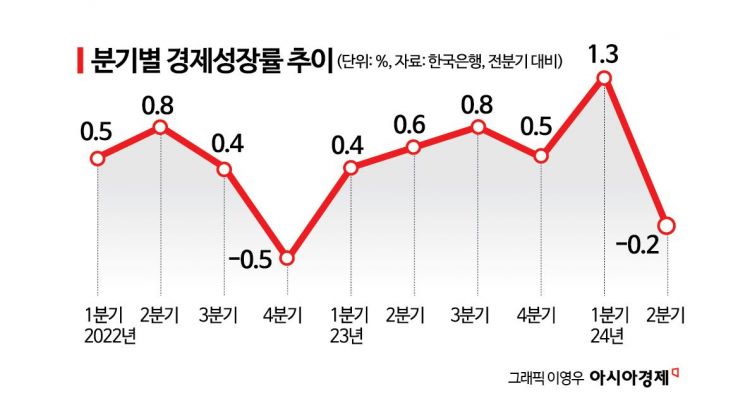

Q2 Growth Rate -0.2%, Below Expectations

Possibility of Downward Revision in Annual Growth Forecast

In the second quarter, South Korea's economic growth rate was worse than expected, leading to a downward revision of the private sector's annual economic growth forecast. Concerns have been raised that sluggish domestic demand, including private consumption and investment, will continue into the second half of the year, and that the export growth momentum may also slow down.

Q2 Growth Rate -0.2%, Domestic Demand Worse Than Expected

According to the Bank of Korea on the 26th, South Korea's economic growth rate in the second quarter of this year was -0.2%, lower than the market's expected range of 0 to 0.1%. Compared to the previous year, the economy grew by 2.3%, which also fell short of the market forecast of 2.5%. The economic growth rate for the first half of the year was 2.8%, below the Bank of Korea's May economic outlook forecast of 2.9%.

The decisive reason for the second quarter growth rate falling short of expectations was sluggish domestic demand. Among these, private consumption declined by 0.2% compared to the previous quarter, marking the first negative growth since the second quarter of last year. There was also an impact from construction investment and facility investment, which fell by 1.1% and 2.1%, respectively.

With the second quarter growth rate falling short of expectations and growing concerns over sluggish domestic demand, there are private sector predictions that achieving the Bank of Korea's forecast of 2.5% economic growth for this year will be difficult.

Following the Bank of Korea's announcement of the second quarter growth rate, major domestic securities firms revised down their economic growth forecasts for this year. Korea Investment & Securities and Eugene Investment & Securities each lowered their forecasts from 2.5% to 2.4%, while Samsung Securities reduced its forecast from 2.7% to 2.5%. Hana Securities (2.4%) and Shinhan Investment Corp. (2.3%) maintained their previously somewhat lower forecasts.

Lee Jeong-hoon, an economist at Eugene Investment & Securities, said, "Even considering the base effect from the surprise growth in the first quarter, the second quarter growth rate fell short of expectations due to sluggish private consumption and investment," adding, "It is difficult to be confident that domestic demand has entered a recovery phase, so we have revised down the annual growth forecast."

There were also concerns about exports. He stated, "In the second quarter, both exports and imports increased, but the contribution to growth was -0.1 percentage points, marking a negative for the first time in four quarters," adding, "Considering that exports are unlikely to improve further in the second half, the contribution of exports will gradually decrease."

Jung Sung-tae, senior research fellow at Samsung Securities, expressed concern, saying, "Due to the impact of high interest rates, private consumption has continued to slow, especially in goods such as automobiles and clothing, and construction and facility investments have also been sluggish, leading to a downward revision of the annual growth forecast," and added, "Exports, which have driven the Korean economy's recovery so far, are only growing in the low single digits excluding semiconductors."

Lee Nam-gang, a researcher at Korea Investment & Securities, analyzed, "Although export growth continued in the second quarter, the export growth rate has been steadily declining since the fourth quarter of last year, showing signs of weakening momentum."

Bank of Korea May Downgrade Annual Economic Growth Forecast

There is also a possibility that the Bank of Korea will revise down its annual economic growth forecast in the updated economic outlook to be released next month. Im Jae-gyun, a researcher at KB Securities, said, "The second quarter economic growth rate was worse than both market expectations and the Bank of Korea's forecast," adding, "If the growth momentum in the second half does not accelerate beyond current forecasts, the Bank of Korea is likely to slightly lower this year's economic growth forecast from 2.5% in the August revision."

However, the Bank of Korea explained that the current situation is still in line with the existing forecast. Shin Seung-chul, director of the Bank of Korea's Economic Statistics Department, responded to a question about the possibility of achieving the annual growth rate of 2.5% at a press briefing following the growth rate announcement, saying, "The first half growth rate is not significantly different from the existing forecast, and the current situation shows a growth pace consistent with the annual growth forecast."

The government also stated that the 2.6% growth forecast for this year remains valid despite the negative growth in the second quarter. A Ministry of Economy and Finance official explained, "The negative growth in the second quarter is an expected adjustment following the strong growth in the first quarter," adding, "Export momentum is being maintained in the second half, and consumption is showing signs of improvement compared to last year, making 2.6% economic growth achievable."

Meanwhile, with the second quarter economic growth rate coming in lower than expected, there are also views that the Bank of Korea's possibility of cutting the base interest rate within this year has increased. Although concerns about a rate cut have grown due to recent housing price increases in the Seoul metropolitan area, the Bank of Korea is expected to lower the base rate at least once by October at the latest, given the weak domestic demand.

Economist Lee Jeong-hoon emphasized, "The second quarter economic growth rate announcement reconfirmed that the domestic demand recovery remains weak," adding, "Despite recent increases in housing prices and household debt, the need for the Bank of Korea to cut rates within this year has increased."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)