SK Inno and SK E&S Merger Press Conference

"Portfolio Expansion Connecting Petrochemicals and Batteries"

Regarding Merger Ratio, "Optimal Choice"

Dismisses Concerns Over KKR Redemption Burden

"We are confident that this merger will enable us to grow into a major player in the global energy market."

The press conference for the merger of SK Innovation and SK E&S was held on the 18th at the SK Seorin Building in Seoul. Park Sang-gyu, President of SK Innovation, is announcing the details of the merger. Photo by Heo Young-han younghan@

The press conference for the merger of SK Innovation and SK E&S was held on the 18th at the SK Seorin Building in Seoul. Park Sang-gyu, President of SK Innovation, is announcing the details of the merger. Photo by Heo Young-han younghan@

On the 18th, Park Sang-gyu, CEO of SK Innovation, explained the background and effects of the merger at a press conference held at the SK Seorin Building in Jongno-gu, Seoul, saying, "If we combine the capabilities of SK Innovation and SK E&S well, we believe we can contribute to shareholder value and the development of the energy industry in our country."

He added, "We will continue to seek areas where the research and development (R&D) capabilities of SK Innovation and the gas industry expertise of SK E&S can create synergy." Regarding the stock merger ratio, which attracted much attention during the merger process, CEO Park explained, "Considering the profit-generating capacity, we judged it to be appropriate."

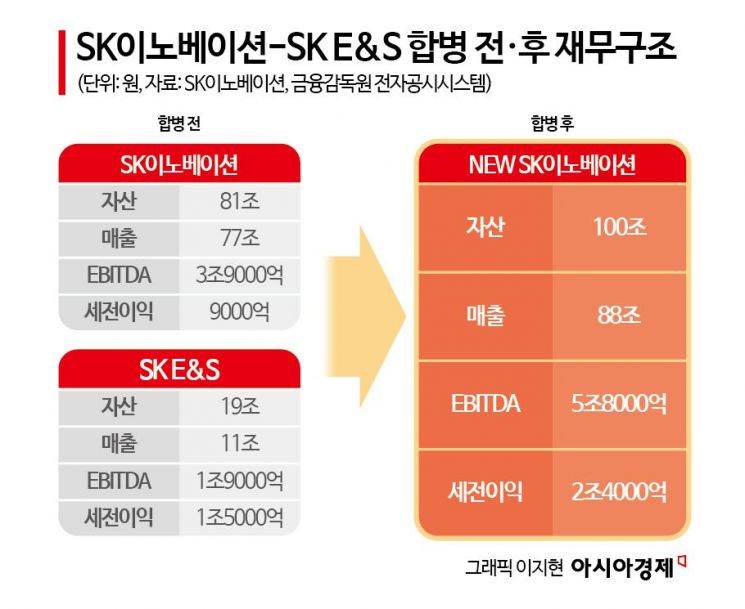

The press conference was organized to explain the significance and market curiosity surrounding the creation of a massive private energy company worth 100 trillion won through the merger of SK Innovation and SK E&S.

CEO Park said that the merger of the two companies is expected to generate synergy in three aspects beyond external growth: ▲strengthening portfolio competitiveness ▲enhancing financial and profit structures ▲securing growth momentum. With the merger, the portfolio has diversified to include petroleum and chemicals, liquefied natural gas (LNG), city gas, electricity, renewable energy, batteries, energy storage systems (ESS), hydrogen, small modular reactors (SMR), ammonia, and immersion cooling. He also anticipated that the emergence of a giant energy company would secure global competitiveness.

However, SK E&S will be integrated as a company-in-company (CIC) operating independently, as before the merger. CEO Park said, "It is most important that the capabilities SK E&S currently possesses are not impaired, so maintaining the current system while seeking synergy is the top priority." SK E&S CEO Chu Hyung-wook also stated, "Maintaining SK E&S's profitability after the merger is important, so we will keep the responsible management system," adding, "Under the umbrella of SK Innovation, we will unite our strengths based on the competitiveness we have secured so far for the future."

From the financial and profit structure perspective, CEO Park viewed positively that SK Innovation's EBITDA (earnings before interest, taxes, depreciation, and amortization) will increase by 1.9 trillion won to about 5.8 trillion won compared to before the merger. In particular, SK E&S's stable profit-generating ability is expected to serve as a cash cow for the group and enhance the financial stability of the petrochemical business, which has high profit volatility.

CEO Park emphasized that the greatest significance of this merger lies in finding new growth momentum. He said, "Currently, SK Innovation's businesses are petrochemicals and batteries, but the electric vehicle chasm (temporary demand slowdown) is lasting longer than before," adding, "The biggest problem for the company was the lack of a business to serve as a bridge during this period, but we believe this merger will alleviate that issue."

Regarding the 'hot potato' of the merger ratio, he said, "Besides the company's internal judgment, we also consulted external institutions and concluded that this level is appropriate considering the scale and profit-generating capacity of both companies," and predicted, "While long-term success depends on proving merger synergy, it will have a positive impact on the stock price going forward." On shareholder return policies, he said, "We expect to implement shareholder return policies once the synergy from the merger materializes and SK On enters an upturn."

In particular, the market expected the merger ratio between the two companies to be around 1 to 2, due to SK E&S's issuance of 3 trillion won worth of redeemable convertible preferred shares (RCPS) to the private equity fund (PEF) operator Kohlberg Kravis Roberts (KKR). However, the actual merger ratio was set at 1 to 1.1917417, with SK E&S's value determined lower than expected. Industry insiders expressed concerns that if SK E&S's value is set too low, KKR, dissatisfied with this, might demand redemption, increasing SK E&S's financial burden.

Regarding this, Seo Geon-gi, head of SK E&S's finance division, dismissed concerns, saying, "We are negotiating with KKR in a friendly atmosphere to maintain the original purpose of the issuance," and added, "There should be no major issues in establishing the merged corporation."

CEO Park said, "Recently, customers are not just concerned with buying electricity cheaply but are presenting various demands such as net-zero and seeking 'energy solutions,'" adding, "In that sense, this merger is a very positive decision because it enables us to respond proactively to changing customer needs." He continued, "We will continuously communicate to find areas where the two companies can maximize synergy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)