Targeting 10% ROE and 50% Shareholder Return Rate by 2027

YouTube Briefing Session Scheduled for the 21st of Next Month for Individual Investors

Shinhan Bank plans to reduce its number of shares by 50 million through the repurchase and cancellation of more than 3 trillion won worth of treasury shares by 2027. During the same period, it aims to achieve a stable Common Equity Tier 1 (CET1) ratio of over 13%, a return on equity (ROE) of 10%, and a total shareholder return ratio of 50%.

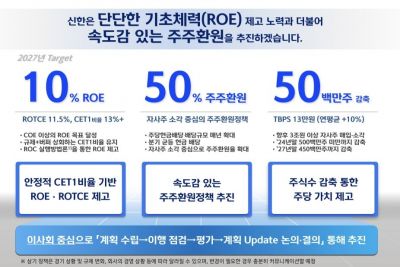

Shinhan Financial Group announced the "10·50·50 Corporate Value Enhancement (Value-Up) Plan" on the 26th, which includes specific execution goals and implementation measures based on improved profitability. Unlike past shareholder return targets that were declarative, this plan sets concrete indicators, goals, and deadlines.

The 10·50·50 plan of Shinhan Financial is broadly categorized into ▲ROE 10%, ▲total shareholder return ratio 50%, and ▲50 million shares reduction. First, to secure sufficient loss absorption capacity, Shinhan Financial raised its CET1 management target from the previous 12% to 13%, and based on this, aims to achieve an ROE of 10% and a return on tangible common equity (ROTCE) of 11.5%. As of the end of last year, Shinhan Financial's ROE was 8.61%, and ROTCE was about 9.87%.

ROTCE is a concept calculated by deducting intangible assets such as goodwill from capital, reflecting the actual capital profitability. Shinhan Financial is the first domestic financial company to introduce the ROTCE concept.

To enhance ROE and ROTCE, Shinhan Financial plans to introduce a group capital return (ROC, Return on Group Capital) indicator that measures profitability relative to capital allocated to each subsidiary, and use this as an evaluation and compensation metric for management to strengthen execution power.

Additionally, Shinhan Financial will consistently pursue existing shareholder return measures such as quarterly and equal dividends, and treasury share repurchase and cancellation, while expanding cash dividends per share and dividend amounts annually. Through continuous treasury share cancellations, it plans to reduce the number of shares and achieve a shareholder return ratio of 50% by 2027. This exceeds the 43% shareholder return ratio of major Singaporean financial companies (DBS, OCBC, UOB) and is comparable to Japan’s (MUFG, Mizuho, SMBC) 52%. Shinhan’s shareholder return ratio last year was 36%.

In particular, by the end of this year, Shinhan plans to reduce the number of shares to below 500 million, and by the end of 2027, to below 450 million shares to enhance per-share value. To this end, it plans to repurchase and cancel more than 3 trillion won worth of treasury shares over about three years. As of the end of last year, Shinhan Financial’s total outstanding shares were approximately 513 million, which is higher compared to competitors such as KB Financial (about 400 million) and Hana Financial (about 290 million).

Furthermore, if the price-to-book ratio (PBR) is below 1, Shinhan will focus shareholder returns on treasury share cancellations, and if it exceeds 1, it will gradually increase the cash dividend payout ratio, implementing a phased and flexible shareholder value enhancement strategy.

Communication with shareholders will also be strengthened. Shinhan Financial plans to hold an online briefing session to help individual investors understand the value-up plan and enhance investor communication. Accordingly, from today until the 2nd of next month, Shinhan Financial will collect questions from individual investors regarding the value-up plan through its website, and on the 21st of next month, it will provide answers via the group’s official YouTube channel.

A Shinhan Financial official stated, "Since introducing quarterly dividends in 2021, Shinhan Financial has led shareholder return policies among domestic financial groups by introducing equal dividends and continuous treasury share cancellations to increase predictability for shareholders. We will strive to quickly achieve the specific goals announced this time to enhance value for shareholders, society, and all stakeholders."

Meanwhile, Woori Financial Group also announced its mid- to long-term value-up plan the day before. Woori Financial stated that it will achieve a CET1 ratio of 12.5% early next year and raise it to over 13% in the mid- to long-term to achieve an ROE of 10% and a shareholder return ratio of 50%. The core of the value-up plan, the total shareholder return ratio, is set to expand to 40% in the CET1 range of 12.5?13.0%, and up to 50% when exceeding 13%. In particular, Woori Financial aims to accelerate shareholder returns by achieving a CET1 ratio of 12.5% early next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)