‘Hanwha Signature Women’s Health Insurance 2.0’ Revised Release

Includes Special Clause for Breast Cancer Prognosis Prediction Test Fees

Women’s Frequent Cancers Detailed into 13 Types

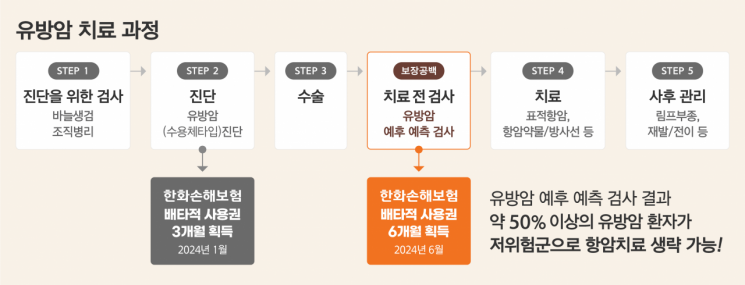

Hanwha General Insurance will start selling the revised product ‘Hanwha Signature Women’s Health Insurance 2.0’ from the 8th, which provides step-by-step coverage for the entire process from breast cancer screening to diagnosis, surgery, pre-treatment examination, treatment, and post-treatment management.

This product includes two special riders for which Hanwha General Insurance received exclusive rights for 3 months and 6 months respectively this year: ▲ Breast Cancer (Receptor Type) Diagnosis Benefit Rider and ▲ Breast Cancer Prognosis Prediction Test Fee Rider. The breast cancer diagnosis benefit is based on the fact that subsequent chemotherapy methods vary according to the four types of breast cancer. It provides coverage up to four times, once for each breast cancer type.

Customers diagnosed with breast cancer can use the Breast Cancer Prognosis Prediction Test Fee Rider to undergo testing to help determine appropriate future treatment. This rider supports the cost of genetic testing, which allows customers to preemptively assess the likelihood of recurrence or the need for chemotherapy, with a one-time payment of up to 3 million KRW after the initial breast cancer diagnosis. A new Breast Cancer Targeted Chemotherapy Drug Approval Treatment Fee Rider has also been established to strengthen coverage and treatment for breast cancer chemotherapy.

In addition, this product has expanded the existing coverage of 11 integrated women’s cancer diagnosis benefits to 13 categories. Among cancers with high incidence in women, colorectal cancer and lung cancer have been separately classified to broaden the scope of coverage.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)