Government Announces 'Senior Residence Revitalization Plan'

Private-Led Deregulation and Expanded Public Support

"Supply Expansion to Japan and US Levels by 2035"

As the rapid aging of the population increases demand for senior-friendly housing spaces and services, the government is launching tailored project support based on income levels and health types. For privately-led Silver Towns, related regulations will be revised to allow facility establishment based on usage rights instead of land and building ownership. To support the middle-income elderly population, which has received limited assistance so far, a new Silver Stay offering reasonable usage fees compared to Silver Towns will be introduced. For low-income elderly, public rental welfare housing will be expanded to 3,000 units annually.

The government announced these measures as part of the 'Senior Residence Activation Plan' at the Economic Ministers' Meeting on the 23rd.

Senior residences include ▲Silver Towns (elderly welfare housing) ▲Silver Stay (private rental) ▲Elderly Welfare Housing (public rental), providing various services tailored to income levels and health conditions in senior-friendly living spaces.

While Silver Towns are elderly welfare housing primarily supplied by the private sector, Silver Stay and Elderly Welfare Housing share the commonality of being rental housing. However, Silver Stay is newly introduced this year as private rental housing targeting middle-income elderly households. Elderly Welfare Housing targets low-income groups.

The government presented this plan as a follow-up to the public discussion held in March under the theme 'Healthy and Happy Old Age.' The goal is to significantly increase the supply of senior residences that combine suitable living spaces with household, health, and leisure services for the elderly. The core is to ease regulations across all supply stages, from establishment and operation rules to land and funding, to supply various types of senior residences.

Considering the difficulty of securing land in urban areas, support will be provided to convert idle urban facilities or unused national land into senior residences. The government is reviewing public support private rental loans from the Housing and Urban Fund for construction financing of senior residences and plans to include sale-type Silver Towns in the target of regional revitalization investment funds.

To protect residents and guarantee choice, standard contracts and quality certification systems will be introduced. An information disclosure system regarding facility status and usage fees will be established on the Ministry of Health and Welfare website. To reduce the burden of securing usage fees after moving in, the system allowing the sale of homes valued under 1.2 billion KRW through Seoul Housing Corporation and receiving the proceeds as an annuity will also be improved.

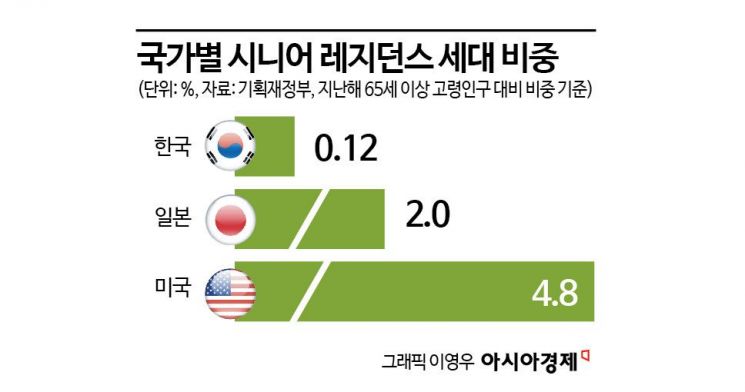

Oh Hyun-kyung, Welfare Economy Division Director at the Ministry of Economy and Finance, said, "We are thinking about activating senior residences at the level of the US or Japan," adding, "The goal is to increase the proportion to about 3% of the elderly population by 2035." The proportion of senior residence households relative to Korea's population aged 65 and over was 0.12% as of last year, which is low compared to Japan (2.0%) and the US (4.8%).

Silver Towns were introduced domestically in 1989 and Elderly Welfare Housing in 2016, but there are limits to meeting the rapidly increasing elderly demand. As of last year, the cumulative number of Silver Town and Elderly Welfare Housing units stood at 9,006 and 3,956 households, respectively. Meanwhile, the elderly population aged 65 and over reached 10,000,062 as of last month, rapidly increasing to about one in five citizens.

Encouraging Private Sector Participation to Expand Silver Towns

The government will promote projects so that elderly people wishing to live in senior residences can reside where and when they want. It aims to increase supply by reducing initial residence establishment costs and various burdens and to diversify services to expand consumer choice.

For Silver Towns, to increase private sector market entry, the government will revise the Enforcement Rules of the Elderly Welfare Act to improve regulations that mandate land and building ownership when establishing facilities. Conditions will be created so that service-specialized businesses can establish Silver Towns with only land and building usage rights. In Japan, Sompo Care, an affiliate of a non-life insurance company, supplies 90% of 28,500 senior residences by securing only land and building usage rights.

