Amount Exposed to Capital Funds Including Private Equity Funds Reaches 17 Trillion Won Over the Past 3 Years

Affiliates Discussing Recent Mergers and Subsidiary Incorporations... Massive Attraction of Private Capital

SK Group's rebalancing (business restructuring) can be summarized from the capital market's perspective as a 'merger of future value companies and cash-generating companies.' Behind this lies private equity fund (PEF) capital tightening the group's financial leash. The process of merging and incorporating profitable companies generating operating profits immediately into future growth companies is not only aimed at business synergy but can also be interpreted as a self-help measure to repay funds by the deadline promised to financial investors (FIs).

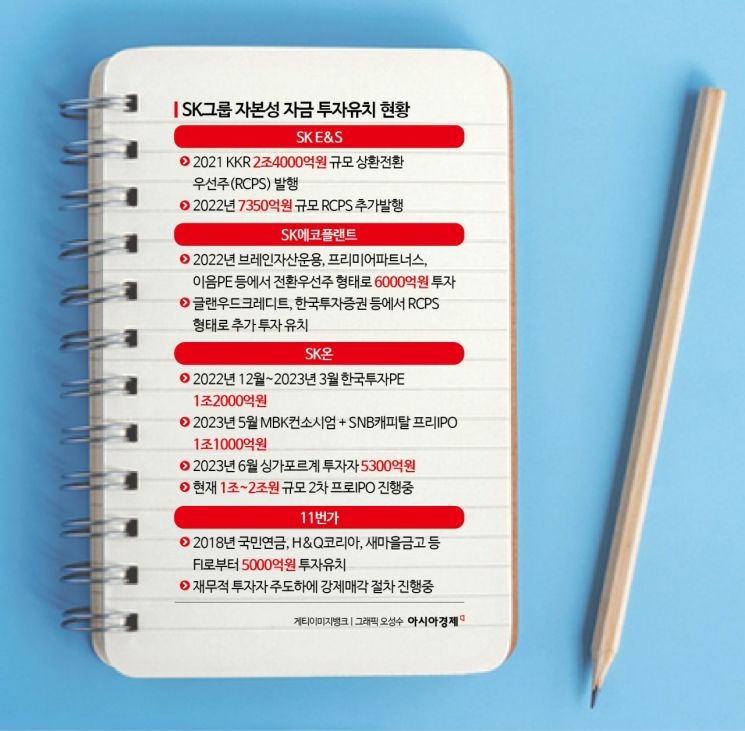

According to data released by Korea Credit Rating on the 18th, SK Group raised approximately KRW 17 trillion in capital-type funds from 2020 to 2023. Of this, KRW 8 trillion was analyzed as capital raised with debt-like characteristics.

Over the past few years, SK Group has rapidly increased capital-type funds targeting domestic and international PEF operators and institutional investors. Excluding the SK Discovery affiliates, SK Group's cash shortfall from 2020 to 2023 exceeded KRW 50 trillion, and in addition to an increase in financial burden of KRW 36 trillion due to external borrowings, it is estimated that more than KRW 17 trillion in capital-type funds were raised mainly by key affiliates.

SK E&S, which is pushing for a merger with SK Innovation, raised about KRW 3 trillion from the global private equity fund (PEF) operator Kohlberg Kravis Roberts (KKR). In 2021, it issued KRW 2.4 trillion worth of redeemable convertible preferred shares (RCPS). The company can redeem the preferred shares in cash or other assets if KKR exercises the stock conversion request. In 2022, SK E&S additionally issued KRW 735 billion worth of RCPS to KKR.

SK Ecoplant, preparing to incorporate Essencore, a 'profitable company' related to semiconductors under SK Inc., as a subsidiary, also promised an IPO while raising large-scale funds from private equity funds. In 2022, it attracted a KRW 1 trillion pre-IPO (pre-listing equity investment) and set the IPO deadline for July 2026. It received investments worth KRW 600 billion from Brain Asset Management, Premier Partners, and Eum PE, and additional investments from Glenwood Credit and Korea Investment & Securities. If the IPO is not completed by the promised deadline, it must guarantee an annual return of 5-8%.

SK On, which is mentioned in connection with mergers with oil business-related subsidiaries such as SK Trading International and SK Entum, is also using large-scale capital due to the nature of the battery industry. In March 2023, it raised KRW 1.2 trillion from the Korea Investment PE consortium, KRW 1.1 trillion from the MBK consortium and SNB Capital in May, and KRW 530 billion from Singapore-based investors in June as pre-IPO funds. As of 2024, it is still in the process of raising a second round of pre-IPO funds worth KRW 1-2 trillion.

The contract terms for investment attraction ranging from hundreds of billions to trillions of won between SK Group and private equity funds are mostly similar. If an IPO attempt fails after several years, the company must repay with a certain interest, or if that is difficult, grant the right to sell management rights. As SK Group's exposure to private equity funds, which has absorbed large-scale PEF funds by emphasizing its 'financial story,' has exceeded manageable levels, institutional investors have become reluctant to participate further in SK Group deals. Especially, cases such as 11st where even the principal investment is at risk of not being recovered have caused institutional investors to close their coffers even more tightly. This is why the view that SK Group's rebalancing is aimed at resolving an imminent financial crisis is gaining traction. An industry insider from the investment banking sector said, "Private equity funds are convenient when companies first borrow, but when it comes to investment recovery, they are harsher than anything else," adding, "SK Group's exposure to private equity funds is at a level that warrants concern and requires proper management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)