As the travel industry moves past the COVID-19 crisis and enters a mature phase, business strategies for domestic and international travel agencies to secure market dominance have been presented. Samjong KPMG outlined key strategies centered on domestic and international online travel agencies (OTA) and comprehensive travel agencies in its report titled ‘New Opportunities Blooming After the Crisis, Travel Industry on a Growth Trajectory,’ published on the 23rd.

According to the Korea Tourism Organization, the number of Koreans traveling abroad last year reached 22.72 million, about 80% of the 2019 figure, and a favorable recovery trend is expected to continue. The report analyzed that the expansion of the international flight share of low-cost carriers (LCC) will have a positive impact on the recovery of travel demand. According to the Ministry of Land, Infrastructure and Transport, the share of LCCs in total international passengers was 51.9% during the period from January to May 2024. This is interpreted as an effect of transferring European route traffic rights to domestic LCCs to resolve passenger route monopolies, as the merger of the two major airlines, Korean Air and Asiana Airlines, is imminent. Being recognized as an alternative to large airlines in Europe and elsewhere, overseas travel demand is expected to continue recovering alongside the expansion of LCCs.

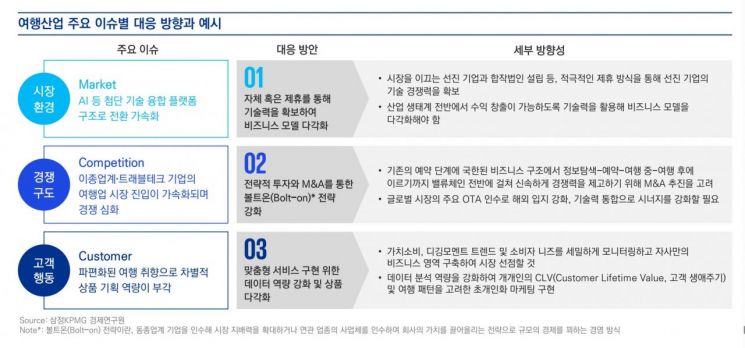

The report presented the main strategies observed in the travel industry, which has reached maturity after the pandemic, in terms of ▲transition to OTA ▲adoption of artificial intelligence (AI) technology ▲strategic mergers and acquisitions (M&A).

Global leading OTA companies such as Booking Holdings and Expedia Group are expanding their influence in the domestic market by leveraging their massive capital and networks. Major traditional domestic travel agencies like Hanatour, Modetour, and Norangpungseon are responding to the expanding dominance of OTA companies by strengthening platform channels and transitioning from an offline-centered distribution structure to OTA.

As the travel industry transitions to OTA, the travel sector is actively adopting AI technology to realize customer-tailored services such as customer data analysis and real-time response services. Hanatour introduced an AI itinerary automatic recommendation feature that automatically compares and summarizes travel products of interest to consumers. Yanolja’s automatic summarization of customer reviews understands even subtle nuances in the Korean language.

Major domestic and international travel companies are pursuing diversification of travel super apps and business-to-business (B2B) operations through strategic M&A. A travel super app integrates related services from travel preparation to review sharing within a single app. Additionally, key companies are utilizing M&A to expand B2B businesses and seek new growth engines. Yanolja recently acquired several global companies including Israel’s MST Travel, GoGlobal Travel, and the U.S.-based Insoft, securing competitiveness in B2B services and seeking opportunities to enter overseas markets.

Won Jeong-jun, Executive Director of the Financial Advisory Division at Samjong KPMG, stated, “Advanced technologies such as AI are converging in the travel industry, while competition is intensifying due to the market entry of travel tech companies,” adding, “Domestic travel agencies including comprehensive travel agencies and OTAs must enhance their technological and product planning capabilities to respond to the accelerating digital transformation. They should discover promising travel tech companies and explore strategic M&A opportunities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)