Semiconductor Division Performance 'In Focus'

Positive Memory Market Outlook..."Increasing Share Effective"

"High Likelihood of Eventually Supplying HBM"

Market attention is focused on Samsung Electronics ahead of its preliminary earnings announcement. In the securities industry, there is an analysis that if Samsung Electronics' inability to supply high-bandwidth memory (HBM) had previously held back its stock price, now it is time for the expectation that it might supply HBM to be reflected in the stock price. Additionally, as HBM encroaches on DRAM production capacity (CAPA), Samsung Electronics' general-purpose semiconductor production capacity is also emerging as a driving force for stock price growth.

Upcoming Q2 Earnings Announcement... Expectations for Memory Performance

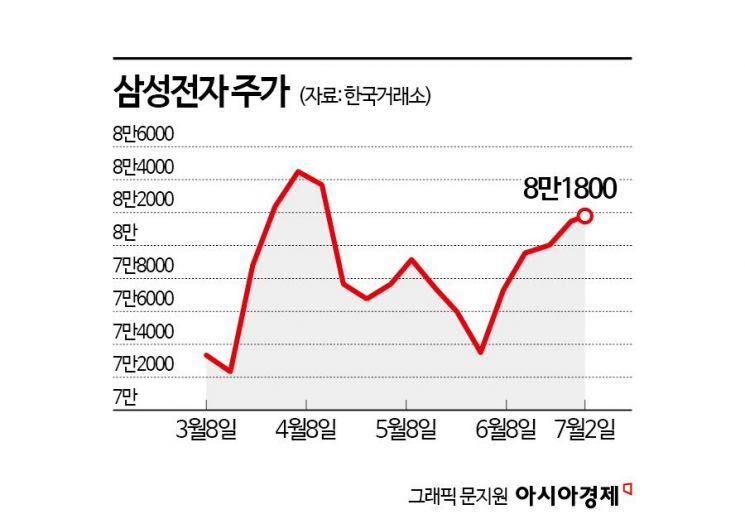

According to the Korea Exchange on the 3rd, Samsung Electronics closed at 81,800 won on the 2nd. Although the stock price showed weakness throughout the second quarter due to confirmed technological gaps with AI semiconductor competitors, it has rebounded by 11.29% over the past month. This appears to be influenced by expectations that DRAM supply and demand will improve in the second half of the year and that Samsung Electronics may be able to supply HBM to Nvidia.

The securities industry is now focusing on Samsung Electronics' preliminary Q2 earnings to be announced on the 5th. Jaewon Lee, a researcher at Shinhan Investment Corp., said, "Through this preliminary earnings report, improvements in the operating environment of the memory business can be confirmed, such as the expansion of high-value-added memory demand like Double Data Rate (DDR)5 and the visibility of NAND profits." He added, "It is especially important to pay attention to whether HBM-related topics come up during the conference call after the earnings announcement."

Rokho Kim, a researcher at Hana Securities, said, "There is a concern that smartphone shipments may be weaker than initially expected, so related figures might fall short of market expectations," but he also predicted, "However, the memory sector will offset this."

Semiconductor Cycle Boom Phase... "Samsung Will Ultimately Supply HBM"

Experts analyzed that Micron Technology, a U.S. memory semiconductor company, confirmed once again through its earnings announcement that the semiconductor cycle is currently in a long-term boom phase. Youngmin Ko, a researcher at Daol Investment & Securities, said, "Micron, a latecomer in HBM, is already using all its production capacity until 2025," adding, "The number of customers requiring HBM is expected to increase, so the long-term continuation of AI demand can be expected." He continued, "Shipments of 30-terabyte (TB) enterprise solid-state drives (eSSD) have increased more than threefold, indicating that AI benefits are continuing in NAND following DRAM, and demand for legacy semiconductors is also recovering," and said, "Samsung Electronics' earnings announcement is expected to be similar." He added, "Since earnings expectations for 2025 could rise significantly, now is a valid period for a strategy to increase semiconductor exposure."

Furthermore, there is an analysis that the only way Nvidia can cope with the HBM shortage it will face starting in Q3 is to receive supply volumes from Samsung Electronics. Junyoung Park, a researcher at Hyundai Motor Securities, said, "From Q3, products with significantly increased HBM content will enter mass production, immediately entering an HBM shortage phase," adding, "Nvidia will not be able to meet HBM demand without help from Samsung Electronics and Micron Technology, excluding SK Hynix." He continued, "Even if Micron adds its current production capacity in Q3, it is estimated to be insufficient," and analyzed, "So far, SK Hynix and related equipment vendors have received relatively more attention, but if Samsung Electronics newly enters, Samsung Electronics and companies that consider Samsung Electronics as a potential customer are likely to benefit."

Geunchang Noh, head of the research center at Hyundai Motor Securities, said, "As HBM increasingly encroaches on DRAM production capacity, a shortage of general-purpose memory semiconductors may be greater than expected," adding, "Considering that competitors reduced capital expenditures (CAPEX) last year, the value of Samsung Electronics' production capacity may receive increasing attention over time." He added, "If the inability to supply HBM3 had been a hindrance to stock price growth, now it should be approached as an opportunity factor that can contribute to earnings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.