministry of Land, Infrastructure and Transport's air transport statistics, the number of international passengers nationwide in June was 7,195,279. This represents a 29.5% increase compared to the same period last year but only a 1.5% increase compared to the previous month. In particular, the Japan routes, which LCCs focus on, decreased by 0.4% compared to the previous month, and Southeast Asia routes increased by only 1.5%. The number of domestic passengers, where LCCs have a large share, was 2,651,285 last month, down 4.1% from the previous month. On the other hand, the number of passengers on the Americas routes, which are major routes for FSCs, increased by 4.1%.

There is also a forecast that the performance gap may widen as fare reduction pressure increases, especially among LCCs engaged in ultra-low-cost competition. NH Investment & Securities researcher Jeong Yeonseung said, "Domestic travel agencies are intensifying competition by launching ultra-low-cost products to exhaust the seat inventory they secured by prepaying airlines," adding, "In the second half of the year, demand for travel agencies' preemptive inventory is likely to decrease, so there is a high possibility of fare reductions mainly on short-haul and regional airport routes where supply has greatly increased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.