Concerns Over Poor Performance Extend from Q1 to Q2

Retail Investors Who Bought at Low Prices Face -10% Paper Losses

Rebound Expected with Q3 Earnings Recovery

The groans of individual investors who have been heavily buying Wontec in the KOSDAQ market are deepening. They bought at low prices, but the stock price has not rebounded, resulting in increasing losses. The securities industry expects that since the anticipation of earnings recovery has already been priced in, the rebound will occur after the second half of the year.

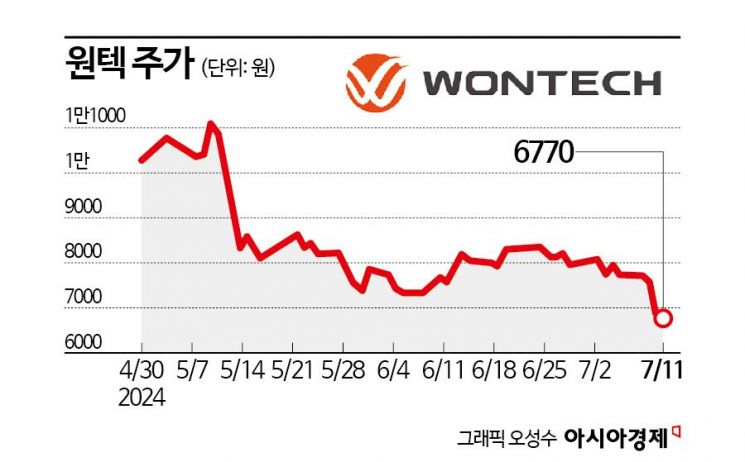

According to the financial investment industry on the 12th, individuals have net purchased Wontec worth 20.2 billion KRW since the beginning of this month. The average purchase price is 7,530 KRW, about 10% higher than the current price of 6,770 KRW.

Wontec is a developer of beauty medical devices. It has developed related technologies such as laser-based, radio frequency (RF), and high-intensity focused ultrasound (HIFU), and launched medical devices with anti-aging and elasticity effects. 'Oligio' is the first monopolar radio frequency skin beauty device developed in Korea.

Wontec recorded sales of 22.6 billion KRW and operating profit of 6.6 billion KRW in the first quarter of this year. This represents a decrease of 21.0% and 50.4%, respectively, compared to the same period last year. The operating profit fell short of the market expectation of 13.5 billion KRW. After the first-quarter earnings announcement, Wontec's stock price dropped by more than 20%. Before the earnings announcement, the stock price was above 10,000 KRW but stayed around 8,000 KRW in early this month.

At that time, the Yeouido securities firms lowered their target prices but still expected growth to continue. Donghee Jeong, a researcher at Samsung Securities, explained, "This is an inevitable process occurring as sales expand from the existing dealership-centered business to corporate-centered business," and added, "The decline after the first-quarter earnings announcement is excessive."

Minsu Shin, a researcher at Kiwoom Securities, said, "Improvement in overseas local subsidiaries' performance will appear," estimating operating profit of 15.4 billion KRW in the second quarter.

Optimistic forecasts from stock market experts spread expectations of earnings recovery. This is why individuals started buying at low prices ahead of the second-quarter earnings announcement. On the 10th, Wontec's stock price plunged once again. It fell nearly 10%, dropping below the 7,000 KRW level. Heeryeong Jeong, a researcher at Shinhan Investment Corp., explained, "This reflects concerns that domestic demand and La Vie sales will continue to decline, causing the second quarter to fall short of market expectations," and added, "In the oversold zone caused by the earnings shock, short-term rebounds depended on confirming the second-quarter earnings." However, he added, "The second-quarter earnings have also been sufficiently reflected in the stock price," and "The company will recover its previous growth trend starting from the second half of this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)