Declaration of Emergency Management at SK On's Morning Executive Meeting on the 1st

All-Out Effort for Profit Turnaround... Executives Lead by Example First

Lee Seok-hee, CEO of SK On, attended the "US IRA-related Public-Private Joint Meeting" at JW Marriott Hotel in Seocho-gu, Seoul on May 8th, listening attentively to the opening remarks by Ahn Deok-geun, Minister of Trade, Industry and Energy. Photo by Kang Jin-hyung aymsdream@

Lee Seok-hee, CEO of SK On, attended the "US IRA-related Public-Private Joint Meeting" at JW Marriott Hotel in Seocho-gu, Seoul on May 8th, listening attentively to the opening remarks by Ahn Deok-geun, Minister of Trade, Industry and Energy. Photo by Kang Jin-hyung aymsdream@

SK On, the core of SK Group's business restructuring, has declared an emergency management and delegated the positions of all C-level executives (chief executives of each field) to the board of directors. Additionally, if the goal of achieving 'quarterly profitability' this year is not met, all executives' salaries will be frozen.

Reducing Executive Salaries and Business Expenses, Frequent Position Changes if Performance is Unsatisfactory

On the morning of the 1st at 8 a.m., SK On held a full executive meeting and declared this emergency management system. Accordingly, the positions of all C-level executives, including the Chief Executive Officer (CEO), Chief Production Officer (CPO), and Chief Technology Officer (CTO), were delegated to the board of directors, and some C-level positions such as Chief Administrative Officer (CAO) and Chief Commercial Officer (CCO) were abolished. Along with this, executives with insufficient performance and roles will have their positions changed frequently throughout the year.

If quarterly profitability is not achieved this year, executive salaries will be frozen next year. Various welfare benefits and business promotion expenses provided to executives will also be drastically reduced. The currently enforced policies, such as mandatory economy class for overseas business trips and starting work at 7 a.m., will continue.

This policy is notable as a concrete measure from the affiliate level following the SK management strategy meeting held over a weekend for two days and one night. At the meeting, there was consensus on the need to streamline the organization reflecting the changed management environment, and to boldly change all areas requiring transformation?from work domains and procedures to resource allocation and working methods. This is to strengthen responsibility in crisis situations and publicly declare the will to overcome them.

After the meeting, CEO Lee Seok-hee sent a message to all members saying, "All members, including management, should unite their efforts to achieve the best performance in their respective positions with the determination that 'there is no place to retreat anymore,'" and added, "The current crisis is rather an opportunity to solidify our foundation as a true global manufacturing company. Let us do our best with the spirit of 'Jagangbulsi (自强不息, self-strengthening and never resting)' with passion."

However, SK On plans to support research and development (R&D) investment as much as possible to continuously secure core competitiveness. It also plans to separate and strengthen the sales organization by region to enhance constant responsiveness to customers.

Group Focuses on AI, 'SK Battery' Takes a Breather

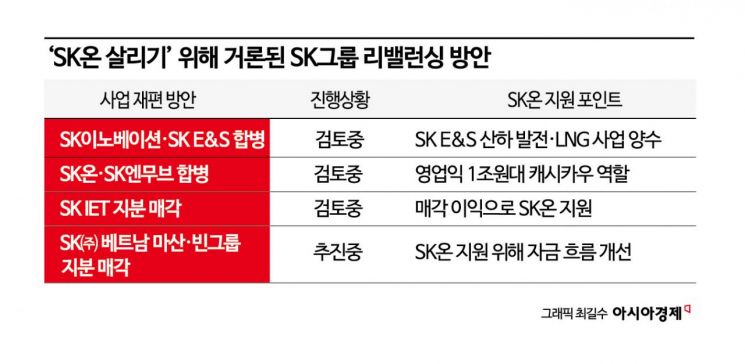

SK On's declaration of emergency management is effectively seen as 'making a last stand.' With the deterioration of the battery market and financial structure and the resulting group-level adjustment of battery investment speed, the management itself is raising awareness of the crisis and striving to improve the financial structure, including turning a profit.

It is especially regarded as a concrete implementation plan for SK Group's announced measures to strengthen 'Operation Improvement' and portfolio reorganization to secure resources. Since its launch at the end of 2021, SK On's annual capital expenditure (CAPEX) increased to 5 trillion KRW in 2022, 6.8 trillion KRW in 2023, and 7.5 trillion KRW in 2024. Over about three years until this year, approximately 19.3 trillion KRW has been spent, but an additional investment of over 10 trillion KRW is still needed. Despite this, the company has not yet escaped a deficit. The accumulated deficit amounts to 2.5876 trillion KRW.

As the group's new investments focus on artificial intelligence (AI) and semiconductors, SK On is expected to strengthen the foundation of currently planned factories rather than new expansions. SK On, with large-scale factories being completed one after another mainly in North America this year and next, must stake the company's fate on improving the yield and operating rate of these factories.

The next one to two years are also regarded as SK On's last 'barley hump' period. From next year, most factory constructions will be completed, leaving only equipment installation. Therefore, the scale of capital investment is expected to be reduced to less than half compared to this year. The industry believes that most of SK On's future investment funds have already been secured.

In the second half of this year, there is also a possibility of a performance turnaround due to inventory depletion and increased shipments following the expansion of new electric vehicle launches. Hyun-ryeol Cho, a researcher at Samsung Securities, said, "The recovery of SK On's North American factory operating rate in the second half of this year is the biggest variable in reducing losses," adding, "Sales volume at the North American factory is expected to gradually increase in the second half, and operating losses are also expected to decrease."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.