The outstanding loan balance for individual business owners at major commercial banks has shown a monthly increase this year, rising by more than 5 trillion won. This is due to the worsening business environment for self-employed individuals caused by high interest rates, high exchange rates, and high inflation, as well as improved loan conditions resulting from competition among banks for corporate loans.

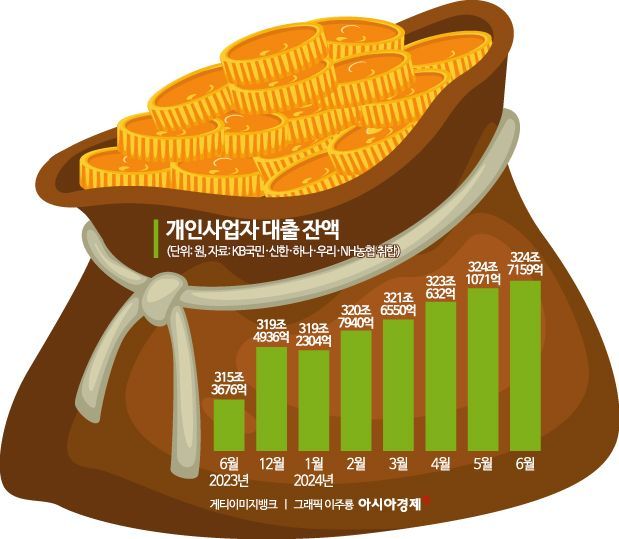

According to the financial sector on the 3rd, the outstanding loan balance for individual business owners at KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Banks was recorded at 324.7159 trillion won. This represents an increase of 608.8 billion won compared to the previous month. Compared to the same period last year, it increased by 9.3483 trillion won.

Individual business owner loans have been increasing by more than 1 trillion won each month, with 319 trillion won in January, 320 trillion won in February, 321 trillion won in March, 323 trillion won in April, and 324 trillion won in May. The total increase in individual business owner loans at the five major banks over six months this year amounts to 5.2223 trillion won. A representative from a commercial bank said, "The difficult economic conditions, along with improved loan terms such as interest cashback offered by banks as part of win-win finance, seem to have influenced this trend."

This phenomenon is not limited to the five major banks. According to Yang Bu-nam from the Democratic Party, the total outstanding financial sector loans for self-employed individuals, including household loans, were estimated at 1,055.9 trillion won as of the end of the first quarter (business loans 702.7 trillion won + household loans 353.2 trillion won). This is an increase of 2.7 trillion won from the previous quarter (1,053.2 trillion won), marking a record high.

The problem is that the delinquency rate for self-employed individuals is also soaring. According to the Financial Supervisory Service, the delinquency rate for individual business owner loans at domestic banks was 0.61% at the end of April, up 0.07 percentage points from the previous month (0.54%) and sharply increased by 0.2 percentage points compared to the previous year. The delinquency rate for individual business owner loans reaching the 0.6% level is the highest in 11 years and 4 months since the end of 2012 (0.64%). The delinquency rate for all self-employed individuals' financial sector business loans also rose from 1.30% in the fourth quarter of last year to 1.66% in the first quarter of this year, an increase of 0.33 percentage points in three months. This is the highest level in 11 years since the first quarter of 2013 (1.79%).

The Bank of Korea also stated in its recent Financial Stability Report, "The pressure for rising delinquency rates centered on self-employed individuals is expected to continue for the time being," and added, "Financial authorities need to actively promote debt restructuring through new start funds for self-employed individuals whose debt repayment ability has significantly deteriorated or who have no possibility of recovery." Furthermore, it warned, "Monitoring the impact of changes in the financial soundness of household and self-employed borrowers on financial institutions should also be strengthened."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)