KOSPI Falls Below 2800 for 3 Consecutive Days

Volatility Increases Amid US Presidential Election Risk and Tech Stock Adjustment

Major Companies Scheduled to Announce Q2 Earnings This Week

KOSPI Valuation Attractiveness Highlights if Strong Earnings Confirmed

The KOSPI has fallen below the 2800 level again. Although it was on the verge of breaking through the 2900 level, risks related to the U.S. presidential election and adjustments in tech stocks pulled the KOSPI below 2800. With major companies scheduled to announce their Q2 earnings this week, the market is expected to stabilize if solid results are confirmed.

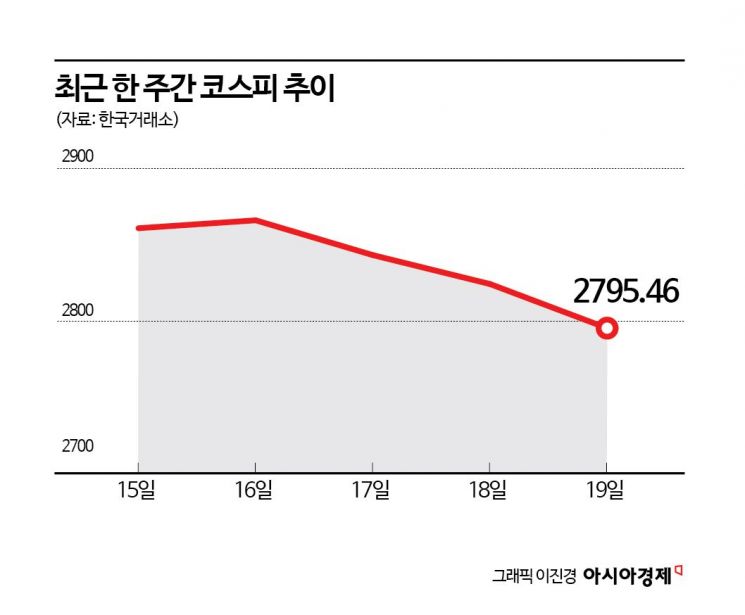

According to the Korea Exchange on the 22nd, the KOSPI closed at 2795.46 on the 19th, down 28.89 points (1.02%). It fell for three consecutive days, dropping below the 2800 level for the first time in 12 trading days based on closing prices.

Foreign investors led the decline in the KOSPI. They sold for three consecutive days during the recent weakness in the KOSPI, offloading 1.026 trillion won over three days. In the futures market, they net sold more than 1.8 trillion won.

After surpassing the 2890 level on the 11th and nearing the 2900 breakthrough, the KOSPI failed to maintain its upward momentum due to issues surrounding the U.S. presidential election and adjustments in tech stocks. Lee Kyung-min, a researcher at Daishin Securities, analyzed, "The attempted attack on former President Donald Trump and his rising approval ratings triggered 'Trump trading,' which increased market volatility. The KOSPI, which was eyeing the 2900 level, experienced intensified differentiation by sector and stock based on the pros and cons of the Trump re-election scenario. Additionally, the U.S. government's semiconductor sanctions against China contributed to the decline in semiconductor tech stocks, causing the KOSPI to fall below 2800."

The adjustment in U.S. large-cap tech stocks, which had been strong until now, also negatively affected the domestic stock market. Lee explained, "The reason the adjustment is severe is that the rise concentrated in U.S. tech stocks had been steep. The correction began mainly in the Magnificent 7 tech stocks (Apple, Amazon, Alphabet, Meta, Microsoft (MS), Nvidia, Tesla) after the U.S. June Consumer Price Index (CPI) announcement last week, when the consensus for a rate cut in September surged to the 90% range."

Since the KOSPI had maintained strength since June, volatility appears to have increased further. Kang Jae-hyun, a researcher at SK Securities, said, "There are several reasons for the adjustment, but above all, it is important to note that the stock market had risen significantly before, indicating short-term overheating signals. Meanwhile, risk factors such as ASML's guidance miss and political uncertainties highlighted triggered profit-taking desires."

Attention is focused on whether the upcoming Q2 earnings announcements from major companies this week can defend against the KOSPI's decline. Earnings reports are scheduled from SK Hynix, Hyundai Motor, Kia, Samsung Biologics, LG Innotek, LG Energy Solution, LG Chem, and banking stocks. Kim Young-hwan, a researcher at NH Investment & Securities, said, "In the short term, solid earnings are necessary to ease volatility. I believe that confirming strong Q2 results and positive guidance for the second half will alleviate concerns in the stock market."

There are opinions that confirming solid earnings will highlight the valuation appeal of the KOSPI. Lee said, "With liquidity conditions still favorable and fundamentals confirmed, the valuation appeal of the KOSPI will be emphasized. After the adjustment caused by the Trump issue is digested in the short term, KOSPI earnings and fundamentals will act as driving forces amid global capital rotation liquidity, leading the KOSPI to attempt to enter the 2900 level."

In the current situation, it seems advisable to focus on healthcare and industrials. Roh Dong-gil, a researcher at Shinhan Investment Corp., explained, "Considering the rate cuts and Trump trade, I prefer healthcare and industrials first. Healthcare is preferred because it is most sensitive to rate cuts, and industrials are relatively preferred from the Trump trade perspective as they compete less with U.S. companies and benefit from favorable effects related to fragmentation." He added, "Communication is also a defensive alternative as it is generally distant from trade frictions and somewhat neglected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.