Kakao Group Stocks Drop 3-7% Consecutively

Brokerage Firms Lower Kakao Target Prices One After Another

Q2 Earnings Outlook Also Deteriorates

On the 23rd, Kakao group stocks plummeted simultaneously as Kim Beom-su, the founder of Kakao and chairman of the management innovation committee, was arrested on charges of market manipulation involving SM Entertainment (SM). The securities industry expects that the stock price will hit bottom and rebound only after the owner’s legal risks are resolved.

According to the Korea Exchange on the 24th, Kakao closed at 38,850 KRW, down 5.36% (2,200 KRW) from the previous day’s close. This brought Kakao closer to its 52-week low of 37,600 KRW, continuing the stock’s sluggish performance. On that day alone, foreigners sold over 1.05 million shares, and institutions also offloaded more than 800,000 shares. The scale of institutional selling was the largest this year. Not only Kakao but the entire group’s stocks showed a downward trend. On the same day, Kakao Games fell more than 5%, Kakao Pay slid over 7%, and Kakao Bank dropped more than 3%.

The decisive factor behind the sharp decline in Kakao group stocks was Chairman Kim Beom-su’s legal risk. Earlier, the Financial Investigation Division 2 of the Seoul Southern District Prosecutors’ Office filed an arrest warrant for Chairman Kim on the 17th, accusing him of manipulating SM’s stock price to keep it higher than the public tender offer price (120,000 KRW) of rival HYBE during the acquisition process of SM last February, thereby blocking HYBE’s public tender offer. Chairman Kim has consistently denied the charges, but the result was his detention.

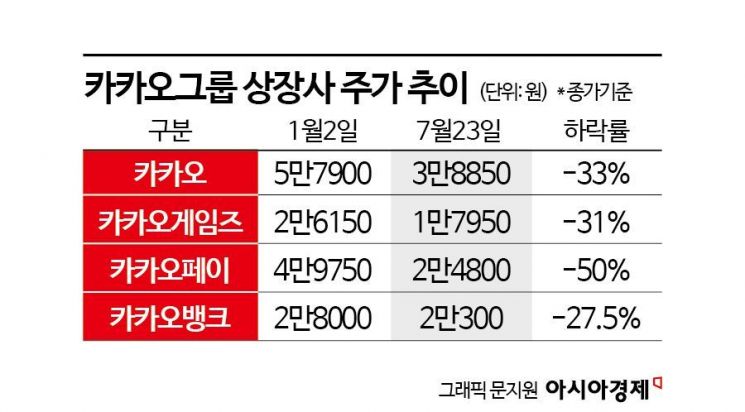

Kakao group stocks had been hitting bottom even before the legal risks emerged. The group’s image had deteriorated significantly due to issues such as split listings and accounting standard violations by the unlisted company Kakao Mobility, and the evaluation that there was no growth strategy led to controversies over overvaluation. Kakao’s stock price fell 36% from 61,100 KRW on January 15 to 38,850 KRW. Kakao Bank’s stock price dropped 27.5% from 28,000 KRW at the beginning of the year to 20,300 KRW. During the same period, Kakao Pay’s price halved from 49,750 KRW to 24,800 KRW. Kakao Games’ stock price fell 31% from 26,150 KRW to 17,950 KRW.

Securities firms have consecutively lowered their target prices for Kakao, which faces both growth stagnation and legal risks. Securities firms that issued target prices within the last month lowered Kakao’s target price by an average of 14.82%. Kakao Bank’s target price was cut by 10.57%, Kakao Pay’s by 53.13%, and Kakao Games’ by 14.99%.

The stock prices of Kakao and its group companies are expected to continue their downward trend for the time being. The securities industry believes that Kakao’s stock price will bottom out and rise only after the legal risks are resolved. Moreover, the earnings outlook for the second quarter is not favorable. Most securities firms expect Kakao’s operating profit for the second quarter to fall short of the market consensus of 144.7 billion KRW.

Oh Dong-hwan, a researcher at Samsung Securities, pointed out, “Kakao is facing criticism related to the entry of large platforms into local markets, making it difficult to introduce new business profit models. To secure aggressive growth engines for a rebound, resolving legal and regulatory risks needs to be prioritized.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.