Individuals, Majority of Top 1-Month KOSDAQ Net Purchase Stocks Suffer Losses

New Stocks Like Innospace, SOS Lab, HVM Face Significant Losses

Individual Funds Tied in New Stocks... Miss Timing for Stop-Loss Sales

In the KOSDAQ market, a significant number of individual investors who invested in newly listed companies over the past month have incurred losses. The stock prices of rookie companies newly listed through initial public offerings (IPOs) are suffering from sluggish performance. This appears to reveal side effects caused by increased volatility compared to the offering price on the first day of listing.

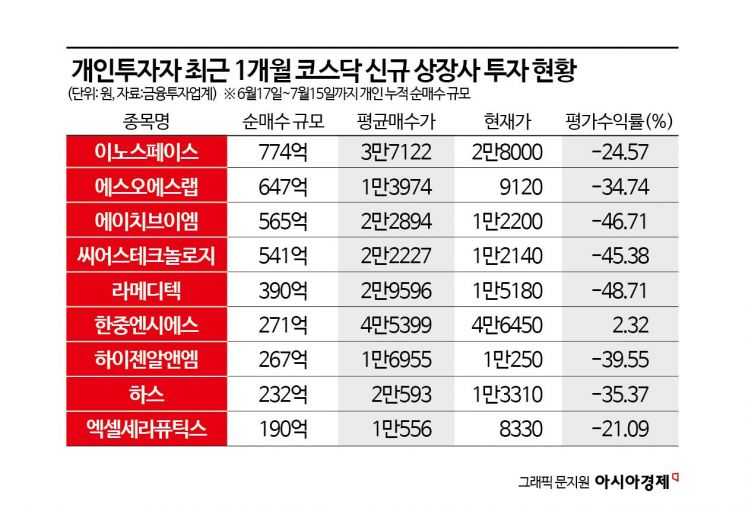

According to the financial investment industry on the 16th, among the top 20 stocks with the highest net purchases by individual investors in the KOSDAQ market from the 17th of last month to the day before, rookies such as Innospace, SOS Lab, HVM, Sears Technology, RamediTech, and Hanjung NS were included.

Individuals mainly actively bought on the first day of listing and invested in new stocks. While institutional investors and foreigners tended to be net sellers on the first day of listing, individuals showed a tendency to be net buyers.

Individuals net purchased Innospace shares worth 77.4 billion KRW on the 2nd, the day it was listed. The average purchase price per share was 37,120 KRW, recording a loss of about 25% compared to the current price of 28,000 KRW.

Innospace started trading at an opening price of 43,900 KRW on the first day of listing and rose to 46,050 KRW in the early session. Afterwards, as IPO investors realized profits, the stock price closed at 34,450 KRW. The stock price continued to decline and at one point during the previous day’s session dropped to 27,600 KRW, setting a new post-listing low. The current stock price is down 35% compared to the offering price of 43,300 KRW.

Innospace is commercializing launch services that transport satellites into orbit using the hybrid rocket technology-based space launch vehicle 'HANBIT.' Hybrid rockets have a simpler structure compared to liquid rockets, making manufacturing costs relatively cheaper. It is the first domestic private company to successfully test-launch the test launch vehicle 'HANBIT-TLV.'

Individuals who invested in SOS Lab and HVM, which were listed on the 25th and 28th of last month respectively, are also suffering. Over the past month, individuals net purchased SOS Lab shares worth 64.7 billion KRW and are currently experiencing an unrealized loss rate of 34.7%. The net purchase amount of HVM by individuals is 56.5 billion KRW, with a decline of 46.7% compared to the average purchase price.

Sears Technology, which individuals net purchased worth 54 billion KRW, is also experiencing continued stock price weakness. RamediTech, which entered the KOSDAQ market on the 17th of last month, has fallen 48.7% compared to the average purchase price by individuals.

Among the top 20 companies with the highest net purchases by individuals over the past month, only four companies?Samchundang Pharmaceutical, Seojin System, HLB Life Science, and Hanjung NS?have current stock prices higher than the average purchase price. Most of the stocks with high unrealized loss rates compared to the average purchase price are newly listed companies.

A financial investment industry official explained, "Because trading is active and volatility is high on the first day of listing, individuals who expect short-term capital gains tend to actively buy new stocks. While IPO investors record high returns, investors who buy on the market often incur losses."

As newly listed companies’ stock prices have been sluggish recently, cases of individual funds being tied up are increasing. Because the stock price drops sharply in a short period, many investors miss the opportunity to cut losses. Many new stocks form a high opening price compared to the offering price on the first day of listing but close trading near the offering price. HAS, Innospace, HVM, SOS Lab, and Sears Technology are trading below their offering prices.

Excel Therapeutics, which was listed on the KOSDAQ market yesterday with an offering price of 10,000 KRW, closed at 8,710 KRW. Although it rose to 12,900 KRW in the early session, it gave up all gains. Individuals net purchased 19 billion KRW worth of shares and are recording an unrealized loss rate of over 20% in just one day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.