Operating Profit of 51.5 Billion KRW in Q2... Expected 332% Increase YoY

Soju Segment Led Growth Driven by 'Jinro Gold' New Product Effect

HiteJinro celebrated its 100th anniversary on the 20th, becoming the first domestic liquor company to reach this milestone. Its main business, soju products, is further strengthening market dominance with new products, and profitability is improving due to more efficient cost management compared to last year, showing steady progress toward the goal of achieving "operating profit of 200 billion KRW." However, since the domestic soju market clearly shows limitations due to declining consumption, overseas market performance is expected to be crucial for sustaining continuous growth.

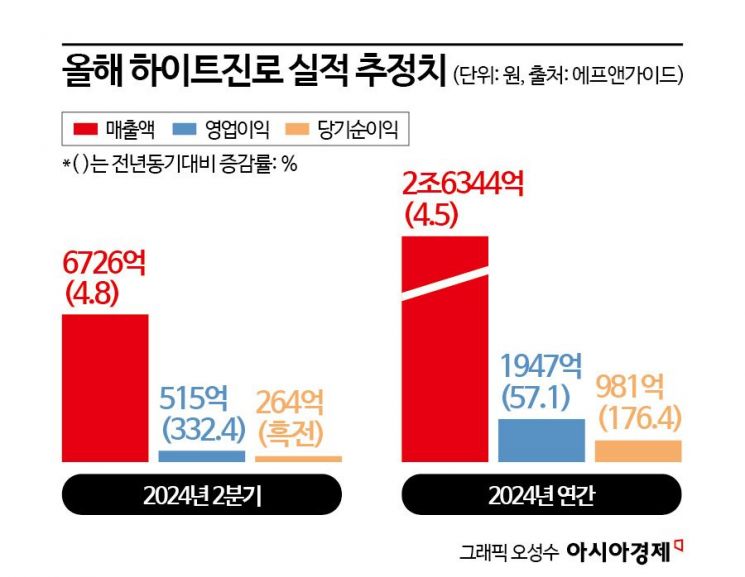

According to financial information provider FnGuide, HiteJinro's operating profit for the second quarter of this year is expected to reach 51.5 billion KRW, a 332.4% increase compared to the same period last year. Sales during the same period are projected to increase by 4.8% to 672.6 billion KRW, and net profit is estimated to turn positive at 26.4 billion KRW.

HiteJinro’s second-quarter performance is expected to improve mainly in the soju segment. With the overall soju market conditions improving in the second quarter compared to the first quarter, total sales volume is increasing, and market share is expected to rise. Additionally, the price increase of key products implemented last November is expected to continue having a positive effect. Furthermore, the zero-sugar soju "Jinro Gold," launched in March, is performing well thanks to the new product launch effect, further solidifying market position and contributing to performance improvement.

On the other hand, the beer segment is expected to experience a decline due to sluggish nightlife market conditions and the impact of recalls on some products. In April last year, HiteJinro introduced "Kelly" aiming to reclaim the top spot in the domestic beer market and succeeded in a smooth market entry with aggressive sales strategies. However, this year, the nightlife market remains sluggish, making it difficult to overcome the high base effect from last year. Additionally, a quality issue with sparkling beer is expected to negatively affect performance. In May, HiteJinro voluntarily recalled and destroyed approximately 1.24 million cans of the sparkling beer "Filite Fresh" due to off-flavors and turbidity found in some canned products.

To achieve the goal of 200 billion KRW in operating profit on its 100th anniversary this year, HiteJinro must deliver results with its zero lineup and overseas markets. Last year, HiteJinro’s export sales on a separate basis reached 166.6 billion KRW, a 14.3% increase compared to the previous year, showing a significant difference from domestic sales, which grew only 0.2% during the same period. However, export sales on a separate basis in the first quarter of this year were 21.8 billion KRW, down 46.1% from 40.5 billion KRW in the same period last year, showing a somewhat sluggish trend.

To accelerate overseas business expansion, HiteJinro selected Vietnam as its first overseas production base and secured a site of 82,083 square meters (approximately 24,873 pyeong) for a soju factory in the Green I-Park Industrial Complex in Thai Binh Province near Hanoi, aiming for completion in 2026. It also set a concrete goal of achieving 500 billion KRW in overseas soju sales by 2030. Having secured a certain level of local sales distribution network, HiteJinro plans to focus on laying the groundwork for full-scale sales expansion until the local factory begins operation.

However, since overseas sales still account for less than 10% and nearly two years remain until the Vietnam factory becomes operational, it is pointed out that strategies to expand influence in the domestic market must also be pursued simultaneously. Regarding the expansion of the zero lineup, this began in earnest last January when "Jinro" was renewed and launched as a zero-sugar product. This year, Jinro Gold, a regular soju line product released for the first time in five years in the first quarter, was also introduced as a zero-sugar product, and last month, the lineup was strengthened with the launch of "Terra Light," a low-calorie version of the flagship beer "Terra."

Moreover, the relatively reduced marketing expenses this year compared to the aggressive spending last year are positive for improving the financial structure. Last year, HiteJinro sharply increased marketing expenses with the launch of Kelly, resulting in operating profit falling 34.9% year-on-year to 123.9 billion KRW. However, this year, cost-cutting efforts led to advertising expenses of 46.5 billion KRW in the first quarter, down 20% from the same period last year. Marketing expenses for the new product Jinro Gold were also limited, demonstrating a commitment to improving profitability, and this trend is expected to continue into the second quarter and the second half of the year.

According to FnGuide, HiteJinro’s operating profit this year is forecasted to improve by 57.1% to 194.7 billion KRW compared to last year. Sales are expected to increase by 4.5% to 2.6344 trillion KRW, and net profit is projected to rise 176.4% to 98.1 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)