Cumulative Auto Insurance Loss Ratio Nears 80%

Insurance Industry Launches Response System in Collaboration with Local Governments and Government

As the rainy season has officially begun this month, there are forecasts that nationwide rainfall this year is likely to exceed the average, prompting domestic non-life insurance companies to take measures to prevent car flood damage. This is because flood damage to vehicles caused by seasonal heavy rains increases the loss ratio, so they aim to manage this in advance.

According to the Korea Meteorological Administration, the probability of rainfall this summer exceeding the average is around 80%. In Jeju Island, where the rainy season starts earliest, the rainy season began in late last month, recording the second highest rainfall ever (243.8mm). In the Seoul and Gyeonggi regions, where the rainy season started last week, there is a 50% chance that rainfall this month will exceed the average.

According to the recent report published by Samsung Fire & Marine Insurance’s Traffic Safety Culture Research Institute titled "Risk Factors and Prevention Measures for Vehicle Flooding in Apartment Complexes during Summer," the number of flooded vehicles increases as rainfall increases, but the trend is more similar to the rainfall patterns in the metropolitan area such as Seoul and Gyeonggi rather than nationwide rainfall. The report shows that in years when there were many days with over 80mm of rain in Seoul and Gyeonggi, the number of flooded vehicles significantly increased.

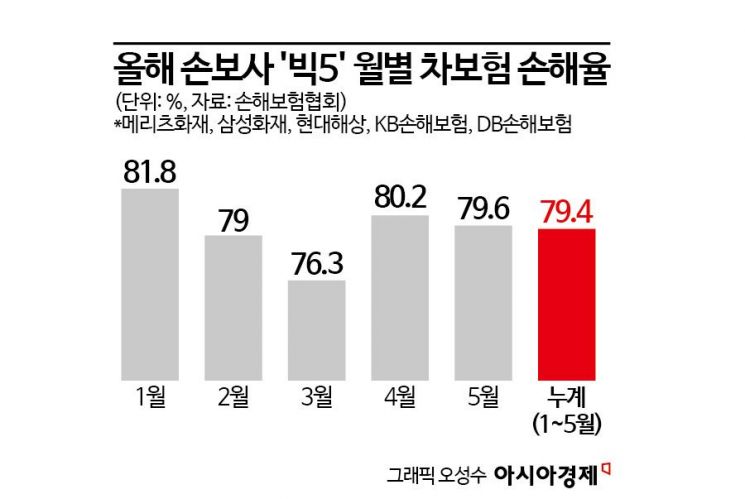

The problem is that the loss ratios of automobile insurance for major non-life insurers have already approached the breakeven point. According to the insurance industry on the 5th, the cumulative automobile insurance loss ratio from January to May for the five major insurers?Samsung, Hyundai, DB, KB, and Meritz?was 79.4%, up 2.6 percentage points from 76.8% during the same period last year. The automobile insurance loss ratio is the ratio of paid insurance claims to earned premiums. Considering operating expenses, automobile insurance typically regards a loss ratio of 80-82% as the breakeven point. Since damages caused by the summer heavy rains have not yet been reflected, and considering the impact of the rainy season, it seems inevitable that insurers’ financial results will worsen.

Non-life insurers are taking preventive measures to minimize flood risks by utilizing their own systems and collaborating with the government. Samsung Fire & Marine Insurance operates a "Flood Prevention Emergency Team" that moves vehicles at risk of flooding to safe locations. When an emergency situation arises due to heavy rain, the emergency team, with customer consent and in cooperation with public authorities, relocates vehicles at risk of flooding to safe places. Additionally, Samsung Fire & Marine Insurance has updated a list of over 374 expected flood-prone areas nationwide, including 93 habitual flood zones in low-lying areas and 281 riverside parking lots, and assigns patrol zones to partner companies for regular checks.

KB Insurance operates a "Heatwave Emergency Response Process" to prepare for a surge in flood vehicle claims and breakdown services. The process is segmented into stages to support rapid recovery when damage occurs. KB Insurance collects weather information and has pre-established infrastructure for response measures, monitors disaster area dispatches and accident occurrences in real time, and shares information in coordination with local governments. They also set up "emergency camps" with sufficient parking space for damaged vehicles.

In addition to these efforts, the financial authorities, together with automobile insurers, the Korea Insurance Development Institute, and the General Insurance Association, began implementing an "Emergency Evacuation Alert System" last month. This system uses automobile insurance subscription information to provide evacuation guidance. It is provided regardless of the insurer or whether the vehicle is registered for Hi-Pass, for vehicles at risk of flooding or secondary accidents.

An industry insider said, "After the rainy season, vehicle movement increases during the vacation season, so automobile insurance loss ratios will rise sharply. Since insurers have already lowered premiums under government pressure for 'win-win finance,' loss ratios have generally increased this year, so proactive management is necessary to prevent financial deterioration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.