Timon and Wemakeprice 1 Trillion Won Deficit

Chronic Losses Continue Leading to Liquidity Crisis

Coupang, Kurly, SSG.com, and 11st Deficits Reach 6 Trillion Won Range

Consumer anxiety stemming from delayed settlements by social commerce platforms WEMAKEPRICE and TMON, subsidiaries of the Qoo10 Group, is spreading throughout the entire e-commerce sector. Although the issue originated from the extended seller settlement cycles of WEMAKEPRICE and TMON, these companies have failed to properly settle payments due to deteriorating liquidity, having recorded complete capital erosion over several years. Given that e-commerce companies have long been associated with "deficits" and "debt," their financial conditions were examined.

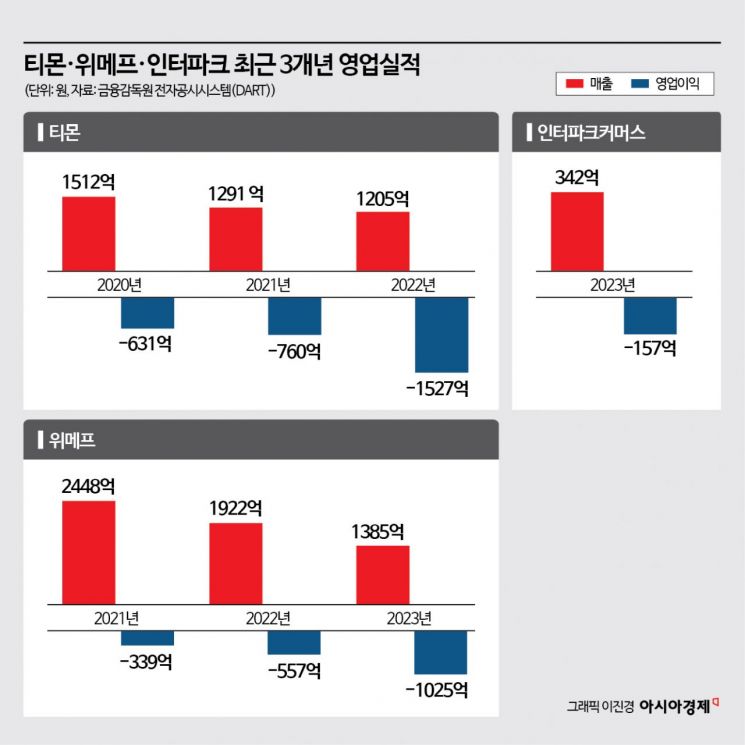

According to the Financial Supervisory Service's electronic disclosure system on the 26th, WEMAKEPRICE and TMON have recorded negative total capital for the past three years, indicating complete capital erosion. Capital erosion means that the total capital is less than the initial business capital, implying that continuous losses have completely depleted the capital.

During this period, WEMAKEPRICE's current liabilities increased significantly. Current liabilities are debts that must be repaid within one year, with accounts payable constituting the largest portion. Accounts payable refer to a type of credit extended when purchasing goods without immediate payment. As of the end of last year, WEMAKEPRICE's accounts payable stood at 292.4 billion KRW, a 6,500% increase from 4.4 billion KRW in 2021. The accumulated deficit reached 755.9 billion KRW.

WEMAKEPRICE recorded an operating loss of 102.5 billion KRW last year, nearly matching its sales revenue of 138.5 billion KRW. The deficit nearly doubled compared to 55.7 billion KRW in 2022. Continued losses have led to an increase in accumulated deficits.

TMON's financial situation is even more precarious. TMON did not submit an audit report last year, so its 2022 performance is the most recent data available. In 2022, TMON's operating loss was 152.7 billion KRW, exceeding its sales revenue of 120.5 billion KRW. As losses increased, the accumulated deficit reached 1.2644 trillion KRW in 2022. The deficit has been accumulating since surpassing the 1 trillion KRW mark in 2020. As unpaid debts increased, current liabilities also rose. Accounts payable increased by over 200 billion KRW, from 509.6 billion KRW in 2020 to 711 billion KRW in 2022.

