Hanwha Asset Management Arirang Rebrands to Plus ETF

KB Asset Management, Hana Asset Management Also Rebrand This Year

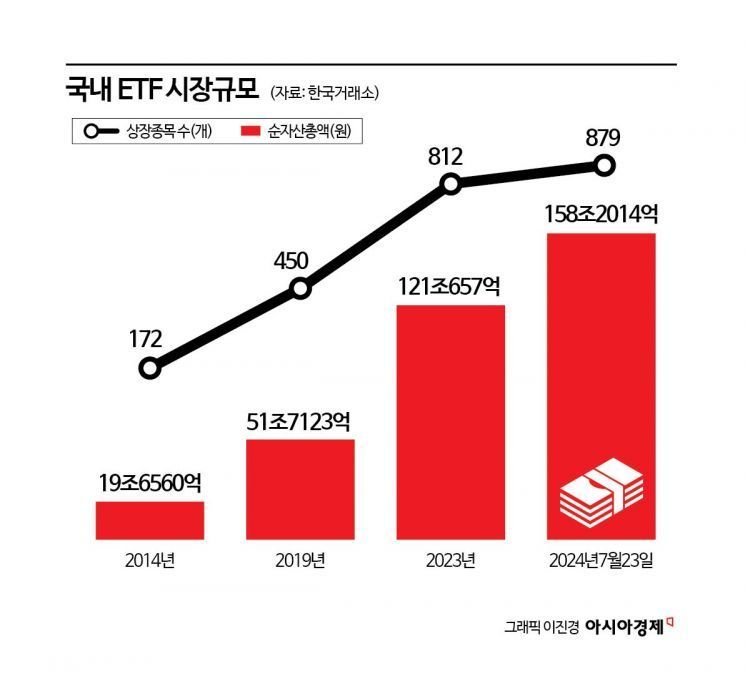

ETF Market Grows to 160 Trillion Won... Increasing Market Share

Asset management companies are changing the names of their exchange-traded funds (ETFs) or launching killer products. This is interpreted as a move to increase market share amid the rapidly growing domestic ETF market, which is approaching 160 trillion won.

According to the financial investment industry on the 24th, Hanwha Asset Management held a launch ceremony the day before after changing its ETF brand from 'ARIRANG' to 'PLUS'. PLUS embodies the company's commitment and determination to protect assets and realize values beyond everyday life to provide a more prosperous future.

Kwon Hee-baek, CEO of Hanwha Asset Management, explained, "PLUS is a brand that reflects our strategic will at Hanwha Asset Management to lead the development of the ETF market while adding value."

Not only Hanwha Asset Management, but other asset managers are also actively changing their ETF brands this year. Most recently, KB Asset Management changed its brand name from KBSTAR to 'RISE'. RISE means 'Rise Tomorrow,' symbolizing the coming tomorrow and emerging investment. It reflects the intention to help individual investors make healthier pension investments.

Along with this, Hana Asset Management also changed its brand from KTOP to 1Q (OneQ) in April this year. OneQ is Hana Financial Group's digital platform brand, meaning that all financial services can be enjoyed at once. Additionally, Kiwoom Asset Management is considering changing its passive ETF brand 'KOSEF' to 'HEROES'.

In addition to rebranding, asset managers are launching killer or specialized ETFs. The day before, Mirae Asset Management's 'TIGER US S&P 500 Equal Weight ETF' was newly listed. This product is an ETF that invests equally (0.2% each) in the constituent stocks of the S&P 500 index, which represents US investments. This is the first time an S&P 500 equal weight investment ETF listed in the US, Europe, Canada, Australia, etc., has been listed in an Asian country. Kim Nam-gi, head of the ETF management division (vice president) at Mirae Asset Management, said at the launch briefing, "Although exclusive rights were not explicitly stated, based on examples from other countries, it is highly likely that we will have exclusive rights."

Korea Investment Trust Management is strengthening the launch of ETFs centered on big tech (large information technology companies). Last month, it released four big tech active ETFs including 'ACE NVIDIA Value Chain Active,' 'ACE Microsoft Value Chain Active,' and 'ACE Google Value Chain Active,' completing the big tech-related value chain ETFs. In addition, it launched the ACE Global Semiconductor TOP4 Plus SOLACTIVE ETF and ACE US Big Tech TOP7 Plus ETF, which focus intensively on leading global semiconductor and big tech companies.

These rebranding efforts and specialized product launches by asset managers are interpreted as responses to the rapidly growing ETF market. According to the Korea Exchange, the net asset value of domestic ETFs grew from 19.656 trillion won in 2014 to 52.0365 trillion won in 2019, and 121.0657 trillion won in 2023. Especially in June this year, it grew to 152 trillion won, increasing by more than 30 trillion won in just six months. On the 23rd of this month, it surpassed 158 trillion won, approaching 160 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)