Loss ratio worsens to breakeven level in first half

May rise further with Jangma damage reflected... Insurance premium cuts likely to stop

This year, the loss ratio of automobile insurance for non-life insurance companies has already deteriorated to the breakeven point in the first half of the year, while vehicle damage caused by heavy rains during the monsoon season has exceeded last year's scale. With the monsoon continuing, the summer vacation season with high vehicle movement, and the upcoming winter expected to bring heavy snowfall, an increase in the loss ratio is anticipated, which is likely to lead to insurance premium hikes next year.

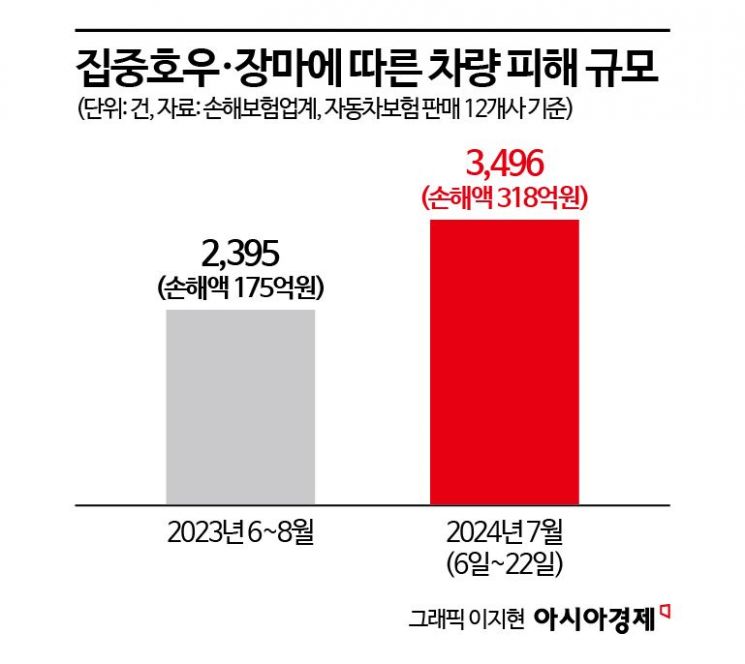

According to the non-life insurance industry, from the official start of the monsoon on the 6th until 3 p.m. on the 22nd, 3,496 vehicle damage cases were reported to 12 non-life insurance companies handling automobile insurance, with flood damage amounting to 31.8 billion KRW. This figure significantly surpasses the damage caused by heavy rains and typhoons from June to August last year (2,395 cases, 17.5 billion KRW). In just three weeks since the start of this year's monsoon, the number of cases is 1.6 times and the amount is 1.8 times higher compared to last year.

The end of the monsoon season remains difficult to predict, and concerns are growing due to the northward movement of Typhoon No. 3 'Gaemi' developed near the Philippines. According to the Korea Meteorological Administration, Typhoon 'Gaemi' is expected to move toward China, but caution is advised given the uncertainty of its path.

As a result, non-life insurance companies handling automobile insurance are on high alert for managing the loss ratio. According to the industry, the cumulative automobile insurance loss ratio for the first half of the year among seven major non-life insurers?Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, Meritz Fire & Marine Insurance, Lotte Insurance, and Hanwha General Insurance?stood at 80.1%, up 2.4 percentage points from 77.7% in the same period last year. The automobile insurance loss ratio is calculated by dividing paid insurance claims by earned premiums, with 80-82% generally considered the breakeven point. Reflecting damages from heavy summer rains, a deterioration in profitability appears inevitable.

In anticipation of higher nationwide rainfall than usual this year, non-life insurers took preventive measures to minimize flood risks, and financial authorities even activated emergency evacuation alert systems, but these efforts were insufficient to reduce damage caused by heavy rains.

Since exceeding the breakeven loss ratio prompts consideration of premium increases, non-life insurers have felt the burden of the automobile insurance premium reduction policies implemented so far as part of 'win-win finance' initiatives.

An industry insider explained, "Unlike last year, this year saw many instances of concentrated heavy rainfall, leading to more focused damage. Considering the increased vehicle use during the vacation season after the monsoon and the continued impact of premium reductions, the automobile insurance loss ratio is expected to rise further, which may lead to future premium hikes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)