Prime Minister Narendra Modi's Third Term

Economic Policy Drive Anticipated

Interest Rate Cut Outlook Also Positive

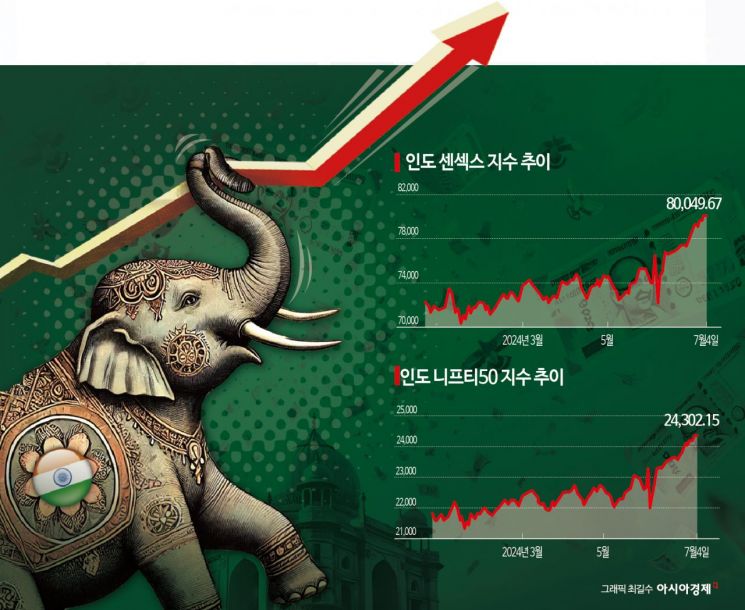

India's stock market has been hitting record highs day after day following Narendra Modi's third term as Prime Minister. Amid this, there is growing attention to analyses suggesting that the peak is still far off.

India's representative stock index, the Sensex, surpassed the 80,000 mark for the first time ever on the 4th (local time). On the same day, the Nifty 50 index also reached a new high. These stock indices have risen 7.62% and 11.94%, respectively, over the past month. This is attributed to expectations that Modi's ruling party, after the general election concluded early last month, will drive growth-focused economic policies through the formation of a new coalition government.

On Wall Street, there is widespread analysis that despite the sharp rise, the Indian stock market will continue its upward trend.

Ridham Desai, Chief India Equity Strategist at Morgan Stanley, cited India's high economic growth rate as the reason. He emphasized, "In the long term, India's real Gross Domestic Product (GDP) growth rate is expected to be 6.0?6.5%, and nominal GDP growth rate 10?12%. This is naturally positive for the stock market."

The fundamental basis for stock investment is also improving. According to Bloomberg Intelligence, the earnings per share (EPS) of companies included in the MSCI (Morgan Stanley Capital International) India Index for the 2024 fiscal year are estimated to surge by 15.6% compared to the previous year. This figure notably exceeds the EPS growth of 10% for China, which is often emphasized as a competitor.

With inflation somewhat controlled in India, the Wall Street Journal (WSJ) reported that the upcoming interest rate cut next month could also serve as a catalyst for stock market gains. India's Consumer Price Index (CPI) in June rose 4.75% year-on-year, which was below market expectations (4.90%) and marked the fifth consecutive month of slowing inflation.

The biggest risk factor for the Indian stock market is crude oil prices. As the largest oil consumer, rising oil prices in India directly lead to inflation, worsening the government's fiscal deficit and increasing risk-averse behavior among investors. However, since India continues oil trade with Russia, which is under Western sanctions, and with forecasts of a global oil price decline due to China's economic slowdown in the second half of this year, it is analyzed that this risk factor will be alleviated.

According to a survey conducted by Bloomberg on the 3rd targeting 24 experts, more than half of the respondents predicted that the Nifty 50 index could rise by 26,000 points by the end of the year. This means the index could increase by approximately 66% from its current level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)