Strengthening PB Cosmetic Lineup with Fermented Milk Know-How

Accelerating Competitiveness of Online Mall 'Predit'

hy (formerly Korea Yakult) is accelerating efforts to strengthen the competitiveness of its online mall 'Predit' by enhancing its private brand (PB) cosmetics lineup. The strategy is to position itself as an e-commerce platform beyond just its own mall by increasing visitors with differentiated killer products developed based on over half a century of expertise in probiotics.

According to the distribution industry on the 9th, hy recently expanded its cosmetics lineup by launching the sunscreen 'NK7714 Probiotics Cholesterol Sun Essence.' This new product is the first hy beauty brand product released this year, following the ampoule and cream-type products introduced last year. Like the previous products, it utilizes 'Skin Probiotics 7714.'

In May last year, hy entered the beauty business by launching the ampoule-type cosmetic 'NK7714 Hyper Boosting Ampoule,' which uses Skin Probiotics 7714, a cosmetic ingredient developed in-house. Skin Probiotics 7714 is a fermented product made by culturing hy's patented probiotic 'Lactobacillus plantarum HY7714,' which is recognized as a functional individual probiotic by the Ministry of Food and Drug Safety. Leveraging its expertise as a fermented milk specialist, hy expanded the probiotic domain, traditionally focused on gut health, into skin care. In its first year, about 60,000 sets of related products were sold, mainly to female consumers in their 40s and 50s.

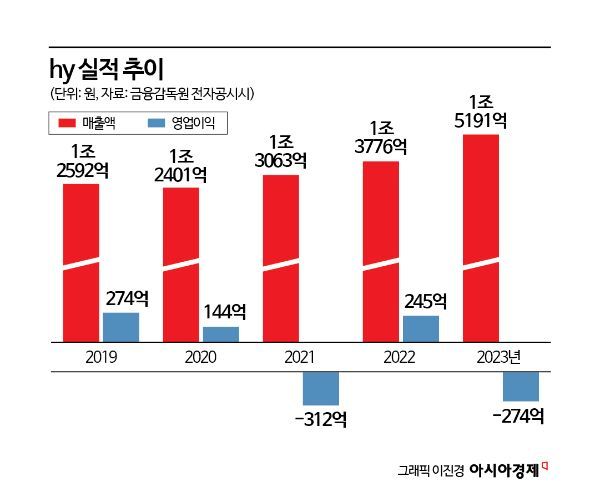

hy's expansion of its cosmetics category is seen as a strategic move to strengthen the competitiveness of its own online mall, Predit. hy has maintained stable sales in the fermented milk market for a long time with flagship brands such as 'Yakult' and 'Will.' However, growth slowed after surpassing 1 trillion KRW in sales in 2017, and the company even recorded negative growth in 2020.

Subsequently, the company changed its name from Korea Yakult to its current name to shed its image as a fermented milk company and declared its ambition to become a comprehensive distribution company. In this process, the Predit service was newly launched. The strategy was to expand consumer touchpoints by adding the online channel Predit to the existing face-to-face offline distribution channel centered on 'Fresh Manager.'

Since the launch of Predit, hy has focused on increasing the number of products handled from about 400 to over 1,100 to attract more visitors. Notably, about 80% of the products are from other companies, clearly showing that Predit aims to be an e-commerce platform rather than just a company mall. However, to attract new members and expand loyal customers, exclusive products available only on Predit are essential. hy judged that beauty products based on its fermented milk expertise fit well with this differentiation requirement. Additionally, for its own products, the entire sales amount is reflected in product sales beyond simple sales commissions, which is another reason for actively strengthening its own product lineup.

Moreover, the fact that other businesses besides its core fermented milk business are underperforming is another reason why hy is focusing on Predit. Based on stable sales in the fermented milk market, hy has actively diversified its business by acquiring stakes in various companies, including NE Neungyule in the education sector in 2009, medical surgical robot companies Curexo and Think Surgical in 2011, and last year, Mesh Korea, the operator of the delivery platform Vroong.

However, aggressive investment activities did not immediately translate into profits. According to the Financial Supervisory Service's electronic disclosure system, hy's consolidated sales last year were 1.5191 trillion KRW, an 8.4% increase from the previous year (1.3776 trillion KRW), but it recorded an operating loss of 27.4 billion KRW, turning to a deficit. While the core fermented milk business performed well with an operating profit of 68.8 billion KRW, the poor performance of other businesses dragged the overall results into the red.

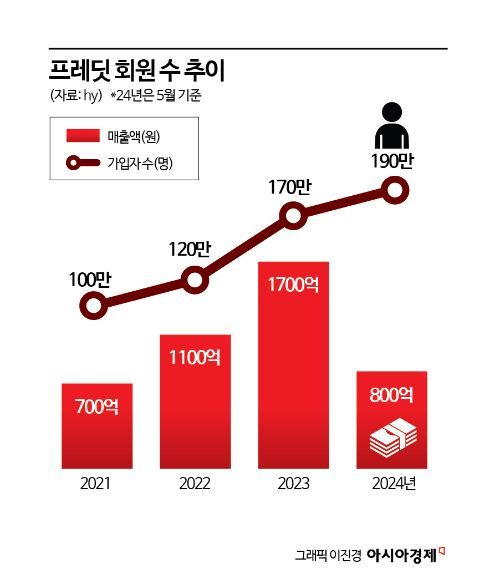

Now in its fourth year since launch, Predit is showing steady growth. As of May, the number of members of hy's online mall Predit was counted at 1.9 million. After surpassing 1 million members in its first year in 2021, the number steadily increased to 1.2 million in 2022 and 1.7 million last year, and it is expected to exceed 2 million within this year. The number of paid members, which started at about 4,000 in December 2021 when the membership system was introduced, increased tenfold to 40,000 by last year. As the number of members increased, sales naturally rose as well. Predit's sales, which were around 70 billion KRW in its first year, grew to 110 billion KRW in 2022 and 170 billion KRW last year, growing about 2.4 times in two years. This year, sales are expected to surpass last year's record, having reached about 80 billion KRW by May.

hy plans to continue expanding the product lineup related to the beauty category to enhance Predit's competitiveness, including launching three additional beauty products by the second half of this year. Furthermore, it intends to diversify sales channels beyond the existing Fresh Manager and Predit channels, such as entering Korean Air's inflight duty-free shop 'Sky Shop' in May. A hy official said, “hy's beauty business is meaningful in expanding overall experience and awareness of probiotic products for consumers,” adding, “We will continue to introduce cosmetics incorporating probiotic technology.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.