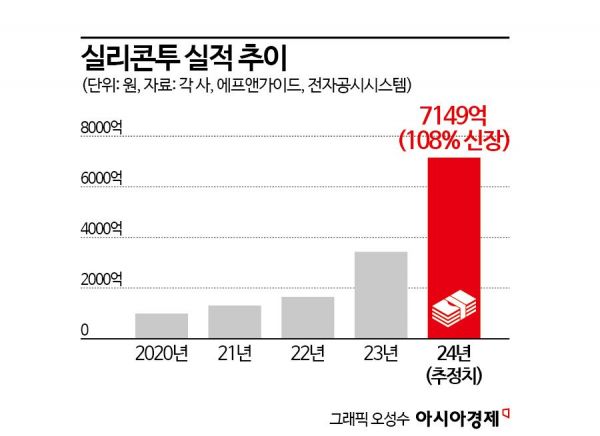

Expected Sales of 714.9 Billion This Year, Double Growth

Introducing Overseas Markets of Joseonminyeo, COSRX, Anua

"Expanding Regional Bases in the US, India, South America, and More"

"A company that domestic small and medium-sized cosmetics enterprises must go through to enter overseas markets, currently possessing a unique business structure in Korea."

Silicon2, which distributes domestic indie cosmetics brands to overseas markets, has emerged as a key player in the 'K-Beauty success story.' Due to the global popularity of Korean cosmetics, Silicon2 is expected to achieve explosive sales growth this year.

According to financial information provider FnGuide on the 10th, the annual sales of Silicon2 estimated by three securities firms for this year amount to 714.9 billion KRW. Last year, Silicon2's sales were 342.9 billion KRW, and this year's expected sales are projected to grow more than double (108%) compared to last year. As the securities industry's expectations for the company's performance have risen, the company's stock price has surged by 440% so far this year.

Silicon2 is a platform operator that sells nearly 400 cosmetics brands wholesale and retail in over 100 countries. It operates 'StyleKorean.com,' a K-beauty direct purchase mall, and provides open market operation agency and consignment delivery services to small and medium-sized brands seeking to enter overseas markets.

Until 10 years ago, Silicon2 was a company distributing semiconductors. However, after seeing promising results in the cosmetics distribution business started in 2012, it closed its semiconductor business in 2016 and focused on selling domestic cosmetics to overseas markets.

Silicon2's business structure consists of CA (corporate customers), PA (individual customers), and fulfillment (delivery agency) divisions. The core business is the CA division. The CA division purchases K-beauty products and exports them tailored to the characteristics of each country, conducting local marketing. As of the first quarter, the CA division accounts for the highest sales proportion at 84%, followed by fulfillment (13%) and PA (3%). Fulfillment is a business that handles logistics transportation for local e-commerce companies, and the PA business operates the purchase site 'StyleKorean,' allowing individual customers from over 120 countries including the U.S., Russia, and Southeast Asia to buy products.

Silicon2's major clients include 'Joseon Beauty,' well known as the No.1 sunscreen on Amazon, accounting for 24% of sales. Other clients who have passed through Silicon2 include COSRX (11%), Anua (10%), Mixsoon (5%), Round Lab (4%), Pyeonggangyul (4%), and Skin1004 (3%), famous for the Amazon hit product 'Snail Mucin Essence.' These brands have gained great popularity and explosive sales growth in Europe, the U.S., Japan, and Southeast Asia. For example, Mixsoon's sales through Silicon2 grew from only 100 million KRW in the first quarter last year to about 6 billion KRW (3,318%) this year, and Anua grew from 100 million KRW to 11.7 billion KRW, a 10,000% increase.

On the 13th, customers, mostly foreigners, are selecting cosmetics at a cosmetics shopping mall in Myeongdong, Seoul. Photo by Heo Younghan younghan@

On the 13th, customers, mostly foreigners, are selecting cosmetics at a cosmetics shopping mall in Myeongdong, Seoul. Photo by Heo Younghan younghan@

Silicon2's competitiveness lies in low transportation costs and a diverse product lineup. By securing more clients through low transportation costs, it has established corporate customers overseas. As of the first quarter, Silicon2 secured about 430 brands and supplied over 10,000 products. The logistics bases in overseas regions have positively impacted transportation costs.

YesAsia, a competitor in K-beauty distribution, only has a logistics warehouse in Hong Kong, so all products must pass through Hong Kong before going overseas. In contrast, Silicon2 can ship via sea and air from local logistics warehouses. According to a Samsung Securities report, Silicon2's logistics and transportation costs account for 3.2% of sales, whereas YesAsia's reach 22.6%. Currently, Silicon2 has logistics infrastructure in the U.S. (California, New Jersey, Santa Fe), Malaysia, Japan, the Netherlands, Russia, Poland, Indonesia, and Vietnam.

A Silicon2 representative said, "We ended the semiconductor business in 2016 and reduced the Chinese cosmetics distribution business to focus on securing distribution networks in the U.S. market." He added, "We believe markets other than China are larger, so we are strategically focusing on growing our cash cow, CA sales."

Silicon2 is increasing investment to enhance competitiveness in the CA business. Expanding regional bases such as establishing branches in India and South America is a key part of this strategy. In fact, as of the first quarter, the company's borrowings reached 108.9 billion KRW, about double compared to one year ago (58.7 billion KRW). Last month, it increased short-term borrowings by 42 billion KRW to expand the logistics warehouse of its U.S. subsidiary (StyleKorean). As of the first quarter, the company's cash equivalents stood at 64.4 billion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.