Real Estate R114 Analyzes Seoul Apartment Supply

8,244 Units in First Half vs 13,810+ Units in Second Half

Seoul Apartment Prices Rise, "Buy Now" Sentiment Spreads

Reconstruction Sites Agree on Increased Construction Costs, Leading to More Sales

This year, a flood of apartment pre-sales is expected in the Seoul area during the second half of the year. Along with pre-sale strategies aiming to ride the wave of rising Seoul housing prices, reconstruction sites agreeing to increase construction costs before raw material and labor costs rise further are emerging one after another, increasing the volume of scheduled pre-sales. As the perception spreads that it will become increasingly difficult to own a home due to rising housing prices, attention is focused on whether the pre-sale sell-out streak will continue.

When crossing the Banpo Bridge in Seoul, you can see new apartments, old apartments, and apartments under construction all at once in the Sinbanpo area. The new apartments on the left are Acro Riverview Sinbanpo, the low old apartments on the right are Sinbanpo 2nd Complex, and the apartments under construction in the back are the Maple Xi construction site. Photo by Younghan Heo younghan@

When crossing the Banpo Bridge in Seoul, you can see new apartments, old apartments, and apartments under construction all at once in the Sinbanpo area. The new apartments on the left are Acro Riverview Sinbanpo, the low old apartments on the right are Sinbanpo 2nd Complex, and the apartments under construction in the back are the Maple Xi construction site. Photo by Younghan Heo younghan@

Where and How Much Pre-sale Volume Will Come Out in the Second Half

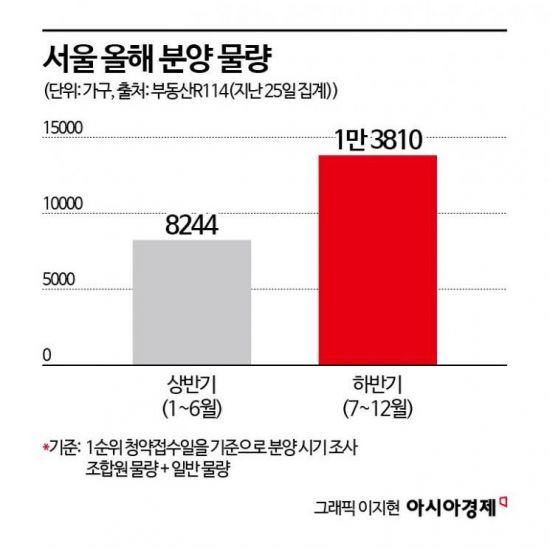

According to Real Estate R114 on the 29th, the pre-sale volume in Seoul for the first half of this year (January to June) was 8,244 units, and it will increase to 13,810 units in the second half. Real Estate R114 compiled the figures by combining the union member units and general pre-sale units based on the first-priority subscription application date. There are also 46,467 units planned for pre-sale within this year, but their subscription application dates have not yet been confirmed. Some of these may be additionally reflected in the second half pre-sale volume.

Within Seoul, the areas with the largest pre-sale volumes in the second half of this year are Seocho-gu (3,706 units), Songpa-gu (4,543 units), Seongbuk-gu (1,637 units), and Mapo-gu (1,101 units), in that order. In Songpa-gu (4,543 units), pre-sales are scheduled for Jamsil Raemian I-Park (2,678 units), Jamsil Le El (1,865 units), and Garak Plaza in Garak-dong (1,305 units) in October. In Seocho-gu, D.H. Bangbae (3,065 units) is scheduled for pre-sale in November.

Baek Saerom, lead researcher at Real Estate R114, said, "The Seoul pre-sale market is overheating, and housing prices are rising due to a shortage of new units. In Seoul, where new apartments are supplied mainly through redevelopment projects, subscription competition rates will remain very high going forward." The subscription competition rates for ‘Prugio Radius Park’ in Jangwi-dong, Seongbuk-gu, and ‘Mapo Xi Hillstate Rachels’ in Gongdeok-dong, Mapo-gu, which were pre-sold this month, were 35:1 and 163:1, respectively.

Seoul Apartment Supply Shortage Problem Remains

Reconstruction and redevelopment sites in Seoul that have agreed to increase construction costs, which was the biggest source of conflict between unions and contractors, are also emerging one after another. Resolving construction cost conflicts allows scheduling of general pre-sale dates.

The Jamsil Jinju Apartment reconstruction union in Songpa-gu agreed with the Samsung C&T and HDC Hyundai Development Consortium to raise construction costs from 6.66 million KRW to 8.115 million KRW per 3.3㎡. The redevelopment union of Gocheok 4 District in Guro-gu also agreed with Daewoo Engineering & Construction and Hyundai Engineering to increase construction costs from 4.47 million KRW to 7 million KRW per 3.3㎡.

An official from a major construction company explained, "Advancing the pre-sale timing as soon as possible is the way to offset the risk of further increases in raw material and labor costs. Above all, the unions judged that pre-selling when there is high demand for sales is advantageous in reducing reconstruction contributions, which has made reaching agreements easier."

However, the temporary increase in pre-sale volume in the second half of this year and the future shortage of apartment supply in Seoul should be viewed separately. A real estate industry official said, "The current pre-sale volume consists of units approved 5 to 6 years ago. The number of approvals has sharply decreased in the past 2 to 3 years, so it will be difficult to find new apartments in Seoul city from 2026 onward."

As concerns about the recent shortage of apartment supply in Seoul grow and housing prices rise, the government has announced plans to release an ‘Additional Housing Supply Expansion Plan’ next month. Accelerating urban redevelopment projects, supplying housing in the 3rd New Town and other metropolitan areas, securing additional sites within the metropolitan area, and expanding non-apartment supply are cited as representative measures.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.