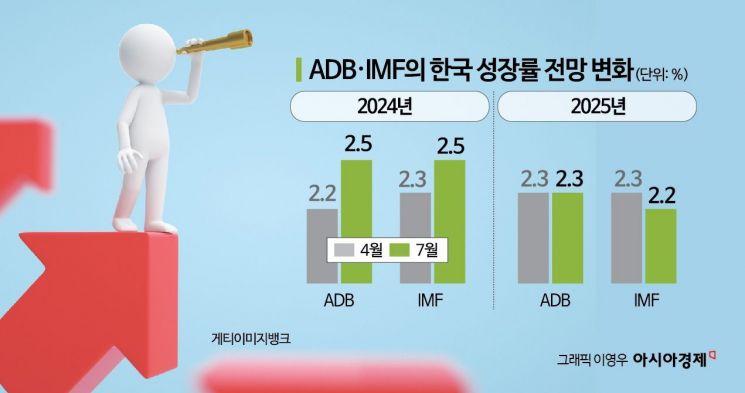

IMF Raises Growth Forecast from 2.3% to 2.5%

Due to Semiconductor Export Growth Trend

The Asian Development Bank (ADB) and the International Monetary Fund (IMF) have both raised their economic growth forecasts for South Korea this year to 2.5%. This revision is attributed to improved performance driven by an increase in semiconductor exports in the first quarter.

On the 17th, ADB released its ‘Asian Economic Outlook 2024’ and projected South Korea’s economic growth rate for this year at 2.5%, which is 0.3 percentage points higher than its forecast in April. The day before (local time), the IMF also published its ‘World Economic Outlook’ report, raising South Korea’s growth forecast by 0.2 percentage points from three months ago to 2.5%. This figure is 0.1 percentage points lower than the 2.6% forecast presented by the government and the Organisation for Economic Co-operation and Development (OECD), and it matches the Bank of Korea’s forecast.

ADB cited the recent increase in semiconductor exports as a key reason for the slight upward revision of South Korea’s growth rate this year. Additionally, increased automobile production and exports also contributed to the upward adjustment. Inflation is expected to be 2.5% this year and 2.0% next year, maintaining the levels forecasted in April. Although the IMF did not specifically mention the reasons for its upward revision of South Korea’s growth rate, the government analyzed that the forecast was slightly raised due to improvements in the semiconductor industry.

Through this forecast announcement, ADB projected that the Asia-Pacific region will grow by 5.0% this year, supported by robust domestic demand and strong exports of electronics. This is a 0.1 percentage point increase from the April forecast. The growth forecast for next year remains unchanged at 4.9% compared to April.

Future risk factors identified include political uncertainties in major countries such as the United States, escalating geopolitical tensions, and continued stagnation in China’s real estate market and domestic demand. The inflation rate in the Asia-Pacific region is expected to be 2.9%, which is 0.3 percentage points lower than previously forecasted. Despite ongoing monetary tightening, inflation is anticipated to gradually stabilize and return to pre-COVID-19 levels due to a slowdown in international food price increases.

The IMF expects the global economy to show solid growth, supported by a recovery in world trade including increased exports from the Asia region, maintaining its global economic growth forecast at 3.2% for this year, unchanged from April. The forecast for the United States was lowered by 0.1 percentage points to 2.6% after its first-quarter economic growth fell short of expectations. China’s growth forecast was raised by 0.4 percentage points to 5.0%, reflecting steady private consumption and exports.

The IMF assessed that upward and downward risks to global economic growth are balanced this year. Upward factors include productivity improvements through successful structural reforms and expanded trade via strengthened multilateral cooperation. Conversely, downward risks include inflation driven by geopolitical conflicts, prolonged high interest rates, abrupt policy changes following election outcomes, and expanding fiscal deficits and debt, all of which could constrain growth.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)