First Half Export Amount $97.3 Million... All-Time High

US, Major User of Han Skin Products, Export Increased by 470%

Beauty Device Market Annual Growth 25%↑... 2030 '116 Trillion Won'

'K-beauty' continues to make waves in the global market. Following a surge in cosmetics sales on Amazon, the world's largest e-commerce platform, the export value of home beauty devices in the first half of this year has already approached last year's annual performance. Notably, exports to the United States increased by 470% year-on-year, driving the growth of beauty device exports.

Hailey Bieber, the wife of Justin Bieber and a model with 11 million TikTok followers, gained attention last year by posting a video of herself using a booster healer on her social media. [Image source=Hailey Bieber SNS]

Hailey Bieber, the wife of Justin Bieber and a model with 11 million TikTok followers, gained attention last year by posting a video of herself using a booster healer on her social media. [Image source=Hailey Bieber SNS]

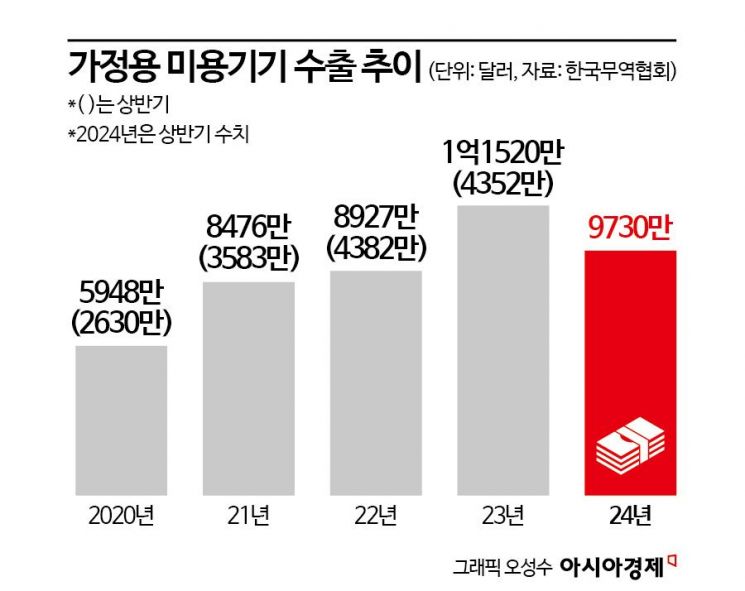

According to the Korea International Trade Association (KITA) on the 23rd, the export value of home beauty devices in the first half of this year reached $97.3 million (approximately 130 billion KRW), marking a 124% increase compared to the same period last year. This accounts for 84% of last year's total export value of $115.2 million (about 150 billion KRW) and represents the largest scale ever recorded for a first half-year period. With results close to last year's annual export value, the total exports for this year are expected to reach record highs.

Half of Global Beauty Device Exports Go to the United States

The country with the highest growth rate and export value for home beauty devices was the United States. The export value to the U.S. in the first half of the year was $42.5 million, accounting for half of the total exports and representing a 470% increase compared to the same period last year. This already surpasses last year's annual U.S. export value of $27.33 million. Following the U.S. were Hong Kong ($16.31 million), Japan ($14.18 million), China ($7.44 million), Singapore ($4.3 million), Vietnam ($1.52 million), and Taiwan ($1.5 million). China showed the steepest export growth rate at 232%. Taiwan (140%) and Singapore (90%) also saw rapid increases, indicating strong growth potential in the future.

Beauty devices have emerged as a new market driven by the increasing number of 'homecare enthusiasts' who manage their skin at home. The biggest advantage is the ability to care for skin conveniently and affordably at home without the time and cost burdens of dermatological treatments. The rising preference for non-invasive procedures that do not damage the skin has also contributed to the increased demand.

In particular, the popularity of Korean skincare products in the U.S. appears to have heightened interest in beauty devices. Recently in Korea, a trend has emerged where basic skincare products such as toner, serum, lotion, and cream are applied step-by-step, followed by the use of beauty devices to aid absorption of these products.

However, overseas markets like the U.S. and Europe traditionally used 'all-in-one' cosmetics that combine toner, serum, and lotion into a single product. They focused more on color cosmetics such as eyeshadow and lipstick rather than basic skincare products.

Recently, as overseas consumers have shown growing interest in anti-aging, the use of Korean skincare products has increased, and there is an analysis that demand for beauty devices has risen as consumers try to emulate the meticulous basic skincare routines of Koreans.

In fact, Korean skincare products such as Anua's 'Houttuynia Cordata Soothing Toner,' TIRTIR's 'Milk Skin,' COSRX's 'Anti-Aging Serum,' and d'Alba's 'White Truffle Spray Serum' have become bestsellers on Amazon in the U.S. A beauty device industry insider said, "The skin of K-pop idols, who have high global recognition, is very good and ages slowly, which has sparked great interest in Korean skincare methods. People are increasing their purchases of beauty devices knowing that there is synergy when Korean skincare products are combined with beauty devices."

APR Leads Exports... Effect of Justin Bieber's Wife's Video

Currently, domestic home beauty device companies include APR (MediCube Age-R Booster Healer·Pro), Dongkook Pharmaceutical (Madeca Prime), LG Electronics (Pra.L), Classys (Volium), and Zion Meditech (Dual Sonic). Among them, APR is leading exports.

APR launched the Booster Healer in 2022 and introduced the Booster Pro in October 2023, selling 2 million units domestically and internationally by April this year. APR has expanded into markets including the U.S., Taiwan, Malaysia, Singapore, China, and Japan. Overseas sales account for about 40% of total revenue.

APR has achieved significant success in the U.S. market; during Amazon's large-scale discount event 'Prime Day' last year, the Booster Healer sold out its initial stock within two days. As a result, the U.S. sales proportion increased from 8% in 2022 to 10%. Sales rapidly grew after Hailey Bieber, Justin Bieber's wife and a model with 11 million TikTok followers, posted a video using the Booster Healer on her social media last year.

The global beauty device market also has high growth potential. According to the U.S. research firm Data Bridge, the beauty device market is expected to grow at an average annual rate of 25%, reaching a scale of 116 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)