Life Insurers Earn 5.005 Trillion Won from Bancassurance in Q1

Up 84.6% QoQ

Samsung Fire & Marine Insurance Halts New Bancassurance Sales in January for First Time in 21 Years

"Bancassurance Presence Gradually Declining Due to Strengthened Non-Face-to-Face Services"

Life insurance companies are solidifying their presence in the bancassurance channel within banks. However, amid the growing trend of strengthening non-face-to-face sales, the influence of bancassurance is expected to gradually diminish.

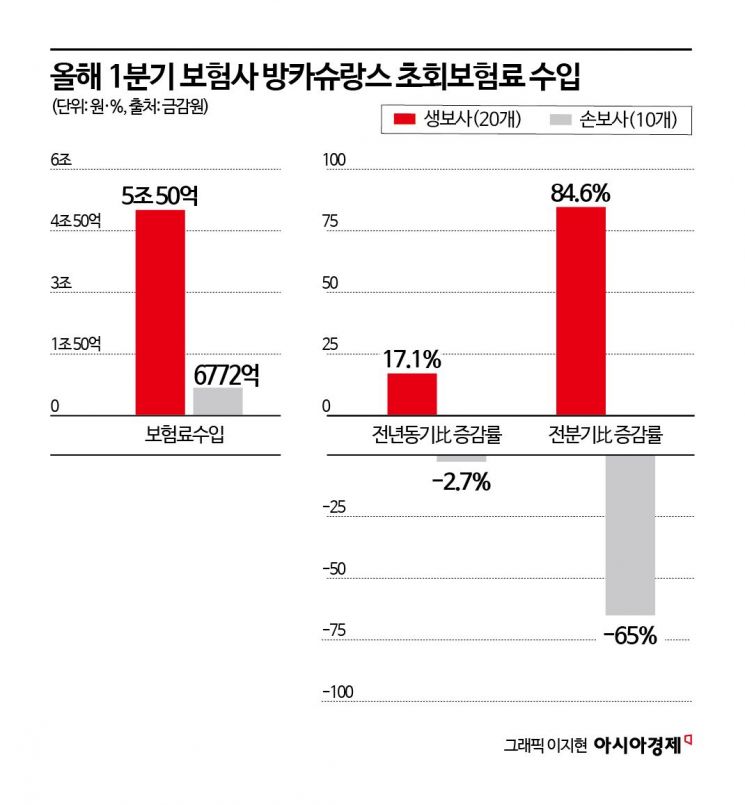

According to statistics from the Financial Supervisory Service on the 4th, the first premium income from life insurers (20 companies) who recruited customers through bancassurance in the first quarter of this year was 5.005 trillion KRW, a 17.1% increase compared to the same period last year (4.273 trillion KRW). Compared to the previous quarter (2.71 trillion KRW), it surged by 84.6%. On the other hand, during the same period, non-life insurers (10 companies) earned 677.2 billion KRW in first premium income, which is a 2.7% decrease from the same period last year and a 65% decrease from the previous quarter.

Bancassurance is a channel where life insurers have a high market share from the start because it is easier to sell savings-type insurance, which has characteristics similar to deposits and savings, rather than non-life insurance products that are complicated to explain. As non-life insurers gradually lose competitiveness, they are withdrawing from bancassurance sales. In January, Samsung Fire & Marine Insurance stopped new bancassurance sales after 21 years. Previously, Meritz Fire & Marine Insurance and Heungkuk Fire & Marine Insurance also exited the bancassurance market.

Industry insiders agree that the sharp increase in life insurers’ bancassurance sales in the first quarter of this year was driven by the Hong Kong H-Share Index (HSCEI) equity-linked securities (ELS) loss incident, which stimulated demand. Customers, fearing principal losses from ELS investments, turned to relatively stable savings-type insurance products with high refund rates despite long maturities. Banks also actively used this point in their marketing since ELS sales were not possible. Short-term whole life insurance, which gained popularity this year due to tax exemption and high refund rates exceeding 130%, was also sold extensively through bancassurance.

Bancassurance remains a significant revenue channel for life insurers. As of 2022, life insurers earned 17.9327 trillion KRW in premium income through bancassurance. However, the effectiveness is expected to decline due to bank branch reductions and digital transformation. The number of branches of the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup?decreased from 4,425 at the end of 2020 to 3,927 last year, with about 500 branches closed in three years. In the first quarter of this year alone, 12 branches of the five major banks were closed.

Moreover, at the end of last month, Naver Pay introduced savings-type insurance on its insurance comparison and recommendation platform, which is expected to further reduce the presence of bancassurance. Three life insurers?Samsung, Hanwha, and Kyobo Life?participated in this platform. All three set the prices of insurance products on the platform identical to those offered on their own websites. A representative from one life insurer said, "When banks sell savings-type insurance through bancassurance, they earn four times more commission revenue compared to comparison platforms. If comparison platforms become popular, we have no reason to cling to bancassurance." The five major banks earned 118.1 billion KRW in commission income from bancassurance in the first quarter of this year. They also earned 64.1 billion KRW in commission income from bancassurance sales in April and May this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.