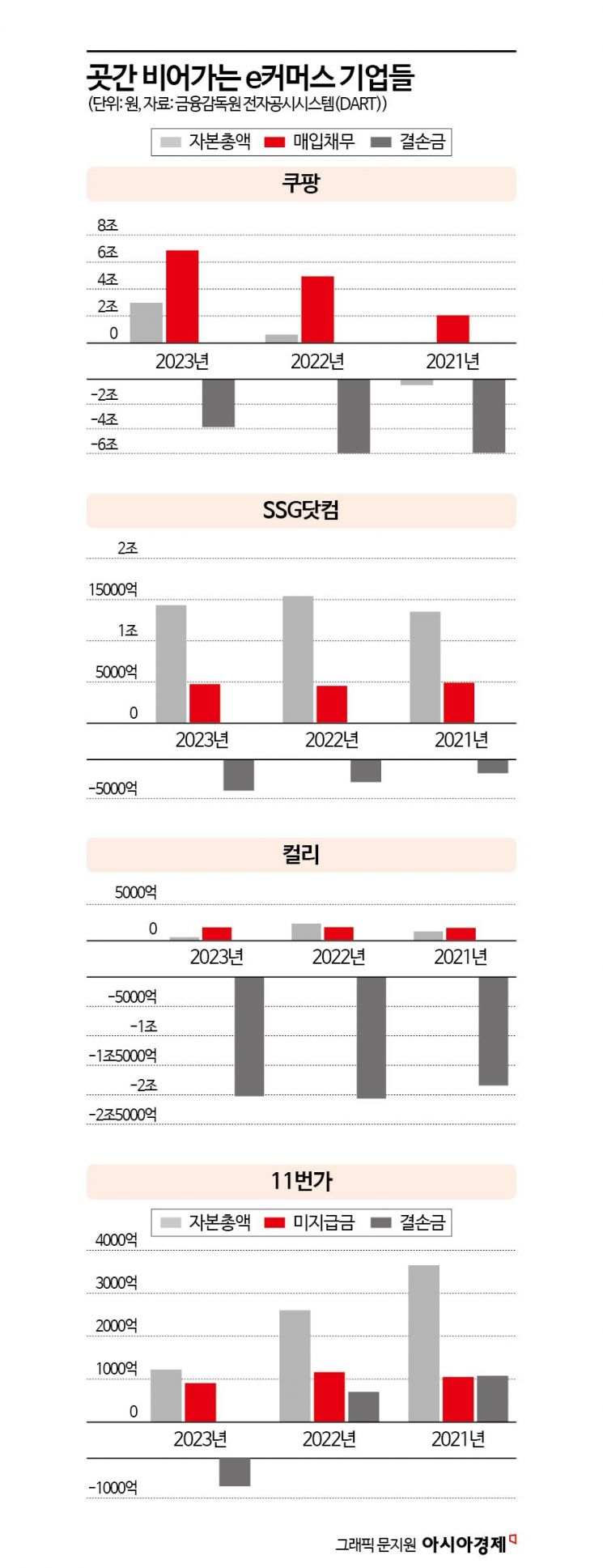

Major domestic e-commerce companies such as Coupang, Gmarket, SSG.com, 11st, and Kurly have also shown significant accumulated deficits due to ongoing losses. Coupang's accumulated deficit reached 3.8675 trillion KRW as of the end of last year. Kurly (2.2615 trillion KRW), SSG.com (399.2 billion KRW), and 11st (69.8 billion KRW) have also increased their accumulated deficits due to continuous losses.

However, Coupang, which turned a profit for the first time last year, reduced its accumulated deficit by over 2 trillion KRW. Coupang's accumulated deficit was close to 6 trillion KRW in 2021. Coupang reduced its deficit by increasing net income. Since disclosing its audit report in 2013, Coupang recorded net income turning positive for the first time last year. Although it posted a net loss of 41.2 billion KRW in 2022, improved performance and corporate tax benefits resulted in a net profit of 2.115 trillion KRW within a year. Coupang's accounts payable surged from 2 trillion KRW in 2021 to approximately 6.9 trillion KRW last year. Consequently, current liabilities increased from 5.5 trillion KRW to 8.445 trillion KRW.

Kurly is striving to turn a profit, but its accumulated deficit continues to grow due to increasing net losses. Net losses were 1.29 trillion KRW in 2021, 223.2 billion KRW in 2022, and 200 billion KRW last year. In the first quarter of this year, Kurly posted an operating profit of 500 million KRW but recorded a net loss of 4.4 billion KRW. Reflecting this, Kurly's accumulated deficit as of Q1 this year stands at 2.2678 trillion KRW.

SSG.com is also experiencing an increase in accumulated deficits due to ongoing losses. After recording a net loss of 104 billion KRW last year, it posted a loss of 12.5 billion KRW in Q1 this year. As a result, its accumulated deficit is estimated to have grown to around 400 billion KRW. 11st recorded an accumulated deficit for the first time last year. Following a net loss in the 1 trillion KRW range in 2022 and a loss of 131 billion KRW last year, retained earnings turned into a deficit. As the deficit grew, 11st's total capital fell from 260 billion KRW to 122.2 billion KRW within a year. Rather than improving profits, 11st has offset deficits by converting capital surplus into retained earnings. Despite not posting a profit even once since 2019, it recorded retained earnings for this reason. Recently, SK Square has effectively withdrawn from operating 11st, and since last year, deficits have been directly recorded in the accounting books.

Oasis, a dawn delivery specialist company, is performing well. Oasis recorded sales of 475.4 billion KRW and an operating profit of 12.7 billion KRW last year, and in Q1 this year, it achieved sales of 128.9 billion KRW and an operating profit of 6.2 billion KRW, marking the highest quarterly performance ever. Its financial structure is solid; while other e-commerce companies' deficits are growing, Oasis is the only one increasing its retained earnings. Its cash and cash equivalents last year amounted to 118.7 billion KRW. During the same period, accounts payable were 24.7 billion KRW, and current liabilities, including accounts payable, were 51.8 billion KRW, less than its cash assets, indicating that it can cover all its debts with the cash it holds.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.