"Exclusion from designation as an excellent governance company is an incentive"

Mentioned at the 2017 Political Affairs Committee bill review subcommittee

Business circles say "Effectiveness is low... burden of separate election is high"

Kim Ju-hyun, Chairman of the Financial Services Commission, is delivering a congratulatory speech at the '1st Seminar on Corporate Value-Up Support Measures for the Leap of the Korean Stock Market' held on the 26th at the Korea Exchange in Yeouido, Seoul. Photo by Kang Jin-hyung aymsdream@

Kim Ju-hyun, Chairman of the Financial Services Commission, is delivering a congratulatory speech at the '1st Seminar on Corporate Value-Up Support Measures for the Leap of the Korean Stock Market' held on the 26th at the Korea Exchange in Yeouido, Seoul. Photo by Kang Jin-hyung aymsdream@

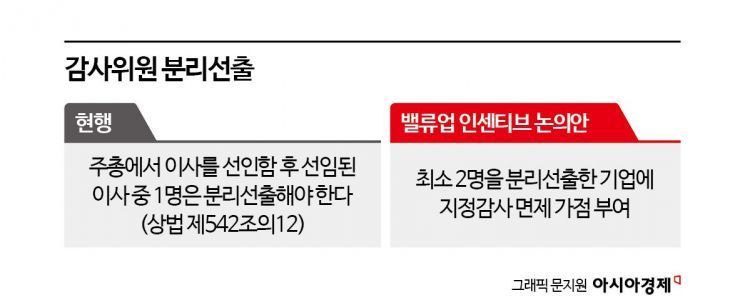

The reason the Financial Services Commission is considering granting exemption points for designated audits to listed companies that separately elect two or more audit committee members is based on the judgment that the independence of auditors is directly linked to improvements in corporate governance. Since the corporate value-up program aims to increase the corporate value of listed companies, the focus is on improving corporate governance, which has been pointed out as the biggest obstacle to the Korea discount. The problem is that there is considerable opposition from companies and the accounting industry. Companies argue that simply installing an audit committee and separately electing at least one member already entails significant costs and burdens.

If two or more audit committee members are separately elected, the company is considered excellent in corporate governance

The periodic exemption from designated audits is intended to encourage companies' efforts to improve corporate governance. It is explained that the corporate value-up program and the periodic designated audit exemption plan can have a positive interaction. The principle is clear. Companies with excellent audit-related corporate governance will be given preferential treatment.

Currently, companies with total assets of 2 trillion won or more must separately elect at least one audit committee member. Companies that separately elect two or more audit committee members can be interpreted as having a strong will to improve corporate governance. A financial authority official said, "Simply separately electing one audit committee member as stipulated by law does not mean that corporate governance is excellent," adding, "Although it is still under discussion, it means that if more audit committee members are separately elected by broadly interpreting the law, exemption points for designated audits will be granted."

The plan to exempt designated audits for companies that separately elect audit committee members was already mentioned in the National Assembly in 2017. At that time, the Legislative and Judiciary Committee's bill review subcommittee fiercely debated with the Financial Services Commission over whether to exempt designated audits during the introduction of the periodic designated audit system. Former Liberty Korea Party lawmaker Kim Jong-seok expressed the opinion that "if companies with excellent corporate governance are excluded from designation, it will actually provide an incentive for companies to improve their corporate governance." Former Democratic Party lawmaker Je Yoon-kyung also positively acknowledged the purpose, saying, "Excluding companies from designation is essentially a good incentive for companies."

The problem lies with companies with total assets under 2 trillion won. Since they are not obligated to establish an audit committee, it is difficult to create exemption criteria for designated audits. These companies must choose between establishing an audit committee or appointing a full-time auditor. If a full-time auditor is appointed, it is not easy to determine how to assess the independence of the auditor. The Financial Services Commission intends to closely consult with stakeholders such as listed companies and the accounting industry to decide the criteria for exemption from designated audits.

Business community: Burden of incentive for separately electing two audit committee members

The business community evaluates the plan to separately elect two or more audit committee members as having little effectiveness as a 'value-up incentive.' Companies find even the current legal obligation to separately elect at least one audit committee member burdensome. Before the 2020 amendment to the Commercial Act passed the National Assembly, the business community pointed out issues such as the possibility of hostile takeovers by hedge funds, reversal of voting rights, and potential technology leakage.

In fact, over the past three years, companies and minority shareholders have engaged in intense strategic maneuvering over the separate election of audit committee members. For example, in the case of the Sajo Group, two years ago, Professor Lee Sang-hoon of Kyungpook National University Law School, recommended by the activist fund Cha Partners Asset Management, was appointed as an audit committee member. From the stage of director appointment, the 3% voting rights restriction was applied, and Professor Lee attended the Sajo Oyang board as an audit committee member for one year. He opposed issues such as ▲final dividend ▲nomination of director candidates ▲change of CEO ▲handling of future legal advisory fees for outside directors, and proposed agendas such as ▲establishment of outside director nomination committee ▲internal transaction committee ▲performance compensation committee.

In response, companies' 'tricks' have also evolved. They have nullified the 3% rule by 'lending shares' to close associates or indirectly secured substantial voting rights through share purchases among affiliates. There have also been cases where companies tried to avoid accepting separately elected audit committee members by limiting the total number of board members.

Professor Kwon Jae-yeol of Kyung Hee University Law School, who has opposed the separate election of one audit committee member since discussions on the amendment of the Commercial Act, said, "A separately elected audit committee member is both an audit committee member and a director," adding, "At that time, I thought it was an infringement of property rights that shareholders' voting rights were restricted when appointing directors (especially major shareholders), and if the number increases, I think it will be even harder to avoid such criticism." He also criticized, "I do not understand logically how the issues of periodic designation system to prevent collusion between companies and accounting firms and the separate election of audit committee members are related."

Professor A, who requested anonymity, said, "Currently, companies find the obligation to separately elect one audit committee member burdensome, so if this is set as an incentive condition, they would rather choose not to receive the (designated audit) exemption," adding, "I think there will be companies that want to block it before it becomes mandatory later."

A business community official said, "Separately electing two audit committee members is an option not adopted except for some companies in key industries, financial companies, or a few companies with management disputes," adding, "Since companies are unlikely to adopt it, it is expected to lack discriminative power."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.