40% Improvement in Semiconductor Data Speed

Power Consumption Reduced by More Than Half

Supplied to Samsung, SK, LG... Intel and AMD Participate

Samsung Electronics Chairman Lee Jae-yong and SK Chairman Chey Tae-won are attracting industry attention as they visit semiconductor glass substrate plants. Glass substrates are identified as a 'game changer' in the AI semiconductor era due to their ability to increase semiconductor package data speeds while reducing power consumption.

Chairman Chey Tae-won of SK Group (center) visited Absolics located in Covington, Georgia, USA, on the 3rd (local time) to tour the world's first mass production plant for glass substrates and check the business status.

Chairman Chey Tae-won of SK Group (center) visited Absolics located in Covington, Georgia, USA, on the 3rd (local time) to tour the world's first mass production plant for glass substrates and check the business status. [Photo by Yonhap News]

According to the industry on the 8th, Chairman Chey visited Absolics in Covington, Georgia, on the 3rd (local time) during his business trip to the U.S., touring the world's first mass production plant for glass substrates and receiving a report on business status. Absolics is a subsidiary established by SKC in 2021, producing glass substrates for high-performance computing semiconductors. During his U.S. trip, Chairman Chey reportedly promoted the competitiveness of glass substrate technology to Sam Altman, CEO of OpenAI; Satya Nadella, CEO of Microsoft; Andy Jassy, CEO of Amazon; and Pat Gelsinger, CEO of Intel. Chairman Lee also visited Samsung Electro-Mechanics' Suwon plant on the 21st of last month to check on the development status of new businesses including glass substrates.

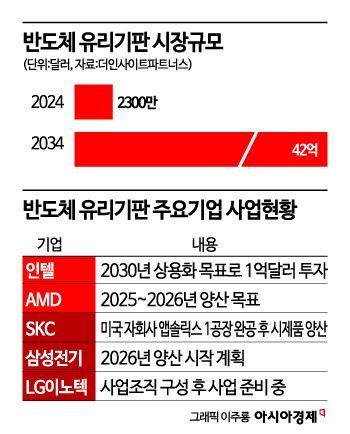

Glass substrates are called the 'dream substrate' due to their superior performance compared to conventional plastic substrates. Compared to plastic (resin) substrates made using silicon interposer (intermediate substrate) methods, glass substrates are 40% faster in speed and can reduce power consumption, package thickness, and production time by more than half. Their smoother surface allows for smaller line widths and more circuits to be embedded. Since an interposer layer acting as a middle layer between the substrate and chip is unnecessary, products can be made lighter. Semiconductor elements can be embedded inside the substrate, enabling more semiconductors to be mounted on the same width of substrate surface. Semiconductor efficiency increases accordingly. When installed in AI devices that need to process massive data as quickly as possible, product performance improves. Market growth potential is also high. According to global market research firm The Insight Partners, the global glass substrate market size is expected to grow from $23 million (approximately 31.5 billion KRW) this year at an average annual rate of about 5.9%, reaching $4.2 billion (approximately 5.786 trillion KRW) by 2034.

Major companies such as Samsung, SK, and LG are leading the competition in glass substrate technology. SKC subsidiary Absolics completed a fully automated glass substrate smart factory in Georgia this year. In May, Absolics became the first Korean semiconductor materials, parts, and equipment company to receive a $75 million (approximately 102.3 billion KRW) subsidy from the U.S. Department of Commerce under the Chips and Science Act (CSA). Currently, they are mass-producing prototypes and plan to proceed with customer certification in the second half of the year. Once certification is completed, they could become the world's first company to commercialize glass substrates.

Domestically, Samsung Electro-Mechanics plans to establish a prototype production line at its Sejong plant within this year. Samsung Electro-Mechanics aims to produce prototypes next year and begin mass production after 2026. LG Innotek is also accelerating its business by increasing personnel related to glass substrates. Earlier, LG Innotek CEO Moon Hyuk-soo officially announced business entry at the regular shareholders' meeting in March, stating, "Our major customers are North American semiconductor companies, and they are very interested in glass substrates, so we are preparing accordingly." U.S. special glass manufacturer Corning also announced plans to expand related business in Korea.

Among semiconductor companies, Intel and AMD are the most proactive in adopting glass substrates. In particular, Intel is pushing a plan to invest $1 billion (approximately 1.4 trillion KRW) in glass substrates and apply glass substrate solutions by 2030. They intend to provide this not only for their own products but also to foundry (contract manufacturing) customers. Japanese company Ibiden, the current number one semiconductor substrate company including plastic substrates, is also reportedly exploring entry into the glass substrate market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)