Last Month's Order Share Only 9%

Fully Packed with No Space for Shipbuilding

Love Calls Flood Despite Selective Orders

Last month, domestic shipbuilders in Korea secured orders for only 8 vessels. During the same period, China contracted 74 ships, surpassing Korea, which ranked second. Given this situation, there would have been strong concerns about a 'Korean shipbuilding crisis' in the industry, but this year is different. Despite a selective order strategy focusing only on profitable ships, there is a prevailing atmosphere that even this approach cannot be avoided.

According to Clarkson Research, a shipbuilding and shipping market analysis agency, Korea secured 22 CGT (Compensated Gross Tonnage) last month. In terms of the number of vessels, it was limited to 8 ships, resulting in a global market share of only 9%. Compared to the 33% share recorded in March, this represents a one-third drop in three months. During the same period, the global ship order volume was 2.43 million CGT (100 vessels), a 45% decrease compared to the same month last year, while China secured 1.9 million CGT (74 vessels), achieving the number one market share.

The sharp decline in orders for domestic shipbuilders is due to the lack of 'slots,' which are the available spaces to build ships over the next 2 to 3 years. This is especially true for LNG carriers, which are the main focus of domestic shipbuilders, where slot availability is even more limited.

According to Kyobo Securities, HD Hyundai Heavy Industries' annual LNG carrier production capacity (CAPA) is 15 vessels, and it is fully booked until 2027. In 2028, 9 vessels and in 2029, 1 vessel are scheduled for delivery. Although at least 6 slots will be available in 2028, considering that ship orders are usually placed 2 to 3 years before delivery, contracts can only be signed as early as 2026. HD Hyundai Samho Heavy Industries also has LNG carrier deliveries scheduled for 11 vessels in 2025, 10 vessels in 2026, and 11 vessels in 2027. It is analyzed that at least 9 slots will be secured in 2028.

The situation is similar for Samsung Heavy Industries and Hanwha Ocean. Both companies have an annual production capacity of 20 vessels each, and all slots are filled until 2026. Slots for 6 and 7 vessels are expected to open in 2027. This means that even if LNG carrier orders increase immediately, there is no capacity to accept new orders.

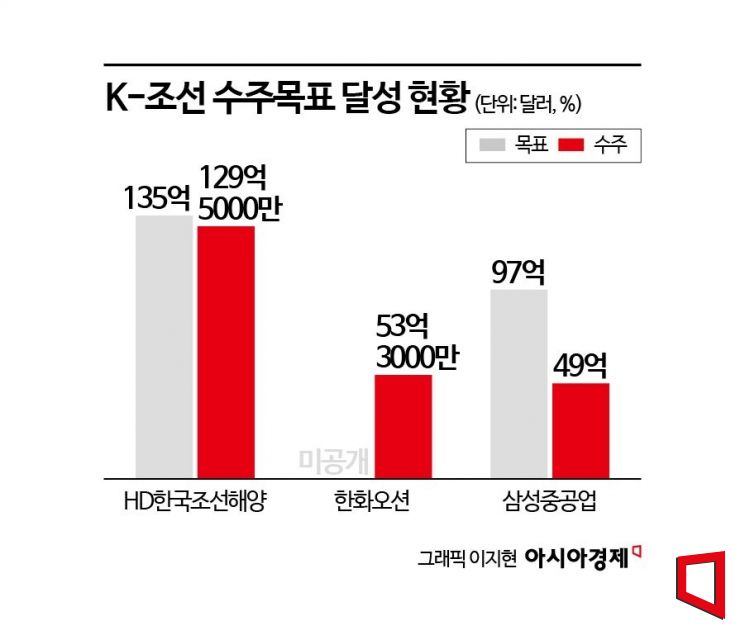

Despite focusing on profitability through selective ordering, shipbuilders are approaching their targets for this year. HD Korea Shipbuilding & Offshore Engineering recently signed contracts to build 2 Very Large Gas Carriers (VLGC) and 2 Petrochemical Carriers (PC) with shipping companies from the Middle East and Oceania. They have secured a total of 122 vessels (including 1 offshore facility) worth 12.95 billion USD this year, achieving 95.9% of their annual target of 13.5 billion USD.

Hanwha Ocean also secured orders for 27 vessels worth approximately 5.33 billion USD in the first half of the year, including 16 LNG carriers, 7 Very Large Crude Carriers (VLCC), 2 Very Large Ammonia Carriers (VLAC), 1 VLGC, and 1 offshore facility. This amount surpassed last year's total order value of 3.52 billion USD in just six months. Samsung Heavy Industries set an order target of 9.7 billion USD for this year and achieved 4.9 billion USD in the first half by securing 22 vessels, including 19 LNG carriers, 2 VLACs, and 1 shuttle tanker (SHTL).

An industry insider explained, "Due to the strengthening of the International Maritime Organization (IMO) environmental regulations, demand for replacing old ships or finding eco-friendly vessels will continue to increase," adding, "It is expected that annual orders will be maintained at around 70 vessels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.