SK Innovation Begins Business Restructuring to Restore Financial Soundness

Large-Scale Battery Investment...Concerns Over Debt Increase and Performance Deterioration

SK On Aims for Profit Turnaround Through Cost Reduction and Investment Pace Adjustment

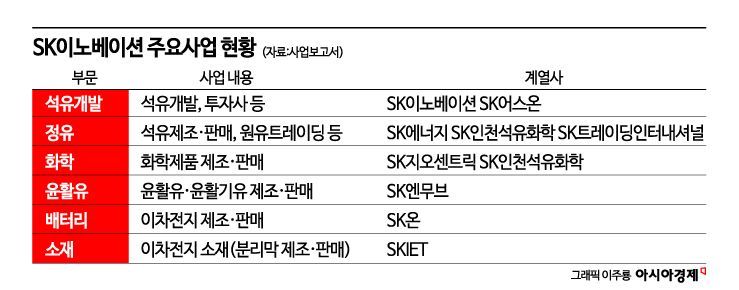

SK Innovation is facing a time for 'selection and concentration.' As the core businesses of energy and petrochemicals go through a downward cycle, the company is tasked with promoting 'qualitative growth' in its battery business, which continues to incur losses. After making massive investments in SK On over the past few years, it is expected to embark on a financial restructuring effort to reduce its net borrowings, which have reached 19 trillion won. There is also a possibility of bold business realignment within the SK Innovation group to save SK On, which has declared 'emergency management.'

According to the industry on the 5th, SK Innovation has started working on a plan to report the value chain reorganization to the board of directors. Following a financial status review, the business roadmap discussed in the 'Green TF (Task Force)' formed with the holding company SK Inc. is expected to be included. An SK official said, "We are reviewing various strategic directions to strengthen business competitiveness, but we have not yet reached a final plan."

In the business community, it is expected that SK Innovation will undertake financial soundness recovery and business realignment. SK Innovation's net borrowings in the first quarter reached 18.5744 trillion won. Net borrowings, which first exceeded 10 trillion won in 2021, surged to 16.2279 trillion won in 2022 and continued to increase to 17.1393 trillion won at the end of last year. During this period, despite raising more than 6.6 trillion won through paid-in capital increases and external borrowings, the company could not offset the increase in borrowings.

The pace of debt increase is also steep. According to FnGuide, total liabilities are expected to rise from 50.8155 trillion won at the end of last year to 55.3588 trillion won by the end of this year.

The company’s capacity to handle debt is insufficient. There are no signs of performance improvement in the near term. Due to a decrease in battery sales in the first quarter, overall sales fell 1.5% year-on-year to 18.8551 trillion won. Operating profit increased by 66.6% year-on-year to 624.7 billion won, thanks to inventory-related gains from rising oil prices, with an operating margin of 3.3%.

As the 'driving season' marks the peak season for the refining industry, the refining margin in the second quarter is on a downward trend. The composite refining margin, which rose to around $15 per barrel in February, dropped to $5.4 in the last week of May and recorded $8.5 in the last week of June. The refining margin is the price difference between petroleum product prices such as gasoline refined from crude oil and operating and raw material costs. The refining industry generally considers around $4 to $5 as the breakeven point. The second-quarter earnings consensus estimates sales of 19.5904 trillion won and operating profit of 538.3 billion won, indicating expected sluggishness.

On the other hand, financial burdens from battery investments are increasing. The cumulative investment in SK On, which was spun off in 2021, has exceeded 20 trillion won. SK On’s annual capital expenditure (CAPEX) was 5 trillion won in 2022, 6.8 trillion won in 2023, and is expected to reach 7.5 trillion won in 2024. SK On’s interest expenses alone amounted to 469.8 billion won last year.

This year, commercial operations have started at the Hungary Plant 3 and China Yancheng Plant, and investments in the U.S. joint venture with Ford, 'BlueOvalSK,' which aims for completion in 2025, are entering the final stages. This means that there is no urgent need to raise large-scale funds, providing some relief.

SK On has begun tightening its belt with strong cost-cutting measures alongside adjusting investment speed. Executive salaries are frozen until profitability is achieved, and welfare benefits and business promotion expenses are significantly reduced. This is interpreted as an effort to raise awareness of the battery industry's crisis caused by the chasm (temporary demand stagnation).

SK Innovation is reviewing business realignment to reduce financial burdens from battery investments. Recently, mergers with SK E&S or the sale of SK IET shares have been mentioned. While this is a strategy to secure cash flow and reduce external borrowings, persuading stakeholders remains key. As SK Group Chairman Chey Tae-won has ordered SK Innovation to pursue 'qualitative growth' through selection and concentration and solid management in the green and chemical sectors, the possibility of divesting non-core affiliates or mergers is also being raised.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.