After Selecting Morgan Stanley as the Sale Advisor Last Month,

Coupang, Alibaba, and BGF Mentioned as Acquisition Candidates,

But These Companies Say "No Review"

Nonghyup Also Denies Store Acquisition Rumors

Homeplus is facing difficulties in the separate sale of its corporate supermarket (SSM) Homeplus Express. Following Chinese AliExpress, e-commerce companies such as Coupang and offline companies like BGF Retail, which operates convenience store CU, have been mentioned as potential buyers, but all these companies have denied involvement, stating they are "not considering it." Since the announcement of the separate sale of Express, labor-management conflicts have intensified, and it is expected to be challenging to find a buyer.

According to the distribution industry on the 12th, MBK Partners, the major shareholder of Homeplus, selected Morgan Stanley as the sales advisor last month and decided to sell the Express business division, after which potential buyers have been continuously mentioned.

Private equity fund (PEF) operator MBK Partners acquired Homeplus in September 2015 for 7.02 trillion won, investing 2.2 trillion won from a blind fund and borrowing the remaining 5 trillion won under Homeplus's name. Since then, Homeplus has sold about 20 stores to repay nearly 4 trillion won in debt and currently has about 400 billion won remaining.

As the possibility of reselling Homeplus as a whole decreased amid the rapid growth of e-commerce, it was decided to split and sell about 310 Homeplus Express supermarkets first, and Morgan Stanley was selected as the sales advisor early last month.

The investment banking (IB) industry expected that existing large retail companies and e-commerce companies such as Coupang and Alibaba Group might purchase Homeplus Express.

In mid-last month, rumors spread among Homeplus employees that Chinese visitors were seen at the headquarters, sparking speculation about AliExpress acquiring Homeplus. However, AliExpress Korea issued an official statement saying, "We are not participating in the acquisition."

Then, rumors circulated that Freshippo (盒馬鮮生), Alibaba Group's fresh food chain in China, was trying to acquire Homeplus or Homeplus Express. However, Freshippo is reportedly struggling with business and Alibaba Group is pushing for its sale.

Recently, there were reports in the IB industry that Coupang negotiated with MBK to use Homeplus Express as a regional logistics center to enter quick commerce (immediate delivery) by delivering fresh food within about an hour. However, Coupang denied considering entering the quick commerce business or acquiring Homeplus Express.

BGF Retail, which operates convenience store CU and is mentioned as another candidate, also has a negative stance on the acquisition. A BGF Retail official stated, "We are not currently conducting any internal review related to acquiring Homeplus Express." GS Retail, a competitor in the same industry, also expressed no intention to acquire.

Some in the IB industry suggested that NongHyup might acquire only some Homeplus Express stores. This idea was based on Homeplus's previous asset liquidation by selling branches one after another, and it was said that NongHyup Central Association or local NongHyup in Seoul was considering acquiring some Express stores. However, NongHyup Central Association denied the acquisition rumors, saying, "Nothing is being pursued."

Meanwhile, the Homeplus labor union plans to hold a large-scale protest in front of MBK Partners' headquarters in Cheongjin-dong, Seoul, on the 22nd of next month. Ahn Soo-yong, chairman of the Homeplus labor union, said, "The union believes the ongoing sale of Homeplus Express is being conducted behind closed doors," and added, "If the management proceeds with a unilateral sale, we will launch additional protests." The union has highlighted management failures by claiming that the interest costs on the funds borrowed by MBK to acquire Homeplus are dividends and has started off-site protests.

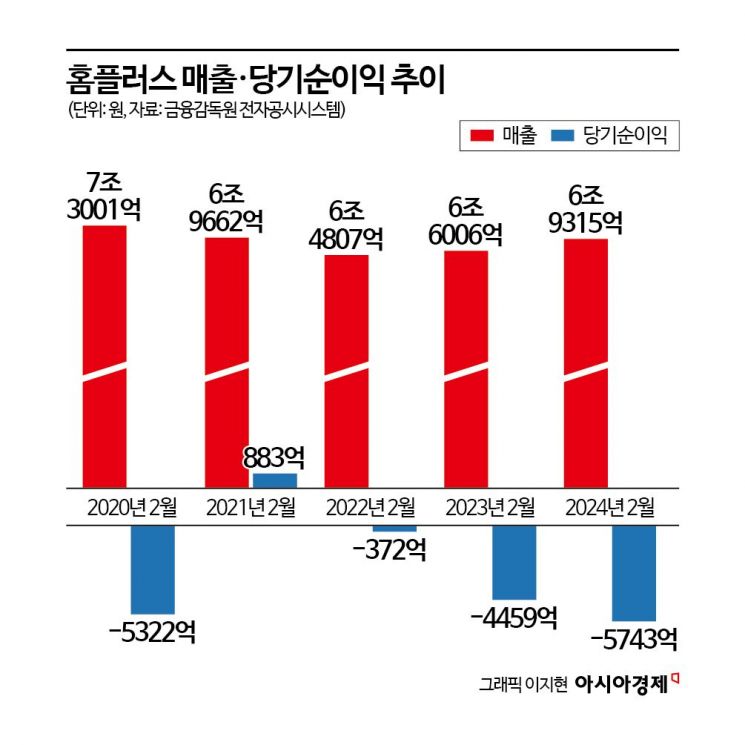

Homeplus's sales for the 2023 fiscal year (March 2022 to February 2023) increased by 5% to 6.9314 trillion won from 6.6005 trillion won in the previous year, and operating losses decreased from 260.1 billion won to 199.4 billion won. However, net losses during the same period widened by 128.4 billion won, from -445.8 billion won to -574.2 billion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.