97% of Investment Funds in Stocks

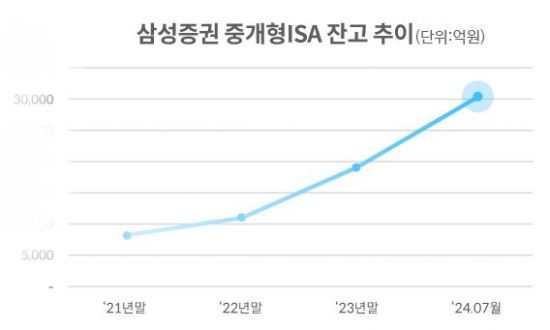

Samsung Securities announced on the 18th that as of the end of last month, the balance of brokerage-type Individual Savings Accounts (ISA) exceeded 3 trillion KRW. The number of brokerage-type ISA accounts also surpassed 1.08 million.

According to an analysis of brokerage-type ISA customers by Samsung Securities, customers are investing 79% of their funds in equity-type assets, with 46% in domestic stocks, 26% in overseas stock exchange-traded funds (ETFs), and 6% in domestic stock ETFs.

In particular, since the introduction of the brokerage-type ISA system, which allows stock trading, in 2021, the overall balance and number of subscribers in the ISA market have been increasing.

ISA is a tax-saving account introduced in 2016 to support wealth formation through comprehensive personal asset management in an era of low interest rates and low growth. It allows various financial products to be managed within a single account and offers tax benefits after a certain period. Contributions can be made up to 20 million KRW annually, with a cumulative maximum of 100 million KRW over five years.

The product offers various tax benefits, including exemption from dividend income tax and a loss offset system that reduces taxable income by offsetting losses from stock investments with gains from indirect products such as overseas funds.

Recently, many accounts have been opened mainly by the 2030 generation, who have relatively high interest in financial technology. Samsung Securities holds an industry market share of 21% in balance and 24% in accounts for brokerage-type ISA.

A Samsung Securities representative stated, "Since the introduction of brokerage-type ISA, many investors have opened accounts and are managing assets. We will strive to increase interest in brokerage-type ISA among investors who want to actively manage their assets while enjoying tax benefits through related reward events."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.