Zero Public Bond Issuance After Late May

Affiliates in Urgent Need Secure Funds Through Small Private Bonds

Minimize Bond Issuance Until Each Affiliate's Fate Becomes Clear

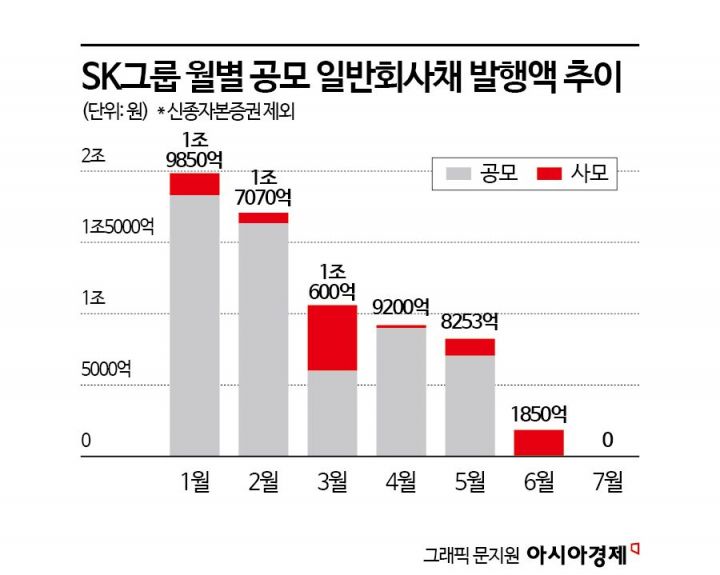

As SK Group pursues business restructuring and rebalancing, it has effectively halted the issuance of public corporate bonds (public bonds). Corporate bonds have been a key funding source for SK Group for years, but since June this year, the group has not issued any public bonds for over a month. Until the direction and strategy of rebalancing become clear, it is expected to be difficult for group affiliates to raise large-scale funds through bond issuance.

Over 7 Trillion Won in Bond Issuance This Year... Zero Public Bonds in the Past Month

According to the investment banking (IB) industry on the 9th, SK Group has issued a total of 7.18 trillion won worth of corporate bonds (including both public and private bonds) through early July this year. This still ranks first among large business groups in terms of domestic bond issuance volume. LG Group, which issued the second-largest amount of corporate bonds domestically, issued 4.27 trillion won, and Lotte Group, third, issued 3.47 trillion won, showing a difference of nearly 3 to 4 trillion won compared to SK Group. When converted to a monthly basis, this means SK Group issued over 1 trillion won in corporate bonds every month.

However, SK Group abruptly stopped issuing public bonds starting in June. Some affiliates in urgent need of funds have been issuing private corporate bonds (private bonds) to raise small amounts of capital. The total amount of private bonds issued by SK Group affiliates in June and July (excluding hybrid capital securities) is only about 180 billion won. SK Rent-a-Car (80 billion won), SK IE Technology (75 billion won), and SK Advanced (30 billion won) issued relatively small amounts of private bonds. There were no public bond issuances.

SK Energy and SK Incheon Petrochem also raised large-scale funds by securitizing demand drafts to pay fuel taxes. SK Energy secured 630 billion won by securitizing demand drafts in early last month, and SK Incheon Petrochem raised 72 billion won using demand drafts. A corporate bond market insider said, "Since SK Group began rebalancing, its affiliates have not issued corporate bonds," adding, "Some affiliates are using alternative funding methods other than corporate bonds to secure urgent liquidity."

SK On, which is struggling with accumulated deficits and increased borrowings, recently issued 500 billion won worth of hybrid capital securities (perpetual bonds) privately. Although perpetual bonds are bonds, they are recognized as equity in accounting, improving financial structure indicators such as debt ratio. Korea Investment & Securities, which has a total return swap (TRS) contract with SK Group Chairman Chey Tae-won and SK Siltron shares, purchased the largest amount of perpetual bonds. NH Investment & Securities, KB Securities, Samsung Securities, and SK Securities also participated in the perpetual bond subscription.

Situation to Continue Until Group Rebalancing 'Uncertainty' Is Resolved

SK On has made large-scale investments in the battery business for years, and with accumulated losses exceeding 2 trillion won over four years, its financial structure has deteriorated. It is not easy to continuously issue public corporate bonds with its own credit rating. For this reason, since September last year, it has secured operating funds by relying on short-term financing such as commercial paper (CP). SK On's CP balance increased from zero in mid-September last year to 605 billion won recently.

SK Innovation, which has provided large-scale financial support to SK On, is also under pressure to continue issuing public bonds. Acting as an intermediate holding company, it has invested several trillion won annually in SK On. During the investment process in SK On, its core refining and chemical businesses experienced ups and downs, and the delay in SK On's initial public offering (IPO) worsened the financial situation. The holding company SK also faces increased borrowings due to the prolonged slump of SK Hynix and delayed performance improvement of SK On, making further affiliate support challenging.

Therefore, until the direction of SK Group's rebalancing becomes clear, it is expected that affiliates will find it difficult to aggressively issue corporate bonds. Issuing bonds publicly requires going through public offering procedures such as securities registration disclosure and demand forecasting. However, in a situation where the fate of each affiliate is uncertain, securing investment demand and determining interest rates (bond prices) is not easy.

An IB industry insider said, "It will be difficult to issue large-scale public corporate bonds until the uncertainty is resolved," and predicted, "Affiliates in urgent need of funds are likely to secure liquidity through private placements or rely on short-term financing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.