The government will prepare requirements for service-specialized businesses and establish support grounds to actively nurture them. It will also stipulate in laws and enforcement decrees the living space, service standards, and contract contents of service-providing elderly housing operated by businesses. Obligations such as posting usage fees, living spaces, and services will be clarified. Management and supervision basis regulations will also be included.

The government will also push for amendments to the Elderly Welfare Act in the second half of the year to introduce new sale-type Silver Towns mainly in population-declining areas (89 locations). In strengthening the operator's responsibility after sales, it will mandate including a certain proportion of rental-type units. An operational plan to establish a service quality management system will also be prepared and included in the amendment.

Standards will be set to allow Silver Town residents who require nursing services to maintain residence without infringing on other residents' living areas. Previously, elderly people with long-term care grades 3 to 5 had difficulty residing in Silver Towns, but this will be improved. The establishment of living assistance residential Silver Towns providing specialized services for related elderly groups will be permitted.

The government plans to relax licensing standards such as personnel placement and facility criteria if private businesses build Silver Towns and nursing facilities together. To reduce the burden of entrance deposits for Silver Town residents, the government is considering expanding Korea Housing Finance Corporation's guarantee support for entrance deposit loans.

Introducing Silver Stay for Middle-Income Elderly in the Second Half

Silver Stay is introduced for middle-income elderly who were in the blind spot of senior residences. The core is to guarantee various services and living spaces at reasonable usage fees compared to Silver Towns through public support. To this end, the government will provide private construction companies supplying Silver Stay with some private rental land within public housing sites located near medical and welfare facilities. Regulatory improvements such as construction standards will also be pursued.

The scope of Silver Stay residents will expand to include elderly homeowners aged 60 and over. Previously, only non-homeowners could move into publicly supported private rental housing. The government is also considering mixed construction of general housing so that various generations other than the elderly can reside.

For low-income groups, Elderly Welfare Housing will supply 3,000 units annually by adding 2,000 units through remodeling and purchasing old rental housing to the current 1,000 newly built rental units. Korea Land and Housing Corporation (LH) complexes with many elderly households and vacant units will be prioritized for remodeling. In this process, middle-income elderly households, previously lower priority for residency, will have increased opportunities through changes from sequential to lottery systems.

Housing benefits (repair and maintenance benefits) for low-income elderly living in their own homes will be increased to enable them to enjoy life where they live. Elderly customized care services providing home repairs, daily support, and health management will be expanded for late-stage elderly with mobility difficulties. Plans will also be made to activate meal services for elderly homeowners using common areas in apartments and senior centers.

The government will establish a dedicated task force (TF) led by related ministries such as the Ministry of Economy and Finance, Ministry of Health and Welfare, and Ministry of Land, Infrastructure and Transport to enact a special law for activating senior residences. To support projects swiftly, a one-stop support system will be built, and additional and supplementary measures will be continuously prepared through field demand surveys and feedback.

Asia Economy's May Report on 'Senior House' Largely Reflected in Government's 'Activation Plan'

The 'Senior Residence Activation Plan' announced at the Economic Ministers' Meeting on the 23rd largely incorporates content from Asia Economy's May report series titled 'The Era of Senior Houses is Coming.'

The core of the measures includes deregulation of private operators to expand elderly housing supply, fostering service-specialized operators, introducing a 'new sale-type' mixing sale and rental units, providing idle urban facilities and national land as sites, and disclosing Silver Town information. This policy direction, created by the Ministry of Economy and Finance, Ministry of Land, Infrastructure and Transport, Ministry of Health and Welfare, and Financial Services Commission, aligns with most proposals from the 'The Era of Senior Houses is Coming' series.

Joo Hwan-wook, Director of Economic Structural Reform Bureau at the Ministry of Economy and Finance, said, "Senior residences are a socially very important issue in the ultra-aging era," adding, "We referred to and greatly benefited from Asia Economy's report series when creating this plan."

'The Era of Senior Houses is Coming' series consisted of 33 articles across four parts (Polarization is the Problem; Where Are Middle-Class Elderly Going; Saturated Elderly Housing in Japan; The Path for Elderly Housing). It addressed the polarization issue of senior houses and raised the social topic of the need for elderly welfare housing for middle-class seniors.

The government's announced measures on 'deregulation of private operators' and 'providing national land in urban areas' were covered in Asia Economy's articles titled

The measures on 'introducing new sale-type combining sale and rental units' and 'introducing service-specialized operators' appeared in articles such as

An industry insider in elderly welfare housing said, "Until now, there were no government support systems, but this government plan is expected to be a turning point for expanding elderly welfare housing," adding, "It is positive from the public's perspective as it allows them to make concrete plans for their old-age residences."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)