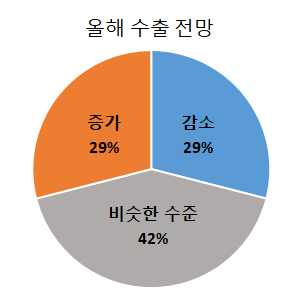

In Contrast to National Trends, 42% of Responding Companies Maintain Last Year's Levels

High Export Dependence on Specific Countries... Need for Diversification Strategy

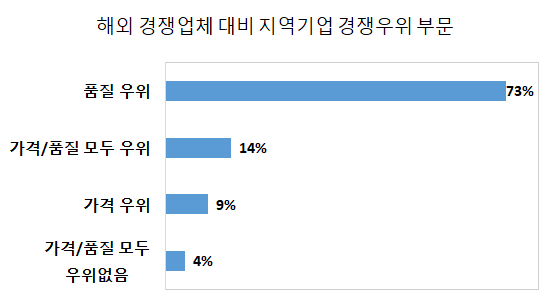

Better Quality Than Overseas, but Weak Price Competitiveness

The export performance of major export companies in the Busan region this year is expected to remain at a similar level to last year, which was weak. This contrasts with the nationwide trend of export recovery, particularly in semiconductors, highlighting the urgent need for countermeasures.

The Busan Chamber of Commerce and Industry (Chairman Yang Jaesaeng) released a report on the 18th titled "Survey on Export Environment in Busan," based on a survey of 100 major export companies in the region.

According to this report, 42% of companies responded that this year's exports would be similar to last year, the largest proportion, while 29% responded that exports would increase and another 29% said exports would decrease.

Considering that last year's export performance was poor, it can be analyzed that 71% of responding companies are expecting weak exports again this year. This is attributed to a decline in overseas demand as the global economy enters a low-growth phase.

Regarding export diversification, 72% of responding companies reported exporting to five or more countries. However, export dependence on specific countries remains high, with 91% of companies indicating that more than 30% of their exports go to a single country, most notably the United States.

When asked about new export destinations in the past three years, 86% of companies responded "none," showing a significant gap compared to those who answered "yes."

As for methods of pioneering new markets, most companies indicated that their own efforts to expand sales channels were more important than government support or trade policies. Given the small proportion of new market development and that most of it relies on companies' own efforts, it appears necessary to enhance the effectiveness of current support programs and trade policies for market development.

With the intensification of global protectionist policies, local export companies perceive global competition as having increased compared to the past. Twenty-eight percent of responding companies said global competition has increased, and China was cited as the main export competitor.

When asked about their competitive advantages over overseas competitors, 73% of companies cited quality competitiveness as their main strength. This was followed by both price and quality (14%), price competitiveness (9%), and no advantage (4%). While quality is generally strong, price competitiveness remains weak. As competition with China in export items intensifies and China's technological level improves, concerns are growing that the local export industry, which lacks price competitiveness, will be negatively affected.

Regional companies' competitive advantages compared to overseas competitors surveyed by the Busan Chamber of Commerce and Industry.

Regional companies' competitive advantages compared to overseas competitors surveyed by the Busan Chamber of Commerce and Industry.

To strengthen export competitiveness, many respondents emphasized the need for short-term support for costs such as logistics and customs clearance. In particular, with recent surges in maritime freight rates due to the Red Sea crisis and increased push exports from China in response to high tariffs imposed by the US and EU, support for logistics costs is seen as urgent. In the medium to long term, there is a need for support in easing regulations in major export countries and developing new sales channels to pioneer new markets.

Shim Jaeun, Head of the Economic Policy Division at the Busan Chamber of Commerce and Industry, said, "While local export companies have strong quality competitiveness, their weak price competitiveness raises concerns about losing ground in difficult external conditions," adding, "It is necessary to reduce companies' cost burdens and provide policy support for export diversification."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)