Financial Supervisory Service Publishes Key Points on Insurance Contract Notification Duty on the 2nd

Notification Obligations Must Be Complied with According to Product Groups Such as Health Disclosure Type and Simplified Disclosure Type

Office worker Mr. A underwent a mammogram during a health checkup in November 2019. The test results showed a suspected nodule, and he received a recommendation for an 'ultrasound examination,' leading to additional consultations and tests. A month later, when signing up for simplified notification insurance, he did not consider this significant and answered 'No' to the question about whether there was a need for additional tests within three months. Last year, he filed an insurance claim for breast cancer, but the insurance company canceled the contract and refused to pay the insurance benefits, citing a 'breach of the duty to notify.'

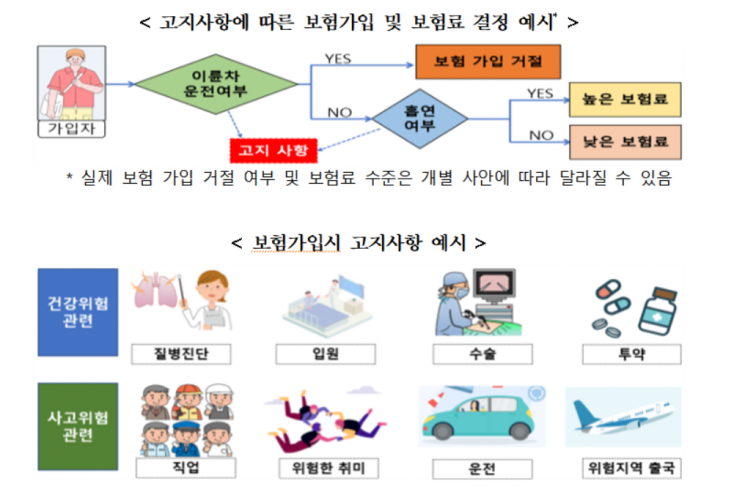

The Financial Supervisory Service disclosed precautions regarding the duty to notify (duty of disclosure) before entering into an insurance contract, which financial consumers may easily overlook in daily life, on the 2nd. The duty to notify means that the insurance applicant must inform the insurer of important matters related to themselves. The insurer decides whether to enter into an insurance contract and the premium level based on the insured's risk status, such as the presence of diseases and occupation. The obligation to inform the insurer of matters that significantly affect the conclusion of the insurance contract is called the duty to notify.

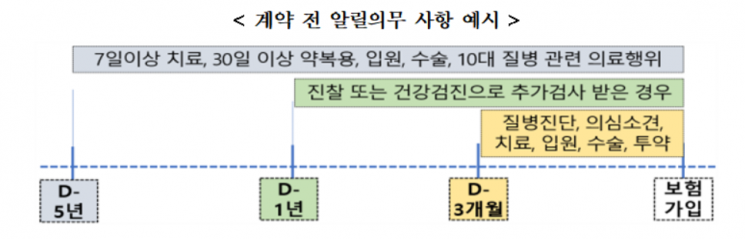

When applying for insurance, accurate disclosure of medical treatments received within the last 3 months, 1 year, or 5 years is required. 'Within 3 months' refers to cases where a disease diagnosis, suspected disease opinion, treatment, hospitalization, surgery, or medication was received. 'Within 1 year' refers to cases where additional tests (re-examinations) were conducted through a doctor's examination or health checkup. 'Within 5 years' refers to cases where treatment for more than 7 days, medication for more than 30 days, hospitalization, surgery (including cesarean section), or diagnosis, treatment, hospitalization, surgery, or medication for any of the 10 major diseases was received.

The duty to notify must be truthfully completed on the 'application form' when entering into an insurance contract. Even if the insured considers the questions on the questionnaire to be minor and does not disclose them, it may still constitute a breach of the duty to notify. If it is unclear whether the matter is subject to the duty to notify, it is advisable to inquire with the insurer. Disclosure made to the insurance agent without writing it on the application form is not recognized as effective.

If the duty to notify is not fulfilled, the insurance contract may be canceled, or insurance benefits may not be paid in the event of an insurance claim. According to Article 651 of the Commercial Act, the insurer may cancel the contract within one month from the date it becomes aware of the breach of the duty to notify by the insured, and even after an insurance accident has occurred, the insurer may cancel the contract. Whether cancellation occurs may vary depending on the specific circumstances of each contract. Mr. B signed up for cancer insurance in September 2022 and was diagnosed with breast cancer last March, filing an insurance claim. During the insurer's accident investigation, it was revealed that Mr. B did not disclose the diagnosis of an ovarian cyst in 2022. Accordingly, the insurer canceled the insurance contract due to breach of the duty to notify.

If the insurance contract is canceled due to a breach of the duty to notify after an insurance accident occurs, the insurer is no longer responsible for paying the insurance benefits. If the insurer has already paid the benefits, it may also claim a refund. However, even if the insurance contract is canceled, if there is no causal relationship between the breach of the duty to notify and the reason for the insurance payment, the insured may still receive the insurance benefits. For example, if false disclosure was made regarding motorcycle driving but stomach cancer developed and an insurance claim was filed, this would apply.

There are also cases where the insurer cannot cancel the insurance contract despite a breach of the duty to notify. This occurs when the insurer's right to cancel has expired. The insurer's right to cancel is restricted if three years have passed since the insurance contract date, or two years have passed since the coverage start date without any insurance payment, or one month has passed since the insurer became aware of the breach of the duty to notify. Additionally, if the insurance agent or others obstructed the duty to notify by encouraging false disclosure, the insurer cannot cancel the insurance contract.

Recently, various insurance products have been launched that expand or reduce disclosure items, such as health disclosure type and simplified disclosure type. It is important to understand the disclosure items for each insurance product and disclose them faithfully. The health disclosure type has more disclosure items than the standard type and covers more medical history to be disclosed. It targets low-risk (healthy) applicants. Although the disclosure items are numerous and the procedure is complicated, making enrollment cumbersome, the insured's risk is relatively low, so the premium is inexpensive. The simplified disclosure type has fewer disclosure items than the standard type and requires less medical history to be disclosed. It allows high-risk chronic disease holders to enroll but has higher premiums.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.