Q2 Operating Profit Surpasses 1 Trillion Won

Achieved Results in Future Growth Businesses

Will Q3 Operating Profit Also Exceed 1 Trillion Won?

LG Electronics recorded an operating profit exceeding 1 trillion KRW in the second quarter of this year, achieving the highest performance ever for the second quarter. This result comes from balanced achievements not only in existing businesses but also in future growth engines. Market forecasts suggest that LG Electronics will continue its performance growth trend in the second half of the year. There are specific expectations that operating profit will exceed 1 trillion KRW again in the third quarter.

Exceeded Market Expectations... Air Conditioner Sales Soar During Seasonal Peak

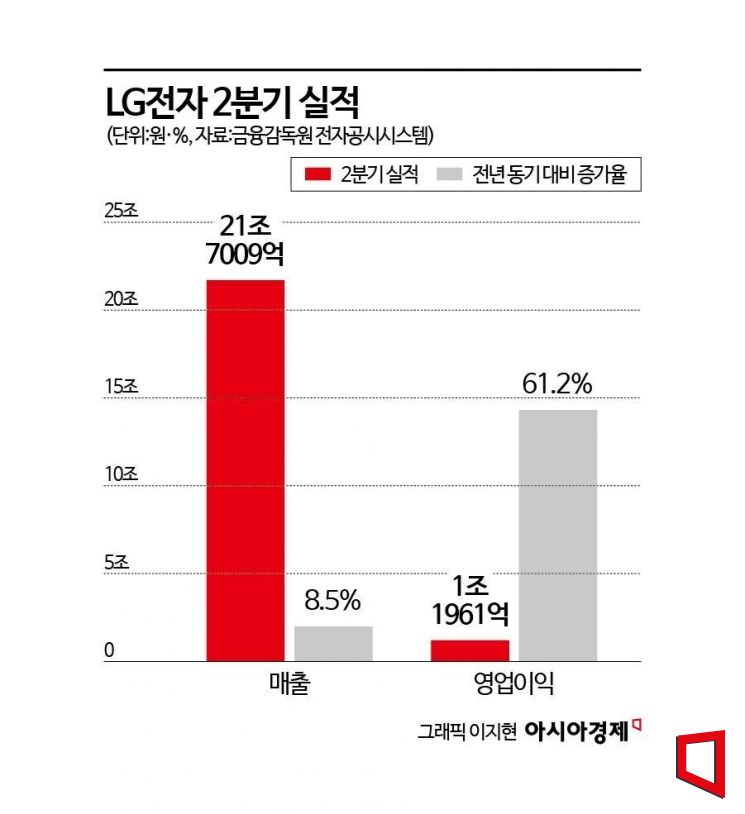

LG Electronics announced on the 5th that it recorded an operating profit of 1.1961 trillion KRW in the second quarter on a consolidated basis, up 61.2% compared to the same period last year. Sales revenue increased by 8.5% to 21.7009 trillion KRW.

This is the highest performance ever recorded for the second quarter. In particular, operating profit surpassed 1 trillion KRW for the first time in the second quarter, setting a new record. It also exceeded the securities market consensus (forecast).

LG Electronics explained that the strong performance was the result of balanced qualitative growth achieved not only in its existing core businesses but also in future growth businesses. Although the figures are provisional and specific numbers by business segment were not disclosed, the company highlighted achievements across major business areas as the background for the profit increase.

In the second quarter, the Home Appliance & Air Solution (H&A) business saw a significant contribution from air conditioner sales during the seasonal peak. In particular, sales of the AI-equipped Whisen Stand Air Conditioner last month increased by more than 80% compared to the same period last year.

The Vehicle Component Solutions (VS) business responded in line with the automotive industry's shift to software-defined vehicles (SDV) by increasing the proportion of premium product sales and introducing the LG AlphaWare solution.

The Home Entertainment (HE) business experienced cost increases such as LCD panel prices, but premium OLED TV sales in advanced markets including Europe showed signs of recovery.

In the Business Solutions (BS) business, premium IT products such as the on-device AI (AI running inside the device) laptop 'LG Gram' and gaming monitors with variable resolution and refresh rates were introduced.

Mirae Asset Securities expects that on a separate basis for the second quarter, LG Electronics' business segment sales were approximately H&A 9.1928 trillion KRW, HE 4.145 trillion KRW, VS 2.7524 trillion KRW, and BS 1.6102 trillion KRW.

Accelerating B2B Transformation... Acquisition of Platform 'AtHome'

LG Electronics is focusing on transforming its corporate structure by expanding its B2B (business-to-business) operations. Amid AI emerging as an industrial inflection point, the HVAC (Heating, Ventilation, and Air Conditioning) business, led by chillers, is increasing revenue in the backend industrial sectors related to AI infrastructure.

The automotive components business, another pillar of B2B growth, continues stable growth based on a diverse portfolio including vehicle infotainment, electric vehicle drive components, and vehicle lamps, as well as secured order volumes, despite a temporary slowdown in electric vehicle demand.

In the B2C (business-to-consumer) sector, LG Electronics is expanding its home appliance subscription business. It also operates content and service businesses utilizing hundreds of millions of products sold worldwide as platforms. LG Electronics explains that this new business model is a driving force to overcome market uncertainties and growth limitations.

LG Electronics is accelerating its shift toward a customer relationship-centered business approach. Having recently completed the acquisition of the smart home platform company 'AtHome,' it is promoting changes in the home appliance business from the perspectives of personalization and service. In particular, the home appliance business is speeding up the paradigm shift toward space solutions and the expansion of 'empathic intelligence appliances.'

The 'LG Channel,' a representative webOS content platform providing over 3,500 channels for free in 28 countries worldwide, has surpassed 50 million users. LG Electronics is expanding its webOS content and service business from TVs to IT and vehicle infotainment.

LG Electronics' Second Half Performance Outlook 'Clear'

The market expects LG Electronics to continue its performance growth in the second half of the year. According to FnGuide, a financial research firm, the consensus operating profit forecast for LG Electronics in the third quarter is 1.1146 trillion KRW, which would represent an 11.83% increase compared to the same period last year. In the fourth quarter, operating profit is expected to decrease to 744.6 billion KRW compared to the previous quarter but could increase by 137.82% compared to the same period last year.

The LG Electronics campaign promotional video playing on the electronic billboard in Times Square, New York, USA / Photo by LG Electronics

The LG Electronics campaign promotional video playing on the electronic billboard in Times Square, New York, USA / Photo by LG Electronics

The annual expected operating profit is 4.2724 trillion KRW, which would be a 20.38% increase compared to last year. Annual sales revenue is forecasted to reach 88.3324 trillion KRW.

Hyunji Cho, a researcher at DB Financial Investment, said, "Despite not-strong front-end demand, LG Electronics has proven its brand power by maintaining upward-trending home appliance sales, unlike Whirlpool and Electrolux." She added, "While core businesses remain solid, the H&A business unit's B2B and subscription appliance segments are forming a stable performance trend," and "there are clear mid- to long-term growth drivers (such as H&A's data center chillers and BS unit's robots and electric vehicle chargers)."

Meanwhile, there are expectations that LG Electronics could pursue additional mergers and acquisitions (M&A) using the cash secured from increased profits. Dongwon Kim, a researcher at KB Securities, said, "LG Electronics, having secured over 8 trillion KRW in cash, is likely to expand its potential for additional M&A in the future," adding, "Since 2018, LG Electronics has maintained a growth strategy through M&A approximately every two years, and the management mentioned the AtHome acquisition as the first step in building an AI platform, indicating the possibility of further M&A."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.