Dairy Promotion Association Negotiation Subcommittee

Deadline Extended Until End of This Month... Expanded to Twice Weekly

Differences in Positions on Adjusting Raw Milk Volume by Use and Incentive Payments

This year, negotiations over the base price of raw milk, which serves as the standard for determining milk prices, are facing difficulties again. The producers, represented by dairy farmers, and the demand side, represented by the dairy industry, have failed to narrow their differences, leading to an extension of the negotiation deadline. As with last year, when discussions dragged on for over a month, last-minute struggles are inevitable.

According to industry sources on the 3rd, the Raw Milk Price Negotiation Subcommittee of the Dairy Promotion Committee, composed of seven directors including dairy farmers and dairy industry officials, held a total of five negotiation sessions from the 11th to the 30th of last month to discuss this year's base price of raw milk but failed to reach an agreement. Consequently, the negotiation deadline was extended by one month until the end of this month. A representative of the Dairy Promotion Committee stated, "We cannot disclose specific progress details, but it is true that the negotiation deadline, which was until last month, has been extended."

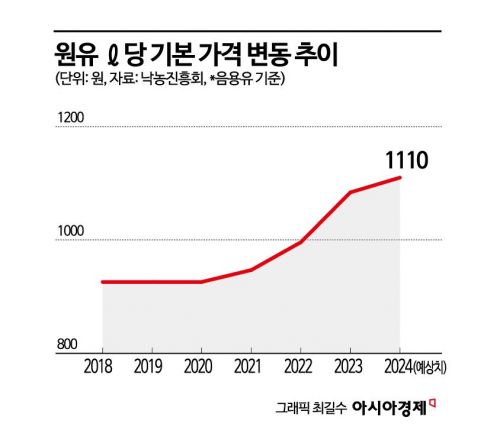

There are three main issues in this year's base price negotiations for raw milk. First, the increase rate for processed milk products, such as drinking milk (mainly white milk), cheese, condensed milk, and powdered milk, must be determined. Domestic dairy companies have traditionally followed the base price of raw milk set by the Dairy Promotion Committee. Last year, the production cost for dairy farmers was approximately 1,003 KRW per liter, a 4.6% increase from the previous year. The Ministry of Agriculture, Food and Rural Affairs recommended a price increase within the range of 0 to 60% of the production cost increase (44.14 KRW per liter), reflecting a 2% decrease in drinking milk consumption compared to the previous year. This means the price could rise by up to 26 KRW per liter. In this case, the current drinking milk price of 1,084 KRW per liter would increase to 1,110 KRW.

The base price of raw milk has been raised for three consecutive years since 2020, with last year's increase being 88 KRW per liter for drinking milk and 87 KRW for processed milk. This was the second-largest increase since the introduction of the raw milk price linkage system in 2013, when the price rose by 106 KRW. Industry insiders expect that, considering the government's firm stance on stabilizing consumer prices and the continuous rise in raw milk prices, the base price will either be frozen or the increase minimized this year.

In this year's negotiations, adjustments to the volume of raw milk used for different purposes (drinking milk and processed milk) for 2025?2026 will also be discussed, following the differentiated pricing system introduced last year. Negotiations on raw milk volume adjustments occur if the cumulative production cost change exceeds ±4% compared to the previous year.

Last year, milk production costs rose by 4.6% compared to the previous year, allowing companies with a relatively high supply of drinking milk, which commands a higher price, to reduce that volume and increase processed milk volume. The excess drinking milk volume last year exceeded 5%, and the reduction range for drinking milk in this negotiation has been set between 9,112 and 27,337 tons.

Previously, dairy farmers insisted that at least the increase in production costs be reflected in the base price of raw milk and that the volume of drinking milk sold at the normal price should not be reduced. The dairy industry, on the other hand, has requested minimizing the increase in raw milk prices and increasing the volume of processed milk, which is priced lower than drinking milk. The clear differences in positions, combined with the ongoing negotiations on volume adjustments by usage, are believed to be slowing the pace of discussions.

The issue of incentives paid additionally to dairy farmers based on evaluation criteria for raw milk prices is also a stumbling block in the negotiations. Incentives are paid after evaluating the quality of raw milk from each dairy farmer based on criteria such as milk components (milk fat and milk protein) and hygiene (bacterial count and somatic cell count). The maximum amount for the four categories is 179 KRW per liter. The dairy industry argues that the domestic raw milk price is higher than overseas prices and thus the incentive system needs to be reformed, while producers counter that incentives are necessary to encourage excellent quality management. An industry insider said, "The positions of both sides are sharply divided, making it difficult to find common ground," adding, "With the extension of the negotiation deadline, the number of meetings will also increase to twice a week."

Last year, the Raw Milk Price Subcommittee extended the deadline three times and held marathon negotiations for nearly 50 days before reaching a conclusion. Once the negotiation results are derived in the subcommittee, the Dairy Promotion Committee's board of directors will approve them, and the finalized base price of raw milk will be applied from the 1st of the following month. Each dairy company will then recalculate product prices based on the increase in the base price of raw milk.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)