The First Year Without a Pandemic, Summer Vacation Overseas Travel Demand Increases

From No-Accident Celebration Bonuses to Companion Enrollment Discounts

As the summer vacation season approaches, insurance companies' fresh travel insurance products are gaining attention. Especially this year, being the 'first year' of the post-pandemic era, outbound travel demand is expected to be higher than before, leading to fierce competition in the overseas travel insurance market to attract customers.

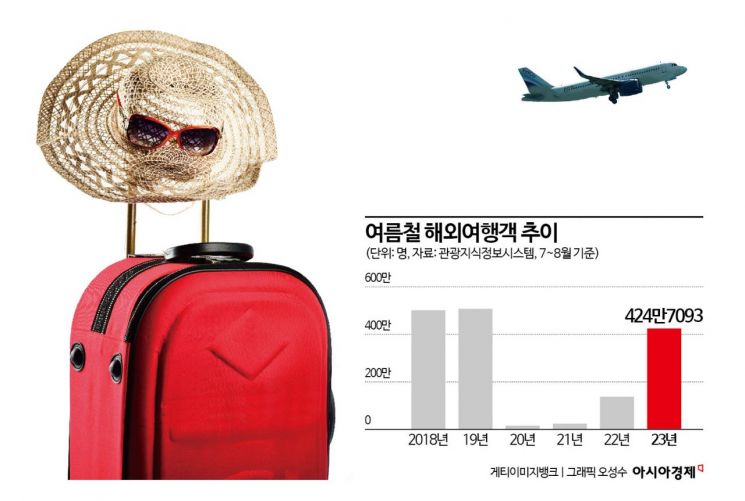

According to the Korea Culture and Tourism Institute, the number of overseas travelers during the summer months of July and August has steadily increased except for 2020, when COVID-19 occurred. Last summer, right after the World Health Organization (WHO) lifted the COVID-19 emergency, about 4.25 million people traveled abroad, recovering to about 84% of the 2019 overseas traveler volume. This year, as it is the first full year without a pandemic, the number of overseas travelers is expected to increase further, boosting demand for travel insurance.

According to the Korea Insurance Research Institute, the overseas travel insurance market has seen not only an increase in insurance demand due to the COVID-19 experience but also changes in travelers' preferences for coverage and increased demand for consumer-friendly products. A report on the travel market after COVID-19 released by the institute shows that the subscription scale for some coverages such as liability, special expenses, and overseas medical expenses increased in 2022 compared to 2019. This reflects travelers' more concrete awareness of risks that may occur abroad after experiencing the pandemic.

In response, insurance companies are attracting customers by applying unprecedented services or launching new types of insurance products. Kakao Pay Insurance attempted to introduce a 'No-accident Refund Service' in travel insurance. This service refunds 10% of the premium to policyholders who complete their overseas trip without any accidents. Since the service was applied, Kakao Pay Insurance's cumulative travel insurance subscribers reached about 1.5 million within approximately one year. Following this, other major insurers like KB Insurance also launched similar services offering a 'Welcome Home Bonus.' Riding on this popularity, Kakao Pay Insurance prepared a benefit that gives existing subscribers an additional 5% discount on premiums when they renew their travel insurance.

Carrot Insurance introduced a product that offers discounts on premiums when signing up together with companions. The discount rate depends on the number of people joining together. If two people subscribe, a 10% discount applies; for three people, 15%; and from four people onward, a 20% discount is applied.

Hana Insurance received exclusive usage rights recognizing the originality and usefulness of its travel insurance riders. The 'Additional Stay Expenses (up to 3 days) Rider for Passport Theft or Loss During Overseas Travel' of Hana Overseas Travel Insurance was granted a three-month exclusive usage right last month. This rider compensates for costs incurred when a policyholder who lost their passport reports it to a diplomatic mission and obtains a travel certificate or emergency passport. It also covers actual additional stay expenses for up to three days if the planned travel period is extended due to passport loss.

Some insurers are enhancing customer convenience through technological cooperation. Meritz Fire & Marine Insurance recently partnered with the blockchain company 'ReTrust' to make it easier for customers traveling abroad to purchase insurance and file claims. Through an 'Open API' agreement between the two companies, insurance subscription, inquiry, and claim filing will be possible on platforms of travel agencies and airlines affiliated with Meritz Fire & Marine Insurance.

However, the evolution of these products amid such competition is sometimes viewed as a regulatory issue by financial authorities. The no-accident refund type travel insurance is currently under review by financial regulators. This is because it contradicts the basic principle of non-life insurance, which is to compensate for damages caused by accidents, and because the no-accident refund may be treated as a 'special benefit provision' limited to a certain amount at the time of insurance contract. An industry insider explained, "Although this service was developed as an 'innovation' to discover new demand in the market, financial authorities fundamentally see potential issues. Since the service became very popular immediately after its launch, the industry is very interested in the conclusion the authorities will reach."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.