Jogeuk Innovation Party and Chamyeo Yeondae Hold Debate Criticizing Tax Cut Policies

Regarding the recurring tax revenue shortfall, opposition parties pointed out that, in addition to economic downturn and other cyclical factors, the government's tax cut policies are the cause of the tax revenue shortage. Suggestions were made to improve the government's tax revenue forecasting model, starting with securing tax revenue through tax system reforms. A major offensive from the opposition is expected in this year's tax law revision discussions.

On the 4th, the Joguk Innovation Party, People's Solidarity for Participatory Democracy, and the Inclusive Fiscal Forum held a debate at the National Assembly under the theme "Is it okay to continue with the recurring tax revenue shortfall and tax cut policies as they are?" Professor Kang Byung-gu of Inha University, who presented the report, pointed out, "In 2023, tax revenue decreased by 56.4 trillion won compared to the original budget, and this year, as of April, tax revenue decreased by 8.4 trillion won compared to the same month last year." Regarding the causes of the tax revenue shortfall, Professor Kang said, "It is the result of a combination of tax cut policies and cyclical factors," but added, "I judge that tax cut policies have a greater impact than cyclical factors."

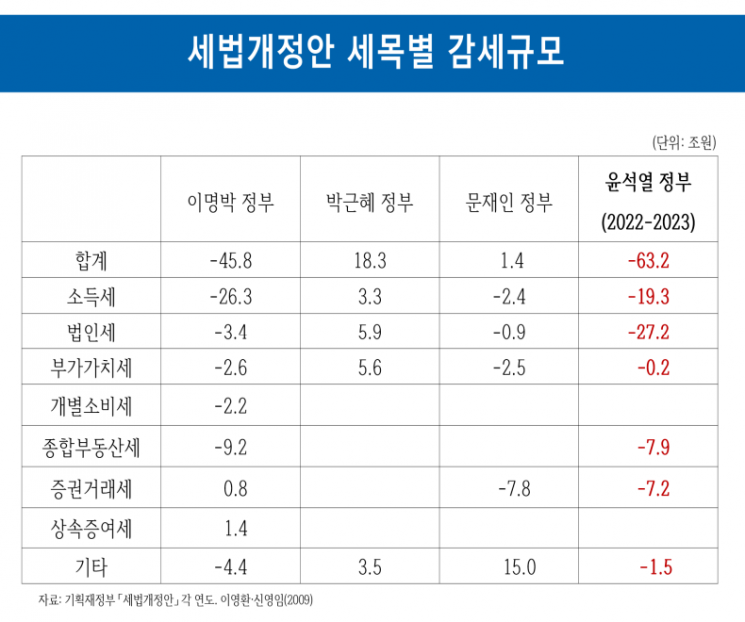

Professor Kang pointed out that due to the 2022 and 2023 tax law revisions, income tax decreased by 19.3 trillion won, corporate tax by 27.2 trillion won, and comprehensive real estate tax by 7.9 trillion won, totaling 63.2 trillion won (cumulative law). He said, "Regarding the government's tax cut policies, they only deepened polarization, and in an economic situation that required expansionary policies, fiscal policy was operated tightly, which only lowered the government's contribution to domestic gross product (GDP) growth." He criticized, "Last year, definitive fiscal policy was needed, but instead, 28 trillion won of the budget went unused."

Assemblyman Cha Gyu-geun of the Joguk Innovation Party, who hosted the debate, pointed out in his congratulatory speech, "Among the various causes of the tax revenue shortfall, the large-scale tax cuts for the wealthy implemented immediately after the inauguration of the Yoon Seok-yeol government in 2022 must be pinpointed."

Lee Sang-min, senior research fellow at the National Fiscal Research Institute, pointed out, "The decrease in corporate tax revenue is the core of the tax revenue deficit, and besides the decline in performance, corporate tax exemptions also played a significant role." He stated, "The consolidated pre-tax income of the top 10 non-financial companies by net income in 2020 was 46.9 trillion won, and 55.4 trillion won in 2023, but the amount of tax exemptions increased from 2.7 trillion won to 10.4 trillion won," adding, "The tax revenue decrease is mainly due not only to the decline in pre-tax income but also to the sharp increase in tax exemptions."

Experts identified securing tax revenue through tax law revisions and improving tax revenue forecasting governance as tasks related to the tax revenue decline issue.

Meanwhile, the ruling party in the National Assembly, the Democratic Party of Korea, also pointed to tax cut policies as responsible for the tax revenue deficit. Jin Sung-jun, chairman of the Democratic Party's Policy Committee, said at the policy coordination meeting held that day, "The reason the nation's treasury is depleted is due to tax cuts for the wealthy." Chairman Jin has expressed the position that "hearings on tax revenue deficits and fiscal collapse should be held."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.