Special Transformer and Reactor Power Equipment Manufacturer

Confirmed Price of 35,000 Won Exceeding Upper Limit of Desired Range

Market Cap 1.4 Trillion Won, Similar Sales Scale to Jeryong Electric

Amid sluggish performance of newly listed IPO stocks in the domestic stock market, Sanil Electric, a manufacturer of special transformers, has attracted attention by setting its IPO price above the upper limit of the expected price range. This is interpreted as institutional investors participating in the demand forecast still focusing on securing IPO shares.

According to the financial investment industry on the 22nd, 97.4% of institutions participating in Sanil Electric's demand forecast wanted to acquire shares even at the IPO price of 35,000 KRW. The IPO price of 35,000 KRW is 16.7% higher than the upper limit of the expected range, which was 30,000 KRW. The total IPO size amounts to 266 billion KRW.

Sanil Electric is a company that manufactures power equipment such as special transformers and reactors. It supplies special transformers to General Electric (GE), Toshiba & Mitsubishi Electric Industrial Systems Corporation (TMEIC), among others. As it expanded its customer base, its sales scale also grew. Sales increased from 64.8 billion KRW in 2021 to 214.5 billion KRW last year, representing an average annual growth rate of 81.9%. Operating profit during the same period rose from 500 million KRW to 46.6 billion KRW.

Mirae Asset Securities, the lead underwriter, selected two comparable companies, Jeryung Electric and LS Electric, to estimate Sanil Electric's corporate value. Since the beginning of this year, the stock prices of Jeryung Electric and LS Electric have risen by 350% and 200%, respectively. Jeryung Electric's performance improved rapidly due to ongoing supply shortages in the U.S. transformer market. LS Electric's stock price increased on expectations of rising demand for distribution power equipment.

The average price-to-earnings ratio (PER) of Jeryung Electric and LS Electric, whose stock prices surged sharply this year, is 20.6 times. The underwriter reflected a baseline performance of 53 billion KRW, considering Sanil Electric's net profit of 16.5 billion KRW in Q1 this year and net profits from Q2 to Q4 last year. They proposed a price range by applying a discount rate of 14.2% to 31.4% to the per-share valuation of 34,984 KRW. Through the demand forecast, the company’s value was recognized up to the level before applying the discount rate.

A representative from Mirae Asset Securities explained, "Sanil Electric received excellent evaluations for its special transformer supply performance and growth potential," adding, "The finalized IPO price was set at a market-friendly level to protect general investors."

Expectations for Sanil Electric's performance are high. Researcher Yoo Seung-jun from YuHwa Securities said, "Demand for transformers is increasing due to the replacement of aging power grids in the U.S.," explaining, "Investments continue in fields such as artificial intelligence (AI), data centers, electric vehicle charging facilities, and renewable energy, leading to increased electricity demand." He added, "Sanil Electric is seeing an increase in new orders and is expected to continue explosive growth this year."

Researcher Na Min-sik from SK Securities analyzed, "The market capitalization after listing is expected to be about 1.7 trillion KRW," and "It will be directly comparable to Jeryung Electric, which produces similar products and has a similar sales scale."

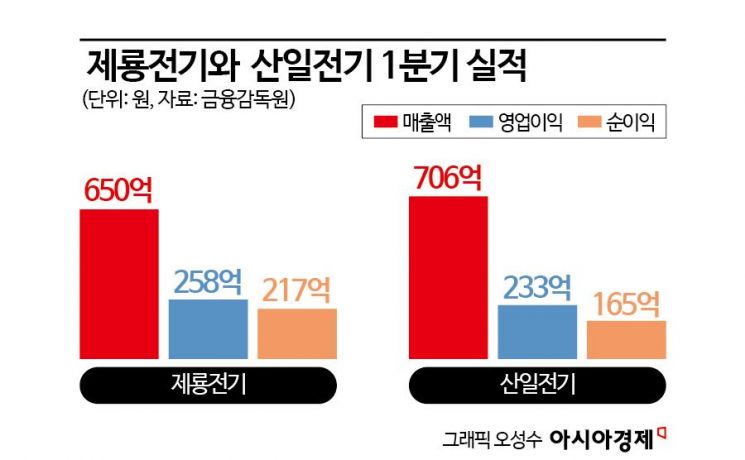

Based on the IPO price, Sanil Electric's market capitalization is 1.0656 trillion KRW. In Q1 this year, it recorded sales of 70.6 billion KRW, operating profit of 23.3 billion KRW, and net profit of 16.5 billion KRW. The comparable company Jeryung Electric has a market capitalization of 1.44 trillion KRW. In Q1 this year, it achieved sales of 65 billion KRW, operating profit of 25.8 billion KRW, and net profit of 21.7 